EXHIBIT 2.1

ASSET PURCHASE AGREEMENT

AMONG

GROVE, INC.,

A Nevada corporation

AND

GROVE ACQUISITION SUBSIDIARY, INC.,

A Nevada corporation

AS BUYING PARTIES

AND

VITAMEDICA CORPORATION,

a California corporation

AND

DAVID RAHM and YVETTE LA-GARDE

AS SELLING PARTIES

AUGUST 1, 2021

| Page 1 |

TABLE OF CONTENTS

| 1. | Defined Terms. |

| 4 |

|

|

|

|

|

|

|

| 2. | Basic Transaction. |

| 4 |

|

| 2.1 | Acquired Assets; Excluded Assets. |

| 4 |

|

| 2.2 | Assumed Liabilities; Retained Liabilities. |

| 4 |

|

| 2.3 | Closing; Place of Closing. |

| 5 |

|

| 2.4 | Payment of Purchase Price. |

| 5 |

|

| 2.5 | Closing Documents for Closing. |

| 6 |

|

| 2.6 | Further Assurances. |

| 8 |

|

| 2.7 | Allocation of Purchase Price. |

| 8 |

|

|

|

|

|

|

|

| 3. | Representations and Warranties by the Selling Parties. |

| 8 |

|

| 3.1 | Organization, Good Standing and Qualification of Seller. |

| 8 |

|

| 3.2 | Authorization of Transaction. |

| 8 |

|

| 3.3 | Non-contravention. |

| 9 |

|

| 3.4 | Consents. |

| 9 |

|

| 3.5 | Brokers’ Fees. |

| 9 |

|

| 3.6 | Subsidiaries. |

| 9 |

|

| 3.7 | Compliance with Laws; Permits. |

| 9 |

|

| 3.8 | Title to Assets. |

| 10 |

|

| 3.9 | Condition and Sufficiency of Assets. |

| 10 |

|

| 3.10 | Financial Information. |

| 10 |

|

| 3.11 | No Undisclosed Liabilities. |

| 10 |

|

| 3.12 | Absence of Certain Events. |

| 10 |

|

| 3.13 | Inventory. |

| 11 |

|

| 3.14 | Employees; Employee Benefits. |

| 11 |

|

| 3.15 | Taxes. |

| 11 |

|

| 3.16 | Litigation. |

| 12 |

|

| 3.17 | Contracts. |

| 12 |

|

| 3.18 | Product Warranty. |

| 13 |

|

| 3.19 | Product Liability and Product Returns. |

| 13 |

|

| 3.20 | Relationships. |

| 14 |

|

| 3.21 | Real Property. |

| 14 |

|

| 3.22 | Intellectual Property. |

| 14 |

|

| 3.23 | GS1 Company Prefix. |

| 15 |

|

| 3.24 | IT Assets. |

| 15 |

|

| 3.25 | Data Privacy and Security. |

| 16 |

|

| 3.26 | Insurance. |

| 16 |

|

| 3.27 | Related Party Transactions. |

| 16 |

|

| 3.28 | No Material Adverse Change. |

| 16 |

|

| 3.29 | Disclosure. |

| 16 |

|

|

|

|

|

|

|

| 4. | Buying Parties’ Representations and Warranties. |

| 17 |

|

| 4.1 | Organization of Buyer. |

| 17 |

|

| 4.2 | Authorization of Transaction. |

| 17 |

|

| 4.3 | Non-contravention. |

| 17 |

|

| 4.4 | Brokers’ Fees. |

| 17 |

|

|

|

|

|

|

|

| 5. | Representations and Warranties Concerning Grove Common Stock. |

| 17 |

|

| 5.1 | Selling Parties’ Representations and Warranties Concerning Grove Shares. |

| 17 |

|

| 5.2 | Grove’s Representations and Warranties Concerning Grove Shares. |

| 19 |

|

| Page 2 |

| 6. | Post-Closing Covenants. |

| 19 |

|

| 6.1 | Books and Records. |

| 19 |

|

| 6.2 | Employees. |

| 20 |

|

| 6.3 | Confidential Information. |

| 20 |

|

| 6.4 | Unfilled Vendor Purchase Orders. |

| 20 |

|

| 6.5 | Non-Use of Name. |

| 20 |

|

| 6.6 | Customer Refunds. |

| 20 |

|

| 6.7 | Product Warranties for Prior Sales. |

| 20 |

|

| 6.8 | Payment of Retained Liabilities. |

| 21 |

|

| 6.9 | Post-Closing Correspondence Related to the Business. |

| 21 |

|

| 6.10 | Filing of Public Reports. |

| 21 |

|

| 6.11 | Restriction or Transfer of Grove Shares. |

| 21 |

|

| 6.12 | Auditable Financials. |

| 21 |

|

| 6.13 | Finder’s Fee. |

| 21 |

|

| 6.14 | Insurance; Products Liability. |

| 22 |

|

|

|

|

|

|

|

| 7. | Survival; Indemnification. |

| 22 |

|

| 7.1 | Survival of Representations and Warranties. |

| 22 |

|

| 7.2 | Time Limitations for Certain Representations and Warranties. |

| 22 |

|

| 7.3 | Indemnification Rights and Obligations. |

| 22 |

|

| 7.4 | Limitation on Indemnification Liability. |

| 23 |

|

| 7.5 | Materiality Scrape. |

| 24 |

|

| 7.6 | No Double Recovery; Effect of Insurance; Third Party Claims. |

| 24 |

|

| 7.7 | Setoff. |

| 25 |

|

| 7.8 | Exclusive Remedy. |

| 25 |

|

|

|

|

|

|

|

| 8. | Miscellaneous. |

| 25 |

|

| 8.1 | Notices. |

| 25 |

|

| 8.2 | Jurisdiction, Venue and Service of Process. |

| 26 |

|

| 8.3 | Governing Law. |

| 26 |

|

| 8.4 | Counterparts. |

| 26 |

|

| 8.5 | Independence of Covenants and Representations and Warranties. |

| 27 |

|

| 8.6 | Expenses. |

| 27 |

|

| 8.7 | Transfer Taxes. |

| 27 |

|

| 8.8 | Construction. |

| 27 |

|

| 8.9 | Schedules and Exhibits. |

| 27 |

|

| 8.10 | Waiver of Jury Trial. |

| 28 |

|

| 8.11 | Severability. |

| 28 |

|

| 8.12 | Entire Agreement. |

| 28 |

|

| Page 3 |

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT (the “Agreement”) is made as of the 1st day of August, 2021, by and among GROVE ACQUISITION SUBSIDIARY, INC., a Nevada corporation (the “Buyer”) and GROVE, INC., a Nevada corporation (the “Buyer Stockholder” or “Grove;” collectively Buyer and Grove are the “Buying Parties”); and VITAMEDICA CORPORATION, a California corporation (“Seller”) and DAVID RAHM, individually and YVETTE LA-GARDE, individually (each a “Seller Stockholder” and collectively the Seller and Seller Stockholders are the “Selling Parties”). The Buying Parties and the Selling Parties are referred to collectively herein as the “Parties” and each individually as a “Party.”

RECITALS

The Seller is engaged in the distribution and sale of nutritional supplements and cosmeceuticals (for purposes of this Agreement called the "Business"). The Seller wishes to sell and the Buyer wishes to purchase the Business and the Acquired Assets (as defined herein) for the consideration and on the terms set forth in this Agreement. The principal place of business of Seller is 1140 Highland Avenue, Suite 196, Manhattan Beach, CA 90266.

AGREEMENT

The Parties, intending to be legally bound, agree as follows:

1. Defined Terms.

For purposes of this Agreement, the terms set forth in Exhibit A to this Agreement have the meanings set forth in Exhibit A to this Agreement.

2. Basic Transaction.

2.1 Acquired Assets; Excluded Assets.

(a) Purchase and Sale of Acquired Assets. On and subject to the terms and conditions of this Agreement, Buyer agrees to purchase from Seller, and Seller agrees to sell, transfer, convey, and deliver to Buyer, all of the Acquired Assets at the Closing for the consideration specified below in Section 2.4. The term "Acquired Assets" means all assets of the Seller, other than the Excluded Assets. The Acquired Assets include, without limitation, those set forth on Schedule 2.1(a) hereto. Upon the terms set forth in this Agreement, at the Closing the Seller shall sell, transfer, assign and deliver to Buyer, and Buyer shall purchase, acquire or accept from Seller, all right, title and interest of Seller in and to all of the Acquired Assets free and clear of all Liens.

