As filed with the U.S. Securities and Exchange Commission on May 21, 2021

Registration No. 333-255266

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

| GROVE, INC. |

| (Exact name of Registrant as specified in its charter) |

| Nevada |

| 5900 |

| 83-3378978 |

| (State or other jurisdiction of incorporation or organization) |

| (Primary Standard Industrial Classification Code Number) |

| (I.R.S. Employer Identification Number) |

1710 Whitney Mesa Drive

Henderson, NV 89014

(701) 353-5425

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Andrew J. Norstrud

Chief Financial Officer

1710 Whitney Mesa Drive

Henderson, NV 89014

(701) 353-5425

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send copies of all communications to:

| Mark Lee, Esq. Greenberg Traurig, LLP 1201 K Street, Suite 110 Sacramento, CA 95814 Tel: (916) 868-0630 Fax: (916) 448-1709 |

| Ross Carmel, Esq. Philip Magri, Esq. Carmel, Milazzo & Feil LLP 55 W 38th Street, 18th Floor New York, NY 10018 Tel: (212)-658-0458 Fax: (646)-838-1314 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

|

|

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

|

|

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

| Proposed Maximum Aggregate Offering Price(1) |

|

| Amount of Registration Fee(3) |

| ||

|

|

|

|

|

|

|

| ||

| Common Stock, par value $0.001 per share (2)(3) |

| $ | 13,915,000.00 |

|

| $ | 1,518.13 |

|

| Underwriters’ Warrants to purchase Common Stock (4) |

|

| -- |

|

|

| -- |

|

| Shares of Common Stock, issuable upon the exercise of the Underwriters’ Warrants (5) |

|

| 1,085,000.00 |

|

|

| 118.37 |

|

| Total |

| $ | 15,000,000.00 |

|

|

| 1,636.50 |

|

__________

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”) |

| (2) | Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of additional securities as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions. |

| (3) | Includes shares which may be issued upon exercise of a 45-day option granted to the underwriters to cover over-allotments, if any |

| (4) | In accordance with Rule 457(g) under the Securities Act, because the shares of the Registrant’s Common Stock underlying the Underwriters’ Warrants are registered hereby, no separate registration fee is required with respect to the warrants. |

| (5) | Pursuant to Rule 457(g) under the Securities Act, the registration fee is determined pursuant to the price at which a share subject to the Underwriters’ Warrants may be exercised, which is equal to 125% of the public offering price per share. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated May 21, 2021

PRELIMINARY PROSPECTUS

GROVE, INC.

2,200,000 Shares of Common Stock

This is the initial public offering of our Common Stock. We currently expect the initial public offering price to be between $4.50 and $5.50 per share of our Common Stock.

Prior to this offering, there has been no public market for the shares of our Common Stock. We intend to apply to list the shares of our Common Stock on The Nasdaq Capital Market under the symbol “GRVI”.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, and a “smaller reporting company” under applicable federal securities laws and as such are eligible for reduced public company reporting requirements. See “Prospectus Summary- Implications of Being an Emerging Growth Company and Smaller Reporting Company.”

Investing in our Common Stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our Common Stock in “Risk Factors” beginning on page 13 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

| Per Share |

|

| Total (1) |

| ||

| Initial public offering price |

| $ | 5.00 |

|

| $ | 11,000,000 |

|

| Underwriting discounts and commissions(2) |

| $ | 0.40 |

|

| $ | 880,000 |

|

| Proceeds to us (before expenses) |

| $ | 4.60 |

|

| $ | 10,120,000 |

|

___________

(1)Assumes no exercise of the over-allotment option by the underwriters.

(2)We have agreed to reimburse the underwriter for certain expenses. See “Underwriting” for additional information regarding compensation payable to the underwriters.

This offering is being conducted on a firm commitment basis. The underwriters are obligated to take and pay for all the Common Stock offered by this prospectus if any such shares are taken.

We have granted each of the underwriters an option, exercisable for 45 days from the date of this prospectus, to purchase up to 15% additional shares of Common Stock at 100.0% of the public offering price, less the underwriting discounts and commissions to cover over-allotments, if any. If this over-allotment option is fully exercised, the Company will receive an additional $1,650,000 and total proceeds to us will be $12,650,000.

The underwriters expect to deliver the shares to purchasers on or about , 2021, through the book-entry facilities of The Depository Trust Company.

Book-Running Manager

KINGSWOOD CAPITAL MARKETS

division of Benchmark Investments, Inc.

The date of this prospectus is , 2021.

|

| 3 |

| |

|

| 9 |

| |

|

| 11 |

| |

|

| 13 |

| |

|

| 26 |

| |

|

| 26 |

| |

|

| 27 |

| |

|

| 27 |

| |

|

| 28 |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

| 30 |

|

|

| 42 |

| |

|

| 57 |

| |

|

| 61 |

| |

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS, AND CORPORATE GOVERNANCE |

| 64 |

|

|

| 65 |

| |

|

| 66 |

| |

|

| 68 |

| |

|

| 70 |

| |

|

| 73 |

| |

|

| 78 |

| |

|

| 78 |

| |

|

| 78 |

| |

|

| F-1 |

|

You should rely only on the information contained or incorporated by reference into this prospectus or any free writing prospectus prepared by us. We have not authorized any other person to provide you with information different from or in addition to that contained in this prospectus or any free writing prospectus prepared by us, and we take no responsibility for any other information that others may give you. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus and any free writing prospectus prepared by us is accurate only as of the date on its respective cover, regardless of the time of delivery of this prospectus or any free writing prospectus or the time of any sale of shares of our Common Stock. Our business, financial condition, results of operations and prospects may have changed since those dates.

We have proprietary rights to trademarks, trade names and service marks appearing in this prospectus that are important to our business. Solely for convenience, the trademarks, trade names and service marks may appear in this prospectus without the ® and ™ symbols, but any such references are not intended to indicate, in any way, that we forgo or will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, trade names and service marks. All trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of Common Stock and the distribution of this prospectus outside the United States.

| 1 |

| Table of Contents |

STATEMENT REGARDING INDUSTRY AND MARKET DATA

The industry and market data in this prospectus are based on the good faith estimates of management, which estimates are based upon our review of internal estimates, research studies and surveys, independent industry publications, and other publicly available information. Industry publications and research studies and surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. These data involve a number of assumptions and limitations, and investors are cautioned not to give undue weight to such estimates. Although neither we nor the underwriters have independently verified the accuracy or completeness of any third-party information, we believe that the information from these publications and studies included in this prospectus is generally reliable, and the conclusions contained in the third-party information are reasonable.

Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus. In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors” and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

| 2 |

| Table of Contents |

PROSPECTUS SUMMARY

This summary highlights information described more fully elsewhere in this prospectus. Because it is a summary, it may not contain all of the information that is important to you. Therefore, you should read this entire prospectus carefully, including, in particular, the sections entitled “Risk Factors” beginning on page 13 of this prospectus and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 33 of this prospectus, and our consolidated financial statements and related notes, before making an investment decision. Some of the statements in this summary and elsewhere in this prospectus constitute forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.” In this prospectus, unless the context otherwise requires, references to “we,” “us,” “our,” the “Company,” or “Grove” refer to Grove, Inc. and its consolidated subsidiaries.

Our Company

We are in the business of developing, producing, marketing and selling raw materials, white label products and end consumer products containing the industrial hemp plant extract, Cannabidiol (“CBD”). We sell to numerous consumer markets including the botanical, beauty care, pet care and functional food sectors. We seek to take advantage of an emerging worldwide trend to re-energize the production of industrial hemp and to foster its many uses for consumers. The development of products in this highly regulated industry carries significant risks and uncertainties that are beyond our control. As a result, we cannot assure that we will successfully market and sell our products or, if we are able to do so, that we can achieve sales volume levels that will allow us to cover our fixed costs.

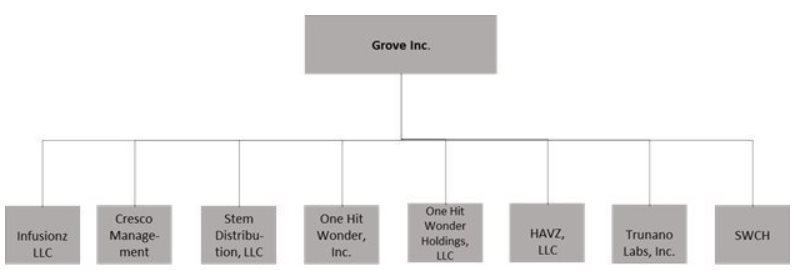

The Company primarily conducts its business operations through its wholly-owned subsidiaries: Steam Distribution, LLC, a California limited liability company; One Hit Wonder, Inc., a California corporation; Havz, LLC, d/b/a Steam Wholesale, a California limited liability company; One Hit Wonder Holdings, LLC, a California limited liability company; SWCH LLC a Delaware limited liability company; Trunano Labs, Inc., a Nevada corporation; Infusionz, LLC a Colorado limited liability company; and Cresco Management, LLC, a California limited liability company.

Historically cultivated for industrial and practical purposes, hemp is used today for textiles, paper, auto parts, biofuel, cosmetics, animal feed, supplements and much more - an impressive scope for such a historically misunderstood and restricted commodity. The market for hemp-derived products is expected to increase exponentially over the next five years1, and we believe Grove is well positioned to take advantage of this growth in the hemp industry.

In the U.S., hemp products are generally regulated by the Agriculture Improvement Act of 2018 (United States) (the “Farm Bill”). Consequently, the Company processes, develops, manufactures, and sells its products pursuant to the Farm Bill. CBD products produced and sold by Grove constitute hemp under the Farm Bill. The Farm Bill explicitly preserves the authority of the Food and Drug Administration (the “FDA”) to regulate products containing cannabis or cannabis-derived compounds under the Federal Food, Drug, and Cosmetic Act (the “FDCA”) and Section 351 of the Public Health Service Act. The FDA has issued guidance titled “FDA Regulation of Cannabis and Cannabis-Derived Products, Including Cannabidiol (CBD)” pursuant to which the FDA has taken the position that CBD is prohibited from use as an ingredient in a food or beverage or as a dietary ingredient in or as a dietary supplement based on several provisions of the FDCA. In the definition of “dietary supplement” found in the FDCA at 21 USC 321(ff), an article authorized for investigation as a new drug, antibiotic, or biological for which substantial clinical investigations have been instituted and for which the existence of such investigations has been made public, is excluded from the definition of dietary supplement. A similar provision in the FDCA at 21 USC 331(ll) makes it a prohibited act to introduce or deliver into commerce any food with a substance that was investigated as a new drug prior to being included in a food. There are no similar exclusions for the use of CBD in non-drug topical products, as long as such products otherwise comply with applicable laws. The FDA created a task force to address the further regulation of CBD and other cannabis-derived products and is currently evaluating the applicable science and pathways for regulating CBD and other cannabis-derived ingredients. Additionally, various states have enacted state-specific laws pertaining to the handling, manufacturing, labeling, and sale of CBD and other hemp products. Compliance with state-specific laws and regulations could impact our operations in those specific states.

In addition, through one of our wholly owned subsidiaries, we produce primarily business-to-business CBD related trade shows in the United States and were looking to expand prior to the COVID-19 pandemic. The trade shows have been profitable and allow Grove to market its own CBD products and services while also increasing the awareness of the expanding CBD market to the public.

Market Opportunity

The industrial hemp market is projected to grow at a CAGR of 34% from USD 4.6 billion in 2019 to USD 26.6 billion by 2025. The growth of this market is attributed to the increased consumption of hemp-based products however, it is also dependent on favorable FDA guidance or legislation from Congress. Additionally, the complex regulatory structure for the usage of industrial hemp in different countries is expected to hinder the market growth of industrial hemp.

The market, customers and distribution methods for hemp-based products are large and diverse. These markets range from hemp-based consumables, cosmetics, bio plastics and textiles, to list a few. This is an ever-evolving distribution system that today includes early adopter retailers and ecommerce entities, and product development companies that use our manufacturing capabilities to produce their internally developed consumer products for distribution. In addition, many of our customers use our propriety products and sell them under their own labels.

_________

1 Financialnewsmedia.com News Commentary, https://www.prnewswire.com/news-releases/us-cbd-market-projected-to-grow-at-107-annual-average-cagr-through-2023-300893763.html, and Hemp Industry Daily, https://hempindustrydaily.com/exclusive-cbd-demand-could-drive-2020-sales-of-2-billion-with-threefold-growth-projected-by-2025/amp/.

| 3 |

| Table of Contents |

There are only a few outlets, approximately 60, in mainstream commercial and retail stores that currently stock and sell our products, with the most significant concentration in Arkansas, Tennessee and Texas. However, we believe that as awareness continues to grow for hemp-based products, such as CBD and other products derived from hemp, the market has and will continue to grow over the next several years.