(b) Excluded Assets. Notwithstanding anything to the contrary in this Agreement, the Acquired Assets shall not include the assets, properties and rights of Seller set forth on Schedule 2.1(b) hereto (collectively, the “Excluded Assets”). The term Excluded Assets includes without limitation cash of Seller.

2.2 Assumed Liabilities; Retained Liabilities.

(a) Assumption of Assumed Liabilities. On and subject to the terms and conditions of this Agreement, Buyer agrees to assume and become responsible for all of the Assumed Liabilities at the Closing. Buyer will not assume or have any responsibility, however, with respect to any other obligation or liability of Seller not included within the definition of Assumed Liabilities. “Assumed Liabilities” means only those Liabilities of Seller set forth on Schedule 2.2(a), which includes a list of the assumed accounts payable of Seller.

| Page 4 |

(b) Retained Liabilities.

(i) With the sole exception of the Assumed Liabilities, the Seller shall retain, and the Buyer shall not be obligated to pay, perform or otherwise discharge, any other Liabilities of Seller, whether arising prior to, on or after the Closing Date, whether or not related to the Business and whether or not disclosed to the Buyer (“Retained Liabilities”). The Selling Parties hereby agree to pay and perform when due all of the Retained Liabilities. Notwithstanding anything to the contrary, Retained Liabilities include without limitation the following (i.e., none of the following are being assumed by the Buyer): (1) any obligations of Seller to the shareholders of the Seller and other Affiliates of the Seller; (2) any Liability resulting from, arising out of, relating to, in the nature of, or caused by any breach of contract, breach of warranty, tort, infringement or violation of Applicable Law by Seller relating to the Business prior to or on the Closing Date, (3) all Liabilities to employees or others for employment benefits, employee plan, collective bargaining agreement or other employment related Liabilities incurred or arising prior to or on the Closing Date, (4) all Liability for Taxes due from Seller, and (5) all Liability to indemnify any individual or entity.

(ii) If, after the Closing Date, Buyer receives any invoice or other request for payment for a Retained Liability, then Buyer shall promptly forward such invoice or other request for payment to Seller.

2.3 Closing; Place of Closing.

Subject to the terms and conditions of this Agreement, the closing of the purchase, sale and transactions contemplated by this Agreement (the “Closing”) shall be held simultaneously with the execution and delivery of this Agreement, which is the date of this Agreement first above set forth. The time at which Closing occurs is the “Closing Date,” which, to the extent permitted by Applicable Law shall be treated as being effective as of 11:59 PM on such date. The Closing shall be consummated at the law offices of Averitt & Alford, PA in Jacksonville Beach, Florida or remotely by exchange of documents and signatures (or their electronic counterparts).

2.4 Payment of Purchase Price.

The total purchase price for the Acquired Assets will be as set forth below (the “Purchase Price”). Buyer shall pay the Purchase Price as follows:

(a) Common Stock. At Closing, Buyer shall deliver to Seller $500,000 of Grove's common stock, par value $0.001 per share (the “Grove Common Stock"), valued at the IPO price, which is $5.00 per share (the “Issuance Price”) and results in 100,000 shares of Grove Common Stock, the stock certificates for which shall be issued in book format within five (5) days after Closing.

(b) Promissory Note. At Closing, Buyer shall deliver to Seller a non-negotiable promissory note from Grove in favor of Seller in the original principal amount of $500,000 in substantially the same form as Exhibit B (the “Promissory Note”).

(c) Convertible Note. At Closing, Buyer shall deliver to Seller a non-negotiable convertible promissory note (the “Convertible Note”) from Grove in favor of Seller in the original principal amount of $500,000, convertible at the Seller’s option into Grove Common Stock at $5.00 per share of Grove Common Stock, which Convertible Note shall be in substantially the same form as Exhibit C. The Convertible Note shall be subject to offset for any amounts that Seller owes to Buyer arising from a reduction in Purchase Price due to a negative NWC Adjustment Amount.

| Page 5 |

(d) Closing Cash Payment. At Closing, Buyer shall pay $2,000,000 in immediately available U.S. funds to the Seller pursuant to the wire transfer instructions set forth on Exhibit D (the “Closing Cash Payment to Seller”).

(e) Purchase Price Reduction - Revenue Shortfall. If the revenues of the Business during the period commencing on the day of Closing and ending on the first anniversary of the Closing are less than $2,500,000, then the Purchase Price shall be reduced as calculated in accordance with the provisions of Appendix I and the Sellers shall refund that reduction to Buyer.

(f) Purchase Price Adjustment –Working Capital. In accordance with Appendix II, the Purchase Price will be adjusted (positively or negatively) based upon the differences in the book value of the Closing Working Capital (as defined in Appendix II) as compared to a “Benchmark Working Capital” of $573,000 (such difference to be called the “NWC Adjustment Amount”.) If the NWC Adjustment Amount is positive, the Purchase Price will be increased by the NWC Adjustment Amount. If the NWC Adjustment Amount is negative, the Purchase Price will be decreased by the NWC Adjustment Amount. If the Purchase Price increases then Buyer will pay an amount equal to the increase to Seller within five (5) days of a final determination under Appendix II in immediately available U.S. funds. If the Purchase Price decreases then the Seller will pay the amount of the decrease to Buyer within five (5) days of a final determination under Appendix II, which shall first reduce the principal of the Convertible Note (thus reducing the number of shares of Grove Common Stock for which it may be converted) and then the remaining balance (if any) shall be paid by Seller in immediately available U.S. funds to Buyer. For example, if (A) the Closing Working Capital exceeds the Benchmark Working Capital by Three Thousand Dollars ($3,000) then the Purchase Price will increase by Three Thousand Dollars ($3,000); or (B) if the Closing Working Capital is less than the Benchmark Working Capital by Three Thousand Dollars ($3,000) then the Purchase Price decreases by Three Thousand Dollars ($3,000), which reduces the principal of the Convertible Note by that amount.

2.5 Closing Documents for Closing.

In addition to the payments and deliverables at Closing referenced in Section 2.4 above, the Buying Parties and the Selling Parties shall execute (where applicable) this Agreement and the following documents (each, a “Closing Document” and collectively, the “Closing Documents”) and take the following actions at the Closing: The Selling Parties shall deliver to the Buyer:

(i) A Bill of Sale and Assignment in the form of Exhibit E executed by Seller; and

(ii) An Assignment of Patents, Assignment of Servicemarks and Trademarks and Assignment of Copyrights in the form of Exhibits F-1, F-2 and F-3 executed by Seller; and

(iii) Non-Competition Agreements in the form of Exhibit G (the "Selling Parties’ Non-Competition Agreements") executed by each of the Selling Parties; and

(iv) Employment Agreements in the form of Exhibits H-1 and H-2 executed by each of the Seller Stockholders (“the Employment Agreements”)

| Page 6 |

(v) An opinion from Seller’s legal counsel in form and substance as set forth in Exhibit I attached hereto, addressed to the Buyer; and

(vi) A certificate executed by the President of Seller certifying that such President has the power and authority to enter into on behalf of Seller this Agreement and the other documents to be executed by Seller pursuant hereto, and to bind Seller hereto and thereto; and

(vii) A Domain Name Assignment in the form of Exhibit J executed by Seller; and

(viii) A list of all Unfilled Vendor Purchase Orders as of the Closing Date, which shall be set forth on Schedule 6.4; and

(ix) such other instruments of conveyance of Seller as Buyer may reasonably request in order to effect the sale, transfer, conveyance and assignment to Buyer of valid ownership of the Acquired Assets; and

(x) deliver possession and control of all of the Acquired Assets of a tangible nature to Buyer; and

(xi) Payoff letters from each Person who has any Lien on or affecting any or all of the Acquired Assets, which letters shall state the outstanding amount of the obligation secured by the Lien (which amount shall be paid by Seller at Closing to such Person) and, after Closing, Seller shall provide copies of executed and filed UCC-3 termination statements and/or similar or other instruments evidencing the satisfaction of such indebtedness or other obligation in each jurisdiction where evidence of such obligation is necessary to perfect such satisfaction; and

(xii) An entity status letter from the State of California Franchise Tax Board confirming that there are no unpaid California taxes for which Buyer may be liable (or its equivalent); and

(xiii) A Transition Services Agreement in the form of Exhibit K executed by Seller;

(xiv) GS1 Company Prefix Release Letter executed by Seller; and

(xv) Such other documents executed by the Selling Parties as may be reasonably requested by the Buyer.