Our target customers are first and foremost end consumers via internet sales, direct-to-consumer retail stores, cooperatives, affiliate sales and master distributors. Secondarily, we are targeting developers of products that we can easily produce with our manufacturing capabilities, national and regional broker networks and major distribution companies who have preexisting relationships with major retail chain stores. As we continue to develop our business, these markets may change, be re-prioritized or eliminated as management responds to consumer and regulatory developments.

Our Competitive Strengths

We attribute our success to the following Growth in CBD Manufacturing.

Growing Market Participant in CBD Product Manufacturing. We are a growing North American distributor and manufacturer of premium CBD products for many of the largest CBD distributors and brands. We manufacture most of our products in our Henderson Nevada leased facility. We believe that loyalty to our brands continues to strengthen as we continue to expand our capabilities and product offering to existing and new customers.

Market Knowledge and Understanding. Due to our experience and our research and development of quality CBD products as well as expansion into new and varied formulations and product categories, we believe our long-term industry relationships will continue to expand. We continue to have a keen understanding of customer needs and desires in both our B2B and B2C customer categories. Custom formulations and a continued commitment to new and improved products at the best possible price has created strong customer demand and a robust pipeline.

Comprehensive Product Offering. We believe we offer a comprehensive portfolio of CBD products and maintain over 1,000 SKUs for our customers to choose from. This broad product offering creates a “one-stop” shop for our customers and positively distinguishes us from our competitors. In addition, we are cultivating a portfolio of well-known brands and premium products.

Trade Show Market. Our market position in the CBD industry trade show continues to drive sales and market exposure. Although COVID-19 led to cancelation of our November 2020 show, we believe that the latest break-throughs with the vaccine and additional precautionary measures will enable us to conduct our next show in the late 2021 expected to take pace in Las Vegas. The brand loyalty and the exposure our show customers receive with premium booth placements has driven a large demand and we anticipate to continue the growth of the tradeshow business in 2022.

Professionalism and Entrepreneurial Culture. Our professionalism and entrepreneurial culture fosters highly-dedicated employees who provide our customers with unsurpassed services. We continue to invest in our talent by providing every sales representative with an extensive and ongoing education and have successfully developed programs that provide comprehensive product knowledge and the tools needed to have a unique understanding of our customers’ personalities and decision-making processes.

Relationships and Superior Service first. We aim to be the premier partner for our customers and suppliers.

|

| · | Customers. We strive to offer unsurpassed services and solutions to our customers and also provide comprehensive product offering, proprietary industry formulations and development. We deliver products to our customers in a precise, safe and timely manner with complementary support from our dedicated sales and service teams. |

|

|

|

|

|

| · | Suppliers. Our industry knowledge, market reach and resources allow us to establish trusted professional relationships with many of our product suppliers. Our expanding product lines continue to drive demand for our raw materials, the continuing increases have allowed us to negotiate what we believe to be the best possible pricing for our customers, while maintaining a quality growing relationship with the suppliers. |

| 4 |

| Table of Contents |

Experienced and Proven Management Team Driving Growth through Organic and Accretive Acquisition Opportunities. We believe our management team has extensive experience in the industry. Our senior management team brings experience in accounting, mergers and acquisitions, financial services, consumer packaged goods, retail operations and third-party logistics.

Our Growth Strategy

We intend to focus or growth on the vertical integration and growth of all segments of the CBD space:

Dependable White/Private Label Manufacturing Service. Our experience and dedicated team continue to refine and expand our white label services, as we grow as a manufacturer for many regional and nationwide brands. Our operations in this segment have doubled over 2020, which we attribute to our commitment to high quality and on time manufacturing services.

CBD Product Research and Development. Our team provides custom products and proprietary formulations for some of the most popular industry items. We also continue to expand product offerings with the development and launch of new items on a regular basis. Custom formulations for outside brands build long term commitments from our customers.

Direct-to-Consumer Expansion. Our direct-to-consumer business is expected to be our growth driver for the next several years. The lower cost of our in-house research, development and manufacturing give us a measurable cost and production advantage, which we believe to be the key to our future success, as margins in the industry compress and are expected to continue to compress over the next several years.

CBD.io Market Place and Trade Show. Our launch of the CBD.io market platform in 2021 is expected to be a driver for growth into 2022 and a driver of retention for the brands that manufacture for us and list acceptable products on the platform. This high margin business should be a driver for future growth in all segments of the business.

Our market position in the CBD industry trade show continues to drive sales and market exposure. Although COVID-19 led to cancelation of our November 2020 show, we believe that the latest break-throughs with the vaccine and additional safety measures will enable us to conduct our next show in late 2021 expected to take pace in Las Vegas. The brand loyalty and the exposure our show customers receive with premium booth placements has driven a large demand and we anticipate expansion of shows and venues in 2022.

Core Brand Distribution. The nationwide rollout of our in-house brands will be another substantial driver of growth for the foreseeable future. We began expansion of our sales and marketing teams into the beginning of 2021 and will look to add talented people in all segments of the business to push current and future growth opportunities.

Acquisition Strategy. We have completed two acquisitions in the past two year and the consolidation and recognition of the consolidated synergies are almost completed and expected to be completed prior to the end of the fiscal year. We will continue to search for target acquisitions that meet our acquisition criteria and are accretive to our business. Our platform was built from the ground up to promote acquisitions expansion as a driver of substantial growth as the industry matures and margins compress. Our relationships and partners in the trade show and manufacturing business will be a key source for possible candidates. Our criteria will be stringent, and we will look at any and all opportunities that allow us to use our low cost manufacturing to drive higher margins in acquisition candidates. Small regional brands with distribution would benefit greatly in both low-cost manufacturing and quality research and development of new and current product offerings available from our inhouse brands and products. As margins compress in the industry with the expansion of competition, the low-cost manufacturing capabilities will be a key component to higher profits leading to consolidation which we intend to capitalize on in the coming years.

| 5 |

| Table of Contents |

Competition

There is vigorous competition within each market where our CBD products are sold. Brand recognition, quality, performance, availability, and price are some of the factors that impact consumers’ choices among competing products and brands. Advertising, promotion, merchandising and the pace and timing of new product introductions also have a significant impact on consumers’ buying decisions. We compete against several national and international companies, most of which have substantially greater resources than we do. Our principal competitors consist of large, well-known, multinational manufacturers and marketers of CBD products, most of which market and sell their products under multiple brand names. They include, among others, 3CHI, Spring Creek Labs, Kazmira LLC, Global Cannabinoids, Triangle Trading Company, Harbor City Hemp and many others. We also face competition from several independent brands, as well as some retailers that have developed their own CBD brands. Certain of our competitors also have ownership interests in retailers that are customers of ours. While we expect we will seek to address the aspirations of our customers at attainable price points which we believe may give us a competitive advantage, there are no assurances we will ever be able to effectively compete within this sector.