(b) The Buyer shall deliver to the Seller:

(i) The Selling Parties’ Non-Competition Agreements executed by Buyer; and

(ii) The Employment Agreements executed by Buyer; and

(iii) The Transition Services Agreement executed by Buyer; and

(iv) A certificate executed by the President or a Vice President of each of the Buying Parties certifying that such President or Vice President has the power and authority to enter into on behalf of the respective Buying Party this Agreement and the other documents to be executed by that Buying Party pursuant hereto, and to bind the respective Buying Party hereto and thereto.

| Page 7 |

2.6 Further Assurances.

Following the Closing Date, at the request of the Buyer, the Selling Parties shall deliver any further instruments of transfer and shall take all such further action as may be necessary or appropriate to vest in the Buyer good title to the Acquired Assets that were to be transferred previously and to effectuate the transactions contemplated herein. Furthermore, following the Closing Date, the Parties agree (i) to use all reasonable efforts to take, or cause to be taken, all actions and to do, or cause to be done, all things necessary, proper or advisable to consummate and make effective the transactions contemplated by this Agreement; (ii) to execute any documents, instruments or conveyances of any kind which may be reasonably necessary or advisable to carry out any of the transactions contemplated hereunder and thereunder; and (iii) to reasonably cooperate with each other in connection with the foregoing.

2.7 Allocation of Purchase Price.

The Parties agree to allocate the entire Purchase Price among the Acquired Assets and the Selling Parties’ Non-Competition Agreements in accordance with Schedule 2.7 attached hereto for all federal, state and municipal Tax purposes. The Parties agree that all Tax Returns shall be prepared consistent therewith.

3. Representations and Warranties by the Selling Parties.

The Selling Parties jointly and severally represent and warrant to the Buying Parties that the following statements are true and correct as of the date hereof, which is the Closing Date.

3.1 Organization, Good Standing and Qualification of Seller.

Seller is a corporation duly organized, validly existing, and in good standing under the laws of the jurisdiction of its incorporation, which is the state of California. The Seller is duly qualified to do business in all states where it is required to be so qualified and has all requisite corporate power and authority to carry on its business as now conducted and as proposed to be conducted. Schedule 3.1 hereof contains a true and accurate list of all jurisdictions in which Seller is qualified to do business as a foreign corporation.

3.2 Authorization of Transaction.

Each Selling Party that is a natural Person has the legal capacity to execute and deliver this Agreement and all Closing Documents to which that Selling Party is a party. Seller has full power and authority (including full corporate or other entity power and authority) to execute and deliver this Agreement and all Closing Documents to which Seller is a party and to perform its obligations under this Agreement and those Closing Documents. Without limiting the generality of the foregoing, the board of directors of Seller as well as all of the Seller Stockholders have duly authorized the execution, delivery, and performance of this Agreement by Seller. This Agreement constitutes the valid and legally binding obligation of Seller and the Selling Stockholders, enforceable in accordance with its terms and conditions.

| Page 8 |

3.3 Non-contravention.

Neither the execution and delivery of this Agreement, nor the consummation of the transactions contemplated hereby, will (i) violate any constitution, statute, regulation, rule, injunction, judgment, order, decree, ruling, charge, or other restriction of any Governmental Authority to which Seller is subject or any provision of the Governing Documents of Seller or (ii) conflict with, result in a breach of, constitute a default under, result in the acceleration of, create in any party the right to accelerate, terminate, modify, or cancel, or require any notice under any agreement, contract, lease, license, instrument, or other arrangement to which Seller is a party or by which it is bound or to which any of its assets is subject (or result in the imposition of any Lien upon any of its assets). Seller does not need to give any notice to, make any filing with, or obtain any authorization, consent, or approval of any Governmental Authority in order for the Parties to consummate the transactions contemplated by this Agreement.

3.4 Consents.

No license, consent or approval of any Person is required, and no notice is required to be given to any Person, for or in connection with the Selling Parties’ execution and delivery of this Agreement or the Closing Documents or the consummation by the Selling Parties of the transactions contemplated hereby or thereby.

3.5 Brokers’ Fees.

Selling Parties have no liability or obligation to pay any fees or commissions to any broker, finder, or agent with respect to the transactions contemplated by this Agreement for which Buyer could become liable or obligated.

3.6 Subsidiaries.

Seller does not have any Subsidiaries. Seller does not own or have any right to acquire, directly or indirectly, any outstanding capital stock of, or equity interest in any Person.

3.7 Compliance with Laws; Permits.

(a) Seller has conducted and operated the Business in compliance with all Applicable Laws.

(b) No event has occurred or circumstance exists that (with or without notice or lapse of time) (i) may constitute or result in a violation by Seller of, or a failure on the part of Seller to comply with, any Applicable Laws; or (ii) may give rise to any obligation on the part of Seller to undertake, or to bear all or any portion of the cost of, any remedial action of any nature; and Seller has not received, at any time since December 31, 2020, any notice or other communication (whether oral or written) from any Governmental Authority or any other Person regarding (1) any actual, alleged, possible or potential violation of, or failure to comply with, any Applicable Laws; or (2) any actual, alleged, possible or potential obligation on the part of Seller to undertake, or to bear all or any portion of the cost of, any remedial action of any nature.

(c) Schedule 3.7 lists all Permits of or held by Seller. Each Permit listed in Schedule 3.7 is in full force and effect, and Seller is not in violation of or default under any Permit. No suspension or cancellation of any such Permit has been threatened in writing. The Permits include, but are not limited to, those required in order for Seller to conduct the Business under federal, state, local or foreign statutes, ordinances, orders, requirements, rules, regulations, Environmental, Health, and Safety Requirements and laws pertaining to public health and safety, worker health and safety, buildings, highways or zoning. None of the Permits is subject to termination as a result of the execution of this Agreement or the consummation of the transactions contemplated hereby, and, to Seller’s Knowledge, Buyer will not be required to obtain any further Permits to continue to conduct the Business immediately after the Closing. Seller has not made any false statements on, or omissions from, any notifications, applications, approvals, reports and other submissions to any Governmental Authority or in or from any other records and documentation prepared or maintained to comply with the requirements of any Governmental Authority.

| Page 9 |

3.8 Title to Assets.

The Seller has good, marketable and valid title to all of the Acquired Assets, free and clear of any Liens. The Acquired Assets are being transferred to Buyer free and clear of any Liens.

3.9 Condition and Sufficiency of Assets.

The Acquired Assets include all of the assets used in the Business and all of the operating assets of Seller, and are in operating condition and in a state of reasonable maintenance and repair (normal wear and tear excepted), are suitable for the uses for which they are used in the Business, and are not subject to any condition that interferes with the economic value or use thereof. The Acquired Assets are sufficient to operate the Business as presently operated. Since December 31, 2020, no assets have been used in the Business which were or are owned (in whole or in part) by any partner or shareholder of Seller or any Person other than Seller, except as disclosed on Schedule 3.9.

3.10 Financial Information.

(a) Seller has delivered to Buyer the following financial statements and the related statements of income for the period then ended (including the notes thereto; collectively, “Financial Statements”): (x) a balance sheet of Seller as of December 31, 2020 (the “Most Recent Year End Balance Sheet”); and (y) balance sheets of Seller for the fiscal years ended December 31 of 2019 and 2020; and (z) a balance sheet of Seller as at June 30, 2021 (the “Interim Balance Sheet”).

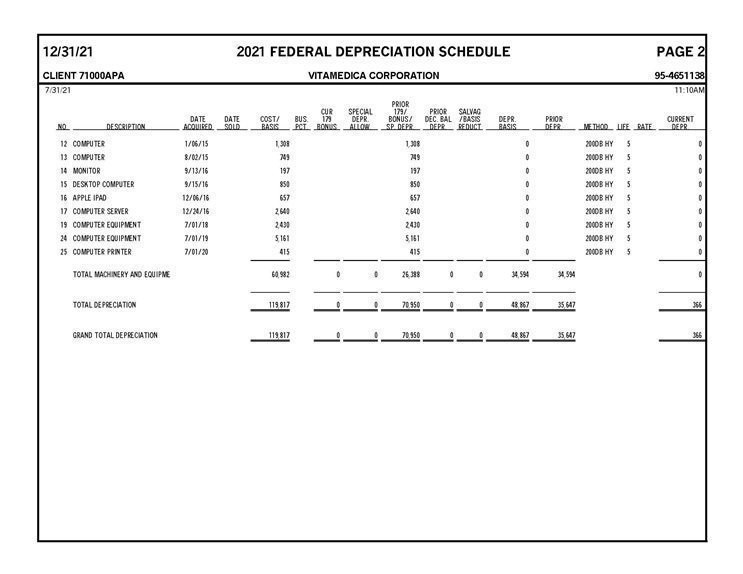

(b) Additionally, as part of the Financial Statements, the Seller has provided to Buyer the following: (i) sales by customer by item of inventory for fiscal year 2020 and January 1 through July 31, 2021; (ii) customer sales by month for fiscal year 2020 and January 1 through July 31, 2021; and (iii) unaudited inventory analysis, as revised, dated July 31, 2021; and (iv) sales by customer in dollars for January 1 through July 31, 2021. The Financial Statements are attached to this Agreement as Schedule 3.10.

(c) The Financial Statements of Seller (including the Interim Balance Sheet) have been prepared from and are in accordance with the historical accounting policies, assumptions, methodologies and practices of Seller, consistently applied, which (i) are consistent with the accounting records of Seller; and (ii) differ from GAAP in a material respect only as set forth in Schedule 3.10(c) hereto.

3.11 No Undisclosed Liabilities.

Seller has no Liabilities, except as set forth on the Interim Balance Sheet and Liabilities entered into in the Ordinary Course of Business since the date of the Interim Balance Sheet, except as set forth in Schedule 3.11.

3.12 Absence of Certain Events.

Since December 31, 2020, the Seller has not:

| Page 10 |

(a) sold, assigned, or transferred any assets used in the Business except in the Ordinary Course of Business consistent with past practice;

(b) suffered any damage, destruction or loss, whether or not covered by insurance, or suffered any repeated, recurring or prolonged shortage, cessation or interruption of delivery of supplies or utility services required to conduct the Business, or suffered any change in its financial condition or in the nature of its Business or operations which has had or might have a materially adverse effect on the operations, Acquired Assets or properties of the Seller, taken as a whole, or its Business; or

(c) entered into any transaction with respect to the Business other than in the Ordinary Course of Business consistent with past practices.

3.13 Inventory.

All items of Inventory included in the Acquired Assets which are being purchased by Buyer consist of a quality and quantity usable and, with respect to finished goods, saleable, in the Ordinary Course of Business of Seller. At Closing, Seller shall not be in possession of any Inventory that is not owned solely by Seller (e.g., goods sold by Seller to others). All Inventory at Closing shall have been purchased in the Ordinary Course of Business of Seller at a cost not exceeding market prices prevailing at the time of purchase. The quantities of each item of Inventory being purchased by Buyer (whether raw materials, work-in-process or finished goods) are not excessive but are reasonable in the present circumstances of Seller and the Business. The Inventory is located at the locations set forth on Schedule 3.13.

3.14 Employees; Employee Benefits.

(a) Employees. To the Knowledge of Seller, no executive, key employee, or significant group of employees plans to terminate employment with Seller during the next twelve (12) months. Seller is not a party to or bound by any collective bargaining agreement, nor has Seller experienced any strike or material grievance, claim of unfair labor practices, or other collective bargaining dispute within the past three (3) years. Seller has not committed any material unfair labor practice within the past three (3) years. To the Knowledge of Seller, there is no organizational effort presently being made or threatened by or on behalf of any labor union with respect to employees of Seller and no such effort has occurred within the past three (3) years. With respect to this transaction, any notice required under any law or collective bargaining agreement has been given, and all bargaining obligations with any employee representative have been satisfied. Seller has adequately investigated all sexual harassment allegations of which it is or was made aware. With respect to each such allegation, Seller has taken all corrective action necessary under Applicable Law.

(b) Employee Benefits. Schedule 3.14 lists each Employee Plan that Seller maintains or to which Seller contributes or has any obligation to contribute, or with respect to which Seller has any liability. All Employee Plans comply with all Applicable Laws, and all amounts that Seller is responsible for with respect to the Employee Plans that are due and payable have been paid. The liability for all Employee Plans is a Retained Liability.

3.15 Taxes.

(a) Seller has filed all Tax Returns on a timely basis (after taking into account extensions) and has timely paid all Taxes due from Seller. Schedule 3.15 lists all federal, state, local, and non-U.S. Tax Returns required to be filed and those that were actually filed with respect to Seller during the period from January 1, 2020 to Closing. All Taxes and Tax Returns are Retained Liabilities. There is no material dispute or claim concerning any Tax liability of Seller either (A) claimed or raised by any authority in writing or (B) as to which Seller Stockholders or any of the directors or officers of Seller has Knowledge.

| Page 11 |

(b) With respect to all sales and operations of the Business prior to the Closing Date with respect to which any Tax Return or Taxes are not yet due, Selling Parties shall file all Tax Returns on a timely basis. Selling Parties shall pay all Taxes on a timely basis.

3.16 Litigation.

Schedule 3.16 sets forth each instance in which Seller is or, at any time during the three (3) years prior to the date of this Agreement, was (i) subject to any outstanding injunction, judgment, order, decree, ruling, or charge or (ii) a party or, to the Knowledge of Seller, threatened to be made a party to any action, suit, proceeding, hearing, or investigation of, in, or before (or that could come before) any court or quasi-judicial or administrative agency of any federal, state, local, or non-U.S. jurisdiction or before (or that could come before) any arbitrator.

3.17 Contracts.

Schedule 3.17 lists the following contracts and other agreements to which Seller is a party:

(i) any agreement (or group of related agreements) for the lease of personal property to or from any Person providing for lease payments in excess of $1,000.00 per annum;

(ii) any agreement (or group of related agreements) for the purchase or sale of raw materials, commodities, supplies, products, or other personal property, or for the furnishing or receipt of services, the performance of which will extend over a period of more than 1 year or involve consideration in excess of $1,000.00;

(iii) any agreement concerning a partnership or joint venture;

(iv) any agreement (or group of related agreements) under which it has created, incurred, assumed, or guaranteed any indebtedness for borrowed money, or any capitalized lease obligation, in excess of $1,000.00 or under which it has imposed a Lien on any of its assets, tangible or intangible;

(v) any material agreement concerning confidentiality or non-competition;

(vi) any material agreement involving any Seller Stockholder and his, her, or its Affiliates (other than Seller);

(vii) any profit sharing, stock option, stock purchase, stock appreciation, deferred compensation, severance, or other material plan or arrangement for the benefit of its current or former directors, officers, and employees;

(viii) any collective bargaining agreement;

(ix) any agreement for the employment of any individual on a full-time, part-time, consulting, or other basis providing annual compensation in excess of $30,000.00 or providing material severance benefits;

(x) any agreement under which it has advanced or loaned any amount to any of its directors, officers, and employees outside the Ordinary Course of Business;

| Page 12 |

(xi) any agreement under which the consequences of a default or termination could have a Material Adverse Effect;

(xii) any settlement, conciliation or similar agreement with any Governmental Authority or which will involve payment after the execution date of this Agreement;

(xiii) any agreement under which Seller has advanced or loaned any other Person amounts in the aggregate exceeding $1,000.00; or

(xiv) any other agreement (or group of related agreements) the performance of which involves consideration in excess of $1,000.00.

Seller has delivered to Buyer a correct and complete copy of each written agreement listed in Schedule 3.17 and a written summary setting forth the material terms and conditions of each oral agreement referred to in Schedule 3.17. With respect to each such agreement: (A) the agreement is legal, valid, binding, enforceable, and in full force and effect in all material respects; (B) no party is in material breach or default, and no event has occurred that with notice or lapse of time would constitute a material breach or default, or permit termination, modification, or acceleration, under the agreement; and (C) no party has repudiated any material provision of the agreement.