Recent Transactions

Acquisition of HAVZ Consolidated

On May 31, 2019, the Company purchased Steam Distribution, LLC, a California limited liability company; One Hit Wonder, Inc., a California corporation; Havz, LLC, d/b/a Steam Wholesale, a California limited liability company, and One Hit Wonder Holdings, LLC, a California limited liability company, collectively known as “HAVZ Consolidated” out of bankruptcy. Each of Robert Hackett, our President and Nikolaos Voudouris, a greater than 5% shareholder of ours, was an equity holder, managing member and/or officer of Steam Distribution, LLC, One Hit Wonder, Inc., Havz, LLC, d/b/a Steam Wholesale, and One Hit Wonder Holdings, LLC. Each of Robert Hackett, our President and Nikolaos Voudouris, a greater than 5% shareholder of ours, was an equityholder, managing member and/or officer of Steam Distribution, LLC, One Hit Wonder, Inc., Havz, LLC, d/b/a Steam Wholesale, and One Hit Wonder Holdings, LLC. Only the one-month period of HAVZ Consolidated was included in the financial statements accompanying this prospectus.

In December of 2018, HAVZ Consolidated filed voluntary petitions for relief under Chapter 11 (Chapter 11 Proceedings) of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the District of Nevada. On May 31, 2019, in connection with a sale under Section 363 s of the U.S. Bankruptcy Code, the Company purchased these four entities, HAVZ Consolidated, for a payment of $2,100,000 to the creditors of HAVZ Consolidated.

Acquisition of Infusionz LLC

On July 1, 2020, the Company entered into an Agreement and Plan of Merger with Infusionz LLC (the “Infusionz Agreement”) with the members of Infusionz LLC (the “Sellers”). Pursuant to the terms of the Infusionz Agreement, on July 1, 2020, the Company acquired 100% of the outstanding membership interests of Infusionz LLC, a Colorado limited liability company (“Infusionz”).

Infusionz was formed in the state of Colorado in May 2016. Infusionz develops, manufactures and markets products based on Hemp-based CBD including, but not limited to edibles, tinctures, topicals, capsules and pet products. Infusionz will continue to sell Infusionz branded CBD products for other businesses under their brand and specifications and add the Grove, Inc products, with the expectation of consolidating manufacturing in the Henderson Nevada facility.

Under the purchase method of accounting, the transaction was valued for accounting purposes at an estimated price of $3,350,000, which was the estimated fair value of the consideration paid by the Company. The estimate was based on the consideration paid or payable, consisting of $3,000,000 of equity consideration payable in the form of a minimum of 1,500,000 shares of Common Stock and cash consideration of approximately $350,000, pursuant to the terms of the Infusionz Agreement. At the closing of the acquisition, the Company issued 222,223 shares of Common Stock, valued at $400,000 based on the most recent price of $1.80 per share, and based on this valuation, the Company will issue an additional 1,738,556 shares of Common Stock to the Sellers. The shares of Common Stock to be issued to the Sellers will be adjusted based on the initial public offering price of the Company’s Common Stock pursuant to the Infusionz Agreement. The Company also issued 83,335 shares of Common Stock and paid a finder’s fee of $127,500 to Kurt Rossner and Mark Breen.

| 6 |

| Table of Contents |

The assets and liabilities of Infusionz will be recorded at their respective fair values as of the closing date of the Infusionz Agreement, and the following table summarizes these values based on the estimated balance sheet at July 1, 2020, the effective closing date.

| Assets Purchased |

| $ | 778,331 |

|

| Liabilities Assumed |

|

| (680,480 | ) |

| Net Assets Purchased |

|

| 97,851 |

|

| Purchase Price |

|

| (3,350,000 | ) |

Summary of Risks Related to Our Business

Our business and our ability to execute our business strategy are subject to a number of risks and unknown factors, as more fully described in the section titled “Risk Factors” beginning on page 13. These risk factors include, among others:

|

| · | Our ability to compete and succeed in a highly competitive and evolving industry; |

|

| · | Our ability to respond to changing consumer preferences and demand for new products and services; |

|

| · | Our ability to identify strategic acquisitions and investments, and to acquire and integrate businesses, product lines and other assets into our Company; |

|

| · | Our ability to protect our intellectual property and to develop, maintain and enhance our branded products; |

|

| · | The long-term success of our branded consumer products will require significant capital resources and ongoing market adoption of our diverse consumer brands; |

|

| · | Our current reliance on certain third parties to conduct various aspects of our vertical business model; |

|

| · | Successful launch of the Company’s specialty brands and our industry trade show market platform; |

|

| · | The success of our ongoing development, implementation, and optimization of various customer acquisition funnels and our industry trade show market platform; |

|

| · | Our ability to achieve and maintain brand loyalty; |

|

| · | Our ability to attract and retain highly qualified key employees; |

|

| · | Our ability to raise capital and the availability of future financing; |

|

| · | Unpredictable events, such as the COVID-19 pandemic, and associated business disruptions which could seriously harm our revenues and financial condition, delay our operations, increase our costs and expenses, and impact our ability to raise capital; |

|

| · | The regulatory environment and market acceptance of our diversely branded products and distribution methods; and |

|

| · | Regulatory risks and changes in applicable laws, regulations and guidelines. |

Our financial statements have been prepared assuming we will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. Our future viability is largely dependent upon our ability to generate profitable operations in the future and to obtain necessary financing as we continue to grow our business. Our management expects that future sources of funding may include sales of equity, obtaining loans, or other strategic transactions. Although our management continues to pursue these plans, there is no assurance that we will be successful with this offering or in obtaining sufficient financing on terms acceptable to us to continue to finance our operations, if at all. These circumstances raise substantial doubt about our ability to continue as a going concern, and our financial statements do not include any adjustments that might result from the outcome of these uncertainties.

| 7 |

| Table of Contents |

Implications of Being an Emerging Growth Company and Smaller Reporting Company

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (which we refer to as the “JOBS Act”). As such, we are eligible to take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to SEC reporting companies. For so long as we remain an emerging growth company we will not be required to, among other things:

|

| · | present more than two years of audited financial statements and two years of related selected financial data and management’s discussion and analysis of financial condition and results of operations disclosure in our registration statement of which this prospectus forms a part; |

|

|

|

|

|

| · | have an auditor report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002 (which we refer to as the “Sarbanes-Oxley Act”); |

|

|

|

|

|

| · | disclose certain executive compensation related items, as we will be subject to the scaled disclosure requirements of a smaller reporting company with respect to executive compensation disclosure; and |

|

|

|

|

|

| · | seek stockholder non-binding advisory votes on certain executive compensation matters and golden parachute arrangements. |

We have elected to adopt the reduced disclosure requirements available to emerging growth companies. As a result of these elections, the information that we provide in this prospectus may be different than the information you may receive from other public companies in which you hold equity interests. If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

The JOBS Act also permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result, our financial statements may not be comparable to companies that comply with public company effective dates.

We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our Common Stock that are held by non-affiliates exceeds $700 million as of the prior the second quarter ending December 31st, and (ii) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

Finally, we are a “smaller reporting company” (and may continue to qualify as such even after we no longer qualify as an emerging growth company) and accordingly may provide less public disclosure than larger public companies, including the inclusion of only two years of audited financial statements and only two years of management’s discussion and analysis of financial condition and results of operations disclosure. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

Corporate Information

Grove, Inc. was incorporated in the State of Nevada on September 5, 2018. Our principal executive offices are located at 1710 Whitney Mesa Drive, Henderson, NV 89014, and our telephone number is (701) 353-5425. The address of our website is CBD.io. The information contained in, or that can be accessed through, our website is not incorporated by reference into, and is not a part of, this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

| 8 |

| Table of Contents |

| Common Stock offered by us | 2,200,000 shares (or 2,530,000 shares if the underwriters exercise their option to purchase additional shares in full). |

|

|

|

| Over-Allotment option | We have granted to the underwriters an option to purchase up to 330,000 additional shares of our Common Stock from us at the initial public offering price less the underwriting discounts and commissions, for a period of 45 days from the date of this prospectus, to cover over-allotments, if any. |

|

|

|

| Common Stock to be outstanding after this offering | 14,208,357 shares (or 14,538,357 shares if the underwriters exercise the over-allotment option in full). |

|

|

|

| Use of Proceeds | We expect to receive net proceeds from this offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, of approximately $10,000,000 (or approximately $11,518,000 if the underwriters exercise in full their option to purchase up to 330,000 additional shares of our Common Stock), based on an assumed public offering price of $5.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus.

We intend to use the net proceeds from this offering (including the additional net proceeds that we would receive if the underwriters exercise their over-allotment option) for purchasing production equipment, building improvements, potential acquisitions, hiring new personnel, marketing, research and development and working capital. See “Use of Proceeds.” |

|

|

|

| Dividend Policy | We currently intend to retain our future earnings, if any, to finance the development and expansion of our businesses and, therefore, do not intend to pay cash dividends on our Common Stock for the foreseeable future. Any future determination to pay dividends will be at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements, restrictions contained in any financing instruments, and such other factors as our board of directors deems relevant in its discretion. See “Dividend Policy.” |

|

|

|

| Risk Factors | Investing in our Common Stock involves a high degree of risk. For a discussion of factors, you should carefully consider before making an investment decision, see “Risk Factors” beginning on page 13. |

|

|

|

| Market for the Common Stock | There has been no market for our securities. We will apply to Nasdaq Capital Market to have our Common Stock listed. |

|

|

|

| Proposed Nasdaq-CM Symbol | GRVI |

| 9 |

| Table of Contents |

The number of shares of our Common Stock to be outstanding immediately after this offering will be 14,208,357, which excludes, as of March 31, 2021:

|

| • | Shares issuable upon the exercise of the Underwriters’ Warrants to be issued to the representative of the underwriters in this offering; |

|

|

|

|

|

| • | 166,667 shares of our Common Stock reserved for the exercise of presently outstanding warrants with a weighted average price of $1.53 per share; |

|

|

|

|

|

| • | 3,472,222 shares of our Common Stock reserved for future grants under our 2019 equity plan; |

|

|

|

|

|

| • | 2,088,333 shares of our Common Stock reserved for the issuance upon the exercise of presently outstanding options with a weighted average exercise price of $1.53 per share; |

|

|

|

|

|

| • | 100,000 shares issuable upon conversion of the Convertible Promissory Note, dated October 3, 2019, issued by Registrant in favor of Jeff M. Bishop; |

|

| · | 100,000 shares issuable upon conversion of the Convertible Promissory Note, dated October 3, 2019, issued by Registrant in favor of Kyle Dennis; |

|

| · | 100,000 shares issuable upon conversion of the Convertible Promissory Note, dated October 17, 2019, issued by Registrant in favor of Jason Bond; and |

Except as otherwise indicated, all information in this prospectus assumes:

|

| · | no exercise by the underwriters’ over-allotment option to purchase additional shares of our Common Stock, |

|

|

|

|

|

| · | an assumed offering price per share of $5.00, which is the midpoint of the price range for the shares set forth on the cover page of this prospectus; |

| 10 |

| Table of Contents |

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following sets forth a summary of our selected consolidated financial and operating information on a historical basis. You should read the following summary of selected consolidated financial information in conjunction with our historical consolidated financial statements, and the related notes thereto, and with the sections entitled “Capitalization” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which are included elsewhere in this prospectus.

Our summary selected historical consolidated statement of operations information for the years ended June 30, 2020 and 2019, unaudited statement of operations for the quarter and nine-month ended March 31, 2021 and 2019 and our related summary selected historical consolidated balance sheet information as of June 30, 2020 and 2019, summary selected historical consolidated balance sheet information as of March 31, 2021 and 2019 have been derived from our historical audited consolidated financial statements as of and for the years ended June 30, 2020 and 2019, and historical reviewed consolidated financial statements for the quarter ended March 31, 2021 and 2020 which are included elsewhere in this prospectus.