3.18 Product Warranty.

(a) Each Product manufactured, sold, or delivered by the Seller has been in conformity with all contractual commitments in all material respects and all express and implied warranties, and the Seller has not received notice of any Liability (and, to the Selling Parties’ Knowledge, there is no basis for any present or future action, suit, Proceeding, hearing, investigation, charge, complaint, claim, or demand against the Seller giving rise to any Liability) for replacement or repair thereof or other damages in connection therewith.

(b) None of the Products manufactured, sold, leased, licensed or delivered by Seller is subject to any guaranty, warranty, right of return, right of credit or other indemnity other than (i) the applicable standard terms and conditions of sale or lease of the Business, which are set forth in Schedule 3.18, (ii) manufacturers’ warranties for which the Business has no liability or (iii) warranties imposed by Applicable Laws. Schedule 3.18 sets forth the aggregate expenses incurred by Seller in fulfilling its obligations under its guaranty, warranty, right of return and indemnity provisions with respect to the Business during calendar year 2020 and the period in 2021 up to the date of the Interim Balance Sheet.

3.19 Product Liability and Product Returns.

(a) Seller has not received notice of any Liability (and, to Selling Parties’ Knowledge, there is no basis for any present or future action, suit, Proceeding, hearing, investigation, charge, complaint, claim, or demand against any of them giving rise to any Liability) arising out of any injury to individuals or property as a result of the ownership, possession, or use of any Product manufactured, sold, leased, or delivered by the Seller.