|

|

| Nine Months Ended (unaudited) |

|

| Year Ended |

| ||||||||||

| Consolidated Statement of Operations |

| March 31, |

|

| June 30, |

| ||||||||||

| (In U.S. Dollars, except share data or otherwise stated) |

| 2021 |

|

| 2020 |

|

| 2020 |

|

| 2019 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Product revenue |

| $ | 13,449,850 |

|

| $ | 3,852,815 |

|

| $ | 6,159,013 |

|

| $ | 1,428,302 |

|

| Trade show revenue |

|

| - |

|

|

| 1,253,847 |

|

|

| 1,253,847 |

|

|

| 779,750 |

|

|

|

|

| 13,449,850 |

|

|

| 5,106,662 |

|

|

| 7,412,860 |

|

|

| 2,208,052 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product costs |

|

| 6,804,269 |

|

|

| 2,937,299 |

|

|

| 4,280,909 |

|

|

| 945,756 |

|

| Trade show costs |

|

| - |

|

|

| 563,971 |

|

|

| 561,988 |

|

|

| 226,099 |

|

|

|

|

| 6,804,269 |

|

|

| 3,501,270 |

|

|

| 4,842,897 |

|

|

| 1,171,855 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

| 6,645,581 |

|

|

| 1,044,821 |

|

|

| 2,569,963 |

|

|

| 1,036,197 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and marketing |

|

| 1,480,855 |

|

|

| 1,243,162 |

|

|

| 1,370,964 |

|

|

| 162,066 |

|

| General and administrative expenses |

|

| 4,768,643 |

|

|

| 3,702,825 |

|

|

| 5,272,997 |

|

|

| 1,227,361 |

|

| Professional fees |

|

| 384,160 |

|

|

| 1,135,170 |

|

|

| 764,332 |

|

|

| 235,823 |

|

|

|

|

| 6,633,658 |

|

|

| 6,081,157 |

|

|

| 7,408,293 |

|

|

| 1,625,250 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from operations |

|

| 11,923 |

|

|

| (4,475,765 | ) |

|

| (4,838,330 | ) |

|

| (589,053 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other expense (income) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Gain) of loss on sale of assets, net |

|

| 6,292 |

|

|

| (130,095 | ) |

|

| (180,211 | ) |

|

| 1,055 |

|

| Impairment of right of use assets |

|

| - |

|

| 237,422 |

|

|

| 588,347 |

|

|

| - |

| |

| Settlement of cancelled lease |

|

| (387,860 | ) |

|

| - |

|

|

| - |

|

|

| - |

|

| Interest expense (income), net |

|

| 133,281 |

|

|

| 70,125 |

|

|

| 138,406 |

|

|

| (3,068 | ) |

|

|

|

| (248,287 | ) |

|

| 177,452 |

|

|

| 546,542 |

|

|

| (2,013 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

| 260,210 |

|

|

| (4,653,217 | ) |

|

| (5,384,872 | ) |

|

| (587,040 | ) |

| Net income (loss) attributable to noncontrolling interest |

|

| - |

|

|

| - |

|

|

| (1,199 | ) |

|

| - |

|

| Net loss attributable to Grove, Inc. |

| $ | 260,210 |

|

| $ | (4,653,217 | ) |

| $ | (5,383,673 | ) |

| $ | (587,040 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share attributable to Grove, Inc. Common Stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted loss per share |

| $ | 0.02 |

|

| $ | (0.48 | ) |

| $ | (0.53 | ) |

| $ | (0.08 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted weighted average shares outstanding |

|

| 11,876,780 |

|

|

| 9,757,663 |

|

|

| 10,097,075 |

|

|

| 7,026,462 |

|

| 11 |

| Table of Contents |

|

|

| (unaudited) March 31, |

|

| June 30, |

| ||||||

| Consolidated Balance Sheets |

| 2021 |

|

| 2020 |

|

| 2019 |

| |||

|

|

|

|

|

|

|

|

|

|

| |||

| ASSETS |

|

|

|

|

|

|

|

|

| |||

| Current assets |

|

|

|

|

|

|

|

|

| |||

| Cash |

| $ | 2,118,179 |

|

| $ | 887,517 |

|

| $ | 3,697,432 |

|

| Accounts receivable, net |

|

| 570,175 |

|

|

| 165,147 |

|

|

| 127,722 |

|

| Other receivables |

|

| - |

|

|

| 72,000 |

|

|

| 20,000 |

|

| Inventory |

|

| 2,293,363 |

|

|

| 1,448,448 |

|

|

| 1,138,064 |

|

| Prepaid expenses |

|

| 682,287 |

|

|

| 76,562 |

|

|

| 131,976 |

|

| Total current assets |

|

| 5,664,004 |

|

|

| 2,649,674 |

|

|

| 5,115,194 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property and Equipment, net |

|

| 1,608,264 |

|

|

| 1,687,273 |

|

|

| 262,015 |

|

| Intangible asset, net |

|

| 2,027,044 |

|

|

| 1,240,260 |

|

|

| 1,633,738 |

|

| Goodwill |

|

| 2,413,813 |

|

|

| 493,095 |

|

|

| 493,095 |

|

| Other assets |

|

| 37,068 |

|

|

| 37,068 |

|

|

| - |

|

| Right-of-use asset |

|

| 179,564 |

|

|

| 294,835 |

|

|

| - |

|

| Total other assets |

|

| 6,265,753 |

|

|

| 3,752,531 |

|

|

| 2,388,848 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

| $ | 11,929,757 |

|

| $ | 6,402,205 |

|

| $ | 7,504,042 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

| $ | 544,842 |

|

| $ | 484,333 |

|

| $ | 271,062 |

|

| Accrued compensation |

|

| 589,082 |

|

|

| 195,399 |

|

|

| 94,241 |

|

| Deferred revenue |

|

| 853,773 |

|

|

| 473,320 |

|

|

| 255,633 |

|

| Accrued liabilities related to acquisition |

|

| 2,424,745 |

|

|

| - |

|

|

| 287,528 |

|

| Accrued liabilities |

|

| 269,407 |

|

|

| 221,664 |

|

|

| 199,095 |

|

| Current portion of notes payable |

|

| 423,961 |

|

|

| 183,595 |

|

|

| - |

|

| Convertible note payable |

|

| - |

|

|

| 1,500,000 |

|

|

| - |

|

| Current portion of operating lease payable |

|

| 169,507 |

|

|

| 461,123 |

|

|

| - |

|

| Total current liabilities |

|

| 5,275,317 |

|

|

| 3,519,434 |

|

|

| 1,107,559 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Notes payable, net of current portion |