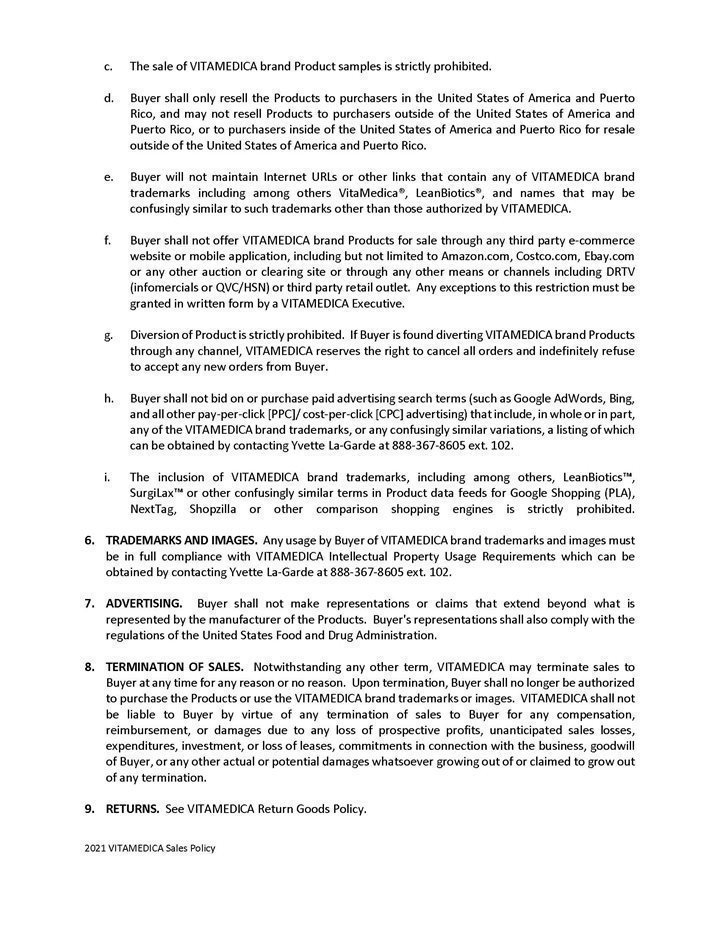

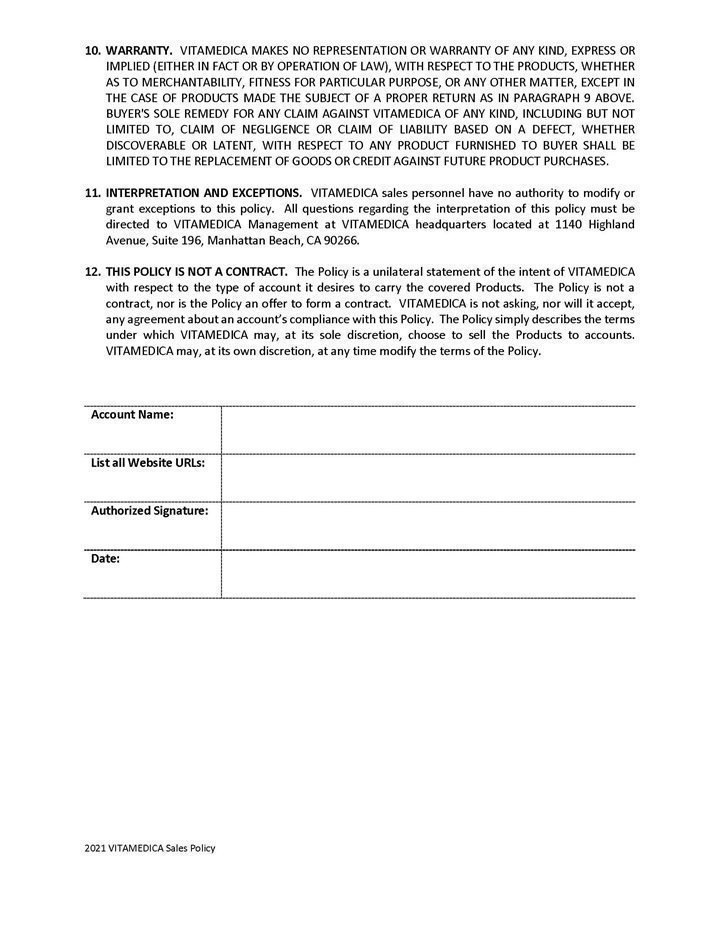

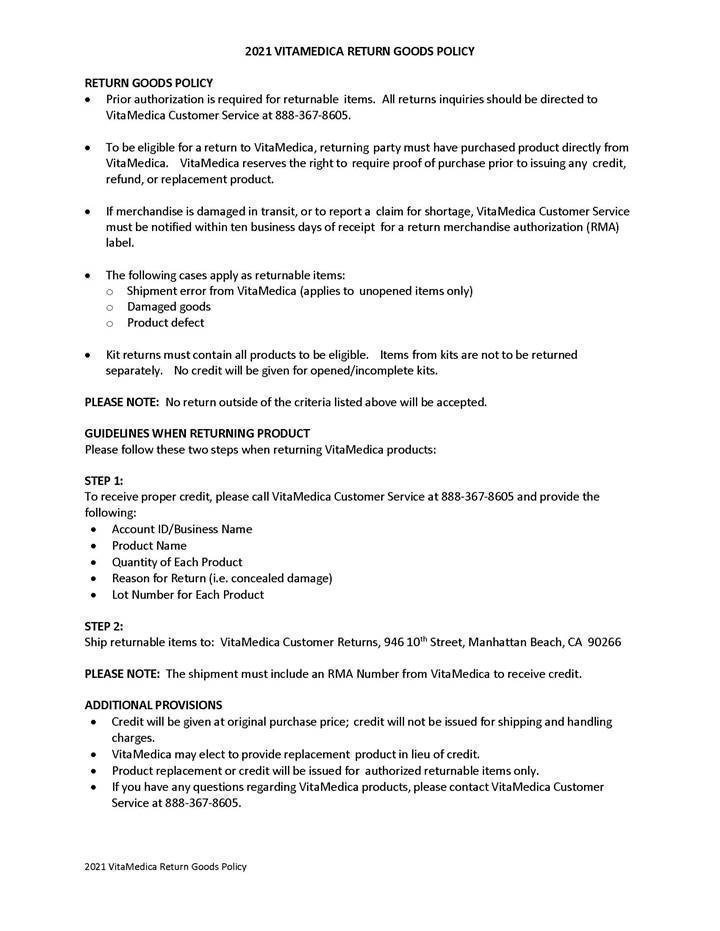

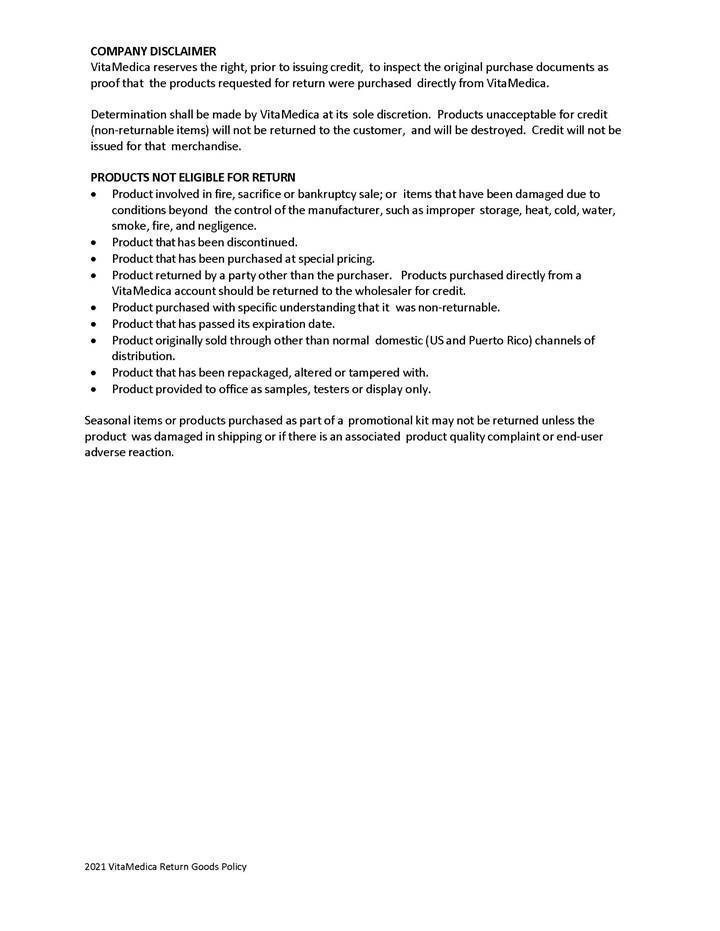

(b) Seller does not maintain a reserve for expected product returns and all product returns are accounted for in the period they occur. Except as set forth in Schedule 3.19(b), the Seller has not received any notice of, and to the Knowledge of the Selling Parties, there are not any pending, threatened or potential product returns by any Customer or other individual or entity which purchased, leased or otherwise acquired from Seller any Products. Except as set forth in Seller’s sales and return goods policies, which Buying Parties acknowledge receipt of , the Seller does not have any agreement with a distributor or other reseller permitting a return of unsold Products.

| Page 13 |

(c) All Liability for product returns or defective products sold, manufactured or imported (in whole or part) by Seller prior to Closing are Retained Liabilities.

(d) For the year 2020 and the partial year 2021 (prior to Closing), the Product returns and refunds are approximately the same percentage of sales as for prior years, which is Two percent (2%). To the best of Selling Parties’ Knowledge, the Product returns and refunds after the Closing will continue to be approximately the same percentage of sales and Seller has no reason to believe that there will be an increase.

3.20 Relationships.

Except as set forth on Schedule 3.20, there is no dispute or controversy existing between the Seller and any of Seller’s Customers, and no Customer has indicated in writing or otherwise that it intends to discontinue or decrease its purchases from Seller; and there is no dispute or controversy existing between the Seller and any supplier or other contractor. There is no dispute or controversy existing between the Seller and any of Seller’s suppliers, contractors or vendors (each a “Vendor” and collectively, "Vendors"). None of the Vendors has indicated that it intends to discontinue or materially decrease its supplying of products or services for the Business or increase the prices. Since December 31, 2020, there are and have been no renegotiations or attempts to renegotiate or outstanding rights to renegotiate any rights or obligations under any agreement with any Customer or any of the Vendors.

3.21 Real Property.

(a) Seller does not own any real property.

(b) Seller leases the real property located at 22109 S. Vermont Ave., Torrance, CA 90502 pursuant to the Warehouse Lease. A true, accurate and complete copy of the Warehouse Lease is attached as Schedule 3.21. The Warehouse Lease is in full force and effect and there are no breaches under the Warehouse Lease.

3.22 Intellectual Property.

(a) The Seller owns or has the right to use pursuant to license, sublicense, agreement, or permission all Intellectual Property necessary for the operation of the Business as presently conducted and as presently proposed to be conducted. Each item of Intellectual Property owned or used by the Seller immediately prior to the Closing hereunder will be owned or available for use by the Buyer on identical terms and conditions immediately subsequent to the Closing hereunder. The Seller has taken all necessary action to maintain and protect each item of Intellectual Property that it owns or uses. The accounting software, websites and other technology will be transferred to the Buyer.

(b) The Seller has not interfered with, infringed upon, misappropriated, or otherwise come into conflict with any Intellectual Property rights of third parties, and the Seller has never received any charge, complaint, claim, demand, or notice alleging any such interference, infringement, misappropriation, or violation (including any claim that the Seller must license or refrain from using any Intellectual Property rights of any third party). To the Knowledge of the Selling Parties, no third party has interfered with, infringed upon, misappropriated, or otherwise come into conflict with any Intellectual Property of the Seller.

| Page 14 |

(c) Schedule 3.22 identifies each patent or registration which has been issued to the Seller with respect to any of its Intellectual Property relating to the Business, identifies each pending patent application or application for registration which the Seller has made with respect to any of its Intellectual Property relating to the Business, and identifies each license, agreement, or other permission which the Seller has granted to any third party with respect to any of its Intellectual Property (together with any exceptions) relating to or used in connection with the Business. The Seller has delivered to the Buyer correct and complete copies of all such patents, registrations, applications, licenses, agreements, and permissions (as amended to date) and has made available to the Buyer correct and complete copies of all other written documentation evidencing ownership and prosecution (if applicable) of each such item. Schedule 3.22 also identifies each trade name or unregistered trademark used by the Seller in connection with any of its businesses. With respect to each item of Intellectual Property required to be identified on Schedule 3.22:

(i) the Seller possesses all right, title, and interest in and to the item, free and clear of any Lien, license, or other restriction;

(ii) the item is not subject to any outstanding injunction, judgment, order, decree, ruling, or charge;

(iii) no action, suit, Proceeding, hearing, investigation, charge, complaint, claim, or demand is pending or, to the Knowledge of the Selling Parties, is threatened which challenges the legality, validity, enforceability, use, or ownership of the item; and

(iv) the Seller has not ever agreed to indemnify any Person for or against any interference, infringement, misappropriation, or other conflict with respect to the item.

(d) There is no Intellectual Property related to the Business or used by Seller that is owned by any third party except for "off-the-shelf" software that is sold by national retail chain stores (e.g., Best Buy).

(e) The Buyer will not interfere with, infringe upon, misappropriate, or otherwise come into conflict with, any Intellectual Property rights of third parties as a result of the continued operation of the Business by Buyer post-Closing so long as the Business is conducted in the same manner as presently conducted by Seller.

3.23 GS1 Company Prefix.

Selling Parties represent and warrant that Seller is the current registered licensee of GS1 Company Prefix Number 0681148 (the “GS1 Company Prefix”), which is being sold to Buyer as part of the Acquired Assets.

3.24 IT Assets.

None of the computer software, computer hardware (whether general or special purpose), telecommunications capabilities (including all voice, data and video networks) and other similar or related items of automated, computerized, and/or software systems and any other networks or systems and related services that are used by or relied on by Seller in the conduct of the Business (collectively, the “IT Systems”) have experienced bugs, failures, breakdowns, or continued substandard performance in the past twelve (12) months that has caused any substantial disruption or interruption in or to the use of any such IT Systems or data by Seller. The IT Systems are sufficient for the needs of the Business, including as to capacity, scalability, and ability to process current and anticipated peak volumes in a timely manner.

| Page 15 |

3.25 Data Privacy and Security.

The Business has complied with and, as presently conducted, is in compliance with, all Data Laws except, in each case, to the extent that a failure to comply would not have a Material Adverse Effect. Seller has complied with, and are presently in compliance with, its and their respective policies applicable to data privacy, data security, and/or personal information except, in each case, to the extent that a failure to comply would not have a Material Adverse Effect. Seller has not experienced any incident in which personal information or other sensitive data was or may have been stolen or improperly accessed, acquired, destroyed, damaged, disclosed, corrupted, or altered, and Seller is not aware of any facts suggesting the likelihood of the foregoing, including without limitation, any breach of security or receipt of any notices or complaints from any Person regarding personal information or other data.

3.26 Insurance.

The Seller maintains general liability insurance on an occurrence basis, which shall remain in effect through and after the Closing Date. Schedule 3.26 sets forth a complete list of, and the following information for, all product liability insurance policies currently in force and those which were in force during any of the last three (3) calendar years, which name the Seller as an insured or beneficiary or as a loss payable payee, or for which the Seller has paid or is obligated to pay all or part of the premiums:

(i) the name, address, and telephone number of the agent;

(ii) the name of the insurer, the name of the policyholder, and the name of each covered insured; and

(iii) the policy number and the period of coverage.

With respect to each currently in force insurance policy, to the Seller’s Knowledge the policy is legal, valid, binding and in full force and effect. Seller shall provide copies of the certificate(s) of insurance for all such currently in force insurance policies to Buyer at Closing.

3.27 Related Party Transactions.

Since December 31, 2020, no Selling Party is now, or has been, the direct or indirect owner of an interest in any Person that is a present or potential competitor, supplier or customer of the Seller (other than non-affiliated holdings in publicly held companies).

3.28 No Material Adverse Change.

Except as set forth in Schedule 3.28, since December 31, 2020, there have been no Material Adverse Changes in the Business, operations, prospects, Acquired Assets, results of operations or condition (financial or otherwise) of Seller, and no event has occurred or circumstances exist that may result in such a Material Adverse Change.

3.29 Disclosure.

No representation or warranty by the Selling Parties in this Agreement (including the schedules and the exhibits attached hereto), or information in any certificate or schedule furnished or to be furnished to the Buyer pursuant hereto, contains or will contain any untrue statement of a material fact, or omits or will omit to state a material fact necessary to make the statements contained herein or therein not misleading.

| Page 16 |

4. Buying Parties’ Representations and Warranties.

The Buying Parties jointly and severally represent and warrant to Selling Parties that the statements contained in this Section 4 are correct and complete as of the date of this Agreement, which is the Closing Date.

4.1 Organization of Buyer.

Each of the Buying Parties is a corporation duly organized, validly existing, and in good standing under the laws of the jurisdiction of its incorporation.

4.2 Authorization of Transaction.

Each of the Buying Parties has full power and authority (including full corporate or other entity power and authority) to execute and deliver this Agreement and to perform its obligations hereunder. This Agreement constitutes the valid and legally binding obligation of Buying Parties, enforceable in accordance with its terms and conditions. Buying Parties need not give any notice to, make any filing with, or obtain any authorization, consent, or approval of any Governmental Authority in order to consummate the transactions contemplated by this Agreement. The execution, delivery and performance of this Agreement and all other agreements contemplated hereby have been duly authorized by Buying Parties.

4.3 Non-contravention.

Neither the execution and delivery of this Agreement, nor the consummation of the transactions contemplated hereby (including the assignments and assumptions referred to in Section 2 above), will (i) violate any constitution, statute, regulation, rule, injunction, judgment, order, decree, ruling, charge, or other restriction of any Governmental Authority to which any of the Buying Parties is subject or any provision of either of the Buying Parties’ Governing Documents or (ii) conflict with, result in a breach of, constitute a default under, result in the acceleration of, create in any party the right to accelerate, terminate, modify, or cancel, or require any notice under any agreement, contract, lease, license, instrument, or other arrangement to which either of the Buying Parties is a party or by which it is bound or to which any of its assets are subject. Buying Parties do not need to give any notice to, make any filing with, or obtain any authorization, consent, or approval of any Governmental Authority in order for the Parties to consummate the transactions contemplated by this Agreement (including the assignments and assumptions referred to in Section 2 above).

4.4 Brokers’ Fees.

Except as set forth in Section 6.13, Buying Parties have no liability or obligation to pay any fees or commissions to any broker, finder, or agent with respect to the transactions contemplated by this Agreement for which Seller could become liable or obligated.

5. Representations and Warranties Concerning Grove Common Stock.

5.1 Selling Parties’ Representations and Warranties Concerning Grove Shares.

Selling Parties jointly and severally represent and warrant to Buying Parties that the statements contained in this Section 5.1 are correct and complete as of the date of this Agreement, which is the Closing Date.

| Page 17 |

(a) Access to Information. Each Selling Party understands that an investment in the Grove Shares involves a high degree of risk and long term or permanent illiquidity, including, risk of loss of their entire investment. Selling Parties have been given full and complete access to the Buyer for the purpose of obtaining such information as each Selling Party or that Selling Party’s qualified representative has reasonably requested in connection with the decision to acquire the Grove Shares. The Selling Parties have received and reviewed copies of the Prospectus. The Selling Parties have been afforded the opportunity to ask questions of the officers of Grove regarding its business prospects, all as each Selling Party (or that Selling Party’s investor’s representatives) has deemed necessary to make an informed investment decision to purchase the Grove Shares.

(b) Restricted Securities. (A) Selling Parties have been advised that none of the Grove Shares have been registered under the Securities Act or any other applicable securities laws. Selling Parties acknowledge that the Grove Shares will be issued as “restricted securities” as defined by Rule 144 promulgated pursuant to the Securities Act. None of the Grove Shares may be resold in the absence of an effective registration thereof under the Securities Act and applicable state securities laws unless, in the opinion of counsel reasonably satisfactory to Grove, an applicable exemption from registration is available; (B) Selling Parties are acquiring the Grove Shares for each Selling Party’s own account, and not as nominee or agent, for investment purposes only and not with a view to, or for sale in connection with, a distribution, as that term is used in Section 2(11) of the Securities Act, in a manner which would require registration under the Securities Act or any state securities laws; (C) each Selling Party understands and acknowledges that the certificates representing the Grove Shares will bear substantially the following legend:

“THE SECURITIES EVIDENCED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR APPLICABLE STATE LAW, AND NO INTEREST THEREIN MAY BE SOLD, DISTRIBUTED, ASSIGNED, OFFERED, PLEDGED OR OTHERWISE TRANSFERRED UNLESS: (i) THERE IS AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT AND APPLICABLE STATE SECURITIES LAWS COVERING ANY SUCH TRANSACTION INVOLVING SAID SECURITIES; (ii) THE COMPANY RECEIVES AN OPINION OF LEGAL COUNSEL REASONABLY SATISFACTORY TO THE COMPANY STATING THAT SUCH TRANSACTION IS EXEMPT FROM REGISTRATION; OR (iii) THE COMPANY OTHERWISE SATISFIES ITSELF THAT SUCH TRANSACTION IS EXEMPT FROM REGISTRATION.”

and (D) Selling Parties acknowledge that an investment in the Grove Shares is not liquid and is transferable only under limited conditions. Selling Parties acknowledge that such securities must be held indefinitely unless they are subsequently registered under the Securities Act or an exemption from such registration is available. Selling Parties are aware of the provisions of Rule 144 promulgated under the Securities Act (“Rule 144”), which permits limited resale of restricted securities subject to the satisfaction of certain conditions and that Rule 144 is not now available and, in the future, may not become available for resale of any of the Grove Shares.

(c) Selling Parties’ Sophistication and Ability to Bear Risk of Loss. Each Selling Party is an Accredited Investor as that term is defined in Regulation D of the Securities Exchange Act, and is able to protect its interests in connection with the acquisition of the Grove Shares and can bear the economic risk of investment in such securities without producing a Material Adverse Change in each respective Selling Party’s financial condition. Each Selling Party, either alone or with Selling Parties’ Representative, otherwise has such knowledge and experience in financial or business matters that said Selling Party is capable of evaluating the merits and risks of the investment in the Grove Shares.

| Page 18 |

5.2 Grove’s Representations and Warranties Concerning Grove Shares.

Grove represents and warrants to Selling Parties that the statements contained in this Section 5.2 are correct and complete as of the date of this Agreement:

(a) Capitalization. Grove’s capitalization is set forth in the Prospectus.