|

| 422,084 |

|

|

| 365,350 |

|

|

| - |

|

| Convertible note payable |

|

| 2,500,080 |

|

|

| - |

|

|

| - |

|

| Operating lease payable, net of current portion |

|

| 11,628 |

|

|

| 338,040 |

|

|

| - |

|

| Total long-term liabilities |

|

| 2,933,792 |

|

|

| 703,390 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock |

|

| 500 |

|

|

| - |

|

|

| 500 |

|

| Common Stock |

|

| 12,008 |

|

|

| 10,223 |

|

|

| 9,654 |

|

| Additional paid in capital |

|

| 10,546,914 |

|

|

| 7,314,341 |

|

|

| 6,446,640 |

|

| Accumulated deficit |

|

| (6,838,774 | ) |

|

| (7,098,984 | ) |

|

| (1,715,311 | ) |

| Total stockholders’ equity |

|

| 3,720,648 |

|

|

| 225,580 |

|

|

| 4,741,483 |

|

| Non-controlling interest in subsidiary |

|

| - |

|

|

| 1,953,801 |

|

|

| 1,655,000 |

|

| Total equity |

|

| 3,720,648 |

|

|

| 2,179,381 |

|

|

| 6,396,483 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

| $ | 11,929,757 |

|

| $ | 6,402,205 |

|

| $ | 7,504,042 |

|

| 12 |

| Table of Contents |

RISK FACTORS

Investing in our shares of Common Stock is very risky. Before making an investment decision, you should carefully consider all of the risks described in this prospectus. If any of the risks discussed in this prospectus actually occur, our business, financial condition and results of operations could be materially and adversely affected, the price of our shares could decline significantly, and you might lose all or a part of your investment. The risk factors described below are not the only ones that may affect us. Our forward-looking statements in this prospectus are also subject to the following risks and uncertainties. In deciding whether to purchase our shares, you should carefully consider the following factors, among others, as well as information contained in this prospectus.

Risks Relating to Our Company

Our limited operating history makes it difficult for potential investors to evaluate our business prospects and management.

The Company was incorporated on September 5, 2018 and only commenced operations thereafter. Accordingly, we have a limited operating history upon which to base an evaluation of our business and prospects. Operating results for future periods are subject to numerous uncertainties, and we cannot assure you that the Company will achieve or sustain profitability in the future.

The Company’s prospects must be considered in light of the risks encountered by companies in the early stage of development, particularly companies in new and rapidly evolving markets. Future operating results will depend upon many factors, including our success in attracting and retaining motivated and qualified personnel, our ability to establish short term credit lines or obtain financing from other sources, such as this Offering, our ability to develop and market new products, our ability to control costs, and general economic conditions. We cannot assure you that the Company will successfully address any of these risks. There can be no assurance that our efforts will be successful or that we will ultimately be able to attain profitability.

Our business has posted net operating losses since inception in 2018

We incurred losses of $5,383,673 and $587,040 for the years ended June 30, 2020 and 2019, respectively. We have incurred losses of $5,123,463 from inception through March 31, 2020. The adverse effects of a limited operating history include reduced management visibility into forward sales, marketing costs, and customer acquisition, which could lead to missing targets for achievement of profitability.

We need additional capital to continue operations; if we do not raise additional capital, we will need to curtail or cease operations.

We require additional capital for the development of our business operations. We may also encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may increase our capital needs and/or cause us to spend our cash resources faster than we expect. Accordingly, we will need to obtain substantial additional funding in order to continue our operations. The uncertainties surrounding our ability to fund our operations raise substantial doubt about our ability to continue as a going concern.

Since our inception, we have financed our operations primarily through the sale of our Common Stock. As of March 31, 2021, we had approximately $2,118,179 in cash. To execute on our business plan successfully, we will need to raise additional money in the future. Additional financing may not be available on favorable terms, or at all. The exact amount of funds raised, if any, will determine how quickly we can reach profitability on our operations.

There are no assurances that future funding will be available on favorable terms, or at all. If additional funding is not obtained, we may need to reduce, defer or cancel product development efforts, our production and marketing operations, or overhead expenditures to the extent necessary. The failure to fund our operating and capital requirements could have a material adverse effect on our business, financial condition and results of operations.

| 13 |

| Table of Contents |

If we are unable to protect our intellectual property rights, our competitive position could be harmed.

Our commercial success will depend in part on our ability to obtain and maintain appropriate intellectual property protection in the United States and foreign countries with respect to our proprietary formulations and products. Our ability to successfully implement our business plan depends on our ability to build and maintain brand recognition using trademarks, service marks, trade dress and other intellectual property. We may rely on trade secret, trademark, patent and copyright laws, and confidentiality and other agreements with employees and third parties, all of which offer only limited protection. The steps we have taken and the steps we will take to protect our proprietary rights may not be adequate to preclude misappropriation of our proprietary information or infringement of our intellectual property rights. If our efforts to protect our intellectual property are unsuccessful or inadequate, or if any third party misappropriates or infringes on our intellectual property, the value of our brands may be harmed, which could have a material adverse effect on the Company’s business and prevent our brands from achieving or maintaining market acceptance. Protecting against unauthorized use of our trademarks and other intellectual property rights may be expensive, difficult and in some cases not possible. In some cases, it may be difficult or impossible to detect third-party infringement or misappropriation of our intellectual property rights, and proving any such infringement may be even more difficult.

We may not be able to effectively manage growth.

As we continue to grow our business and develop products, we expect to need additional research, development, managerial, operational, sales, marketing, financial, accounting, legal and other resources. The Company expects its growth to place a substantial strain on its managerial, operational and financial resources. The Company cannot assure that it will be able to effectively manage the expansion of its operations, or that its facilities, systems, procedures or controls will be adequate to support its operations. The Company’s inability to manage future growth effectively would have a material adverse effect on its business, financial condition and results of operations.

Our management may not be able to control costs in an effective or timely manner.

The Company’s management has used reasonable efforts to assess, predict and control costs and expenses. However, the Company only has a brief operating history upon which to base those efforts. Implementing our business plan may require more employees, capital equipment, supplies or other expenditure items than management has predicted. Likewise, the cost of compensating employees and consultants or other operating costs may be higher than management’s estimates, which could lead to sustained losses.

We expect our quarterly financial results to fluctuate.

We expect our net sales and operating results to vary significantly from quarter to quarter due to a number of factors, including changes in:

|

| · | Demand for our products; |

|

| · | Our ability to obtain and retain existing customers or encourage repeat purchases; |

|

| · | Our ability to manage our product inventory; |

|

| · | General economic conditions, both domestically and in foreign markets; |

|

| · | Advertising and other marketing costs; and |

|

| · | Costs of creating and expanding product lines. |

As a result of the variability of these and other factors, our operating results in future quarters may be below the expectations of our stockholders.

We will be subject to the reporting requirements of U.S. federal securities laws, which can be expensive.

We will be subject to the information and reporting requirements of the Exchange Act and other federal securities laws, including compliance with the Sarbanes-Oxley Act. The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the SEC and furnishing audited financial statements to stockholders will cause our expenses to be higher than they would be if we had remained privately-held. In addition, it may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal controls and other finance personnel in order to develop and implement appropriate internal controls and reporting procedures.

| 14 |

| Table of Contents |

Cybersecurity breaches of our IT systems could degrade our ability to conduct our business operations and deliver products and services to our customers, delay our ability to recognize revenue, compromise the integrity of our software products, result in significant data losses and the theft of our intellectual property, damage our reputation, expose us to liability to third parties and require us to incur significant additional costs to maintain the security of our networks and data.

We increasingly depend upon our IT systems to conduct virtually all of our business operations, ranging from our internal operations and product development activities to our marketing and sales efforts and communications with our customers and business partners. Computer programmers may attempt to penetrate our network security, or that of our website, and misappropriate our proprietary information or cause interruptions of our service. Because the techniques used by such computer programmers to access or sabotage networks change frequently and may not be recognized until launched against a target, we may be unable to anticipate these techniques. In addition, sophisticated hardware and operating system software and applications that we produce or procure from third parties may contain defects in design or manufacture, including “bugs” and other problems that could unexpectedly interfere with the operation of the system. We have also outsourced a number of our business functions to third-party contractors, including our manufacturers and logistics providers, and our business operations also depend, in part, on the success of our contractors’ own cybersecurity measures. Similarly, we rely upon distributors, resellers and system integrators to sell our products and our sales operations depend, in part, on the reliability of their cybersecurity measures. Additionally, we depend upon our employees to appropriately handle confidential data and deploy our IT resources in safe and secure fashion that does not expose our network systems to security breaches and the loss of data. Accordingly, if our cybersecurity systems and those of our contractors fail to protect against unauthorized access, sophisticated cyberattacks and the mishandling of data by our employees and contractors, our ability to conduct our business effectively could be damaged in a number of ways, including:

We may incur significant costs and require significant management resources to evaluate our internal control over financial reporting as required under Section 404 of the Sarbanes-Oxley Act, and any failure to comply or any adverse result from such evaluation may have an adverse effect on our stock price.

As a smaller reporting company, as defined in Rule 12b-2 under the Exchange Act, we will be required to evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”) and to include an internal control report beginning with the Annual Report on Form 10-K for the fiscal year ending June 30, 2022. This report must include management’s assessment of the effectiveness of our internal control over financial reporting as of the end of the fiscal year. This report must also include disclosure of any material weaknesses in internal control over financial reporting that we have identified. Failure to comply, or any adverse results from such evaluation could result in a loss of investor confidence in our financial reports and have an adverse effect on the trading price of our equity securities.

The COVID-19 pandemic and the efforts to mitigate its impact may have an adverse effect on our business, liquidity, results of operations, financial condition and price of our securities.

The pandemic involving the novel strain of coronavirus and related respiratory disease (which we refer to as COVID-19) and the measures taken to combat it, have had an adverse effect on our business. Public health authorities and governments at local, national and international levels have announced various measures to respond to this pandemic. Some measures that directly or indirectly impact our business include:

|

| · | voluntary or mandatory quarantines; |

|

| · | restrictions on travel; and |

|

| · | limiting gatherings of people in public places. |

We have undertaken measures in an effort to mitigate the spread of COVID-19 including limiting company travel and in-person meetings. We also have enacted our business continuity plans, including implementing procedures requiring employees working remotely where possible which may make maintaining our normal level of corporate operations, quality controls and internal controls difficult. Notwithstanding these efforts, our results of operations have been adversely impacted by COVID-19 and this may continue.

| 15 |

| Table of Contents |

Moreover, the COVID-19 pandemic has previously caused some temporary delays in the delivery of our inventory, although recently we are no longer experiencing such delays. In addition, the travel restrictions imposed as a result of COVID-19 have impacted our ability to visit customer and potential customers for sales presentations, which have been substituted with on-line conference calls. Further, the COVID-19 pandemic and mitigation efforts have also adversely affected our customers’ financial condition, resulting in reduced spending for the products we sell.

As events are rapidly changing, we do not know how long the COVID-19 pandemic, or localized outbreaks or recurrences of COVID-19, and the measures that have been introduced to respond to COVID-19 will disrupt our operations or the full extent of that disruption. Further, once we are able to restart normal operations doing so may take time and will involve costs and uncertainty. We also cannot predict how long the effects of COVID-19 and the efforts to contain it will continue to impact our business after the pandemic is under control. Governments could take additional restrictive measures to combat the pandemic that could further impact our business or the economy in the geographies in which we operate. It is also possible that the impact of the pandemic and response on our suppliers, customers and markets will persist for some time after governments ease their restrictions. These measures have negatively impacted, and may continue to impact, our business and financial condition as the responses to control COVID-19 continue.

A prolonged economic downturn, particularly in light of the COVID-19 pandemic, could adversely affect our business.

Uncertain global economic conditions, in particular in light of the COVID-19 pandemic, could adversely affect our business. Negative global and national economic trends, such as decreased consumer and business spending, high unemployment levels and declining consumer and business confidence, pose challenges to our business and could result in declining revenues, profitability and cash flow. Although we continue to devote significant resources to support our brands, unfavorable economic conditions may negatively affect demand for our products.

Increases in costs, disruption of supply or shortage of raw materials could harm our business.

We may experience increases in the cost or a sustained interruption in the supply or shortage of raw materials. Any such an increase or supply interruption could materially negatively impact our business, prospects, financial condition and operating results. We use various raw materials in our business including aluminum. The prices for these raw materials fluctuate depending on market conditions and global demand for these materials and could adversely affect our business and operating results. Substantial increases in the prices for our raw materials increase our operating costs, and could reduce our margins if we cannot recoup the increased costs through increased prices for our products and services.

Our failure to meet the continuing listing requirements of the NASDAQ Capital Market could result in a de-listing of our securities.

If, after this offering, we fail to satisfy the continuing listing requirements of NASDAQ, such as the corporate governance, stockholders equity or minimum closing bid price requirements, NASDAQ may take steps to delist our Common Stock. Such a delisting would likely have a negative effect on the price of our Common Stock and would impair your ability to sell or purchase our Common Stock when you wish to do so. In the event of a delisting, we would likely take actions to restore our compliance with NASDAQ’s listing requirements, but we can provide no assurance that any such action taken by us would allow our Common Stock to become listed again, stabilize the market price or improve the liquidity of our securities, prevent our Common Stock from dropping below the NASDAQ minimum bid price requirement or prevent future non-compliance with NASDAQ’s listing requirements.

| 16 |

| Table of Contents |

We will incur increased costs and demands upon management as a result of complying with the laws and regulations affecting public companies, which could adversely affect our operating results.