(b) Filings with SEC. Grove has filed a prospectus pursuant to SEC Rule 424(b)(4) dated 6/24/2021 (the “Prospectus”). To Grove 's Knowledge, Grove has made all filings (including the Prospectus) with SEC that it has been required to make on or after June 24, 2021 under the Securities Act and the Securities Exchange Act (collectively the “Public Reports”). To Grove’s Knowledge, as of the time it was filed with the SEC (or, if amended or superseded by a filing prior to the date of this Agreement) the Prospectus: (i) has complied with the Securities Act and the Securities Exchange Act in all material respects; and (ii) does not contain any untrue statement of a material fact or omitted to state a material fact necessary in order to make the statements made therein, in light of the circumstances under which they were made, not misleading. Grove has made available to Selling Parties, through the SEC’s “EDGAR System,” a correct and complete copy of the Prospectus.

(c) Financial Statements. The financial statements included in or incorporated by reference into the Prospectus (including the related notes and schedules) have been prepared in accordance with GAAP throughout the periods covered thereby, and present fairly the financial condition of Grove and its Subsidiaries as of the indicated dates and the results of operations of Grove and its Subsidiaries for the indicated periods; provided, however, that the interim statements are subject to normal year-end adjustments.

(d) Events Subsequent to Most Recent Fiscal Quarter End. To Grove’s Knowledge, since the date of the Prospectus, there has not been any Material Adverse Change.

6. Post-Closing Covenants.

The Parties agree as follows with respect to the period following the Closing:

6.1 Books and Records.

(a) At or promptly after the Closing, Seller will deliver and transfer all the books and records of the Seller that Buyer will need to operate the Business post-Closing. Buyer shall grant reasonable access to Seller for reviewing and copying of those books and records to the extent needed by Seller for preparation of Tax Returns or other legitimate business purposes, subject to the confidentiality obligations set forth in this Agreement. Selling Parties shall grant access to Buying Parties for reviewing and copying of those books and records that are Excluded Assets to the extent requested by Buying Parties for preparation of Tax Returns or other legitimate business purposes, and shall provide Buying Parties with any information stored digitally (e.g., on hard drives or the ‘cloud’) that Buying Parties request for preparation of Tax Returns or other legitimate business purposes.

(b) Except as may otherwise be required by law or agreed to in writing by the parties to this Agreement, Seller shall use reasonable commercial efforts to preserve, until six (6) years after the Closing Date, all information in its possession or control pertaining to the Business prior to the Closing. Notwithstanding the foregoing, in lieu of retaining any specific information, Seller may offer in writing to Buying Parties to deliver such information to Buying Parties, and if such offer is not accepted within 90 days, the offered information may be disposed of at any time.

| Page 19 |

6.2 Employees.

Buyer shall offer a minimum one-year of employment on substantially the same terms as presently offered (except for the 401(k) plan) to the following employees: Paige Avery, Marybeth Knight, Elena Pineda, Melanie Sullivan, Julie Seago and Andrea Mangandi. Buyer will use commercially reasonable efforts to engage Stuart Ridge as an employee or independent contractor.

6.3 Confidential Information.

All information pertaining to the Business and Customers and suppliers shall be protected by Seller and the other Selling Parties and kept as confidential, all of which shall be treated as confidential information that is being transferred to the Buyer under this Agreement which is not to be used or disclosed by Selling Parties.

6.4 Unfilled Vendor Purchase Orders.

The Buyer shall accept the shipment of items pursuant to purchase orders to Vendors made by Seller in the Ordinary Course of Business and pay up to the amount for each set forth on Schedule 6.4 (“Unfilled Vendor Purchase Orders”).

6.5 Non-Use of Name.

Selling Parties acknowledge that the “VitaMedica” name and all rights thereto are being transferred to Buyer as part of the Acquired Assets and that none of Selling Parties will use that name or similar name after the Closing. Seller shall change its name within thirty (30) days after Closing to name that is different from and not similar to “VitaMedica Corporation”.

6.6 Customer Refunds.

With respect to sales of Products made prior to Closing, Selling Parties will promptly reimburse Buyer in immediately available funds within ten (10) days of delivery of written notice from Buyer for any claims for refunds by Customers that are authorized by Seller or are in accordance with the agreements with the applicable Customer (even if not authorized by Seller); provided, however, that Buyer shall be responsible for the first $10,000 in the aggregate of those refunds (i.e., Buyer shall not charge Selling Parties for those until the sum of payments and costs exceeds $10,000).

6.7 Product Warranties for Prior Sales.

All Liability for any Warranty Obligations, including product warranties, is a Retained Liability. Any Liability for Products sold prior to Closing, whether arising out of Warranty Obligations or otherwise, are Retained Liabilities and Seller will honor the Warranty Obligations and reimburse Buyer for any that Buyer pays or honors; provided, however, that Buyer shall be responsible for the first $10,000 in the aggregate of those Warranty Obligations claimed against Buyer (i.e., Buyer shall not charge Selling Parties for those honored by Buyer until Buyer’s sum of payments and costs incurred exceeds $10,000 in the aggregate). Buyer agrees to reasonably cooperate with Seller at Seller’s sole cost and expense to assist Seller in servicing and honoring Warranty Obligations.

| Page 20 |

6.8 Payment of Retained Liabilities.

Selling Parties shall pay in full the Retained Liabilities. If any such Liabilities are not so paid or provided for, or if Buyer reasonably determines that failure to make any payments will impair Buyer's use or enjoyment of the Acquired Assets or conduct of the Business with the Acquired Assets, Buyer may, at any time after the Closing Date, elect to make all such payments directly (but shall have no obligation to do so) and set off and deduct the full amount of all such payments from any amounts that Buyer is obligated to pay to the Selling Parties.

6.9 Post-Closing Correspondence Related to the Business.

Selling Parties agree that if any mailed correspondence or emails relating to the Acquired Assets or post-Closing matters relating to the Business are received by any Selling Party (or its Affiliate) post-Closing, then the Selling Parties will be responsible to promptly forward those to Buyer within two (2) Business Days at the following physical or email address, as applicable: 1710 Whitney Mesa Drive Henderson, NV 89014 or Andrew.Norstrud@cbd.io.

6.10 Filing of Public Reports.

From the Closing Date until the second anniversary of the Closing Date, so long as the Selling Parties own, collectively, fifty one percent (51%) of the Grove Shares acquired hereby, Grove shall file on a timely basis, any and all filings with SEC that it is required to make or amendments thereto, as it is required to file in order to remain fully current with all of its reporting obligations under the Securities Exchange Act so as to enable sales without resale limitations, pursuant to Rule 144, as amended (“Rule 144 Sales”). Grove shall pay for all opinions or similar letters to its transfer agent, as well as pay for all transfer agent costs, relating to the removal of the Rule 144 restrictive legend on share certificates representing the Grove Shares. For the avoidance of doubt, all references herein to filings to be made on a “timely basis” shall include and mean, any extension periods permissible under Rule 12b-25 of the Securities Exchange Act, provided that Grove has complied with such rule, but not beyond said extension date.

6.11 Restriction or Transfer of Grove Shares.

Selling Parties shall not transfer, assign or convey the Grove Shares within twelve (12) months of issuance of those shares. The Stock Certificates for those shares shall bear a legend to that effect.

6.12 Auditable Financials.

Selling Parties represent, warrant and covenant to Buying Parties that the Seller has the necessary records and documents for auditable financial statements by a certified public accounting firm. Selling Parties shall furnish audited financial statements of the Seller for the fiscal years ended June 30, 2020 and June 30, 2021 to Buyer within sixty (60) days after Closing, which financial statements shall be prepared by an independent accounting firm, the cost of which accounting firm is Buyer’s responsibility through a separate agreement between Buyer and that accounting firm.

6.13 Finder’s Fee.

Buying Parties shall pay Brett Benning a finder’s fee of $70,000 cash consideration and $35,000 of Grove Common Stock with respect to the sale of Acquired Assets contemplated by this Agreement, and shall indemnify, defend and hold Selling Parties harmless from any claims or obligations for Buyer’s failure to pay that finder’s fee.

| Page 21 |

6.14 Insurance; Products Liability.

Seller shall maintain in force and effect its product liability insurance on an “claims made” basis until December 31, 2021. Buyer shall maintain in force and effect product liability insurance for Products sold prior to Closing by Seller in the amount of $2,000,000 for a minimum period of three (3) years after December 31, 2021.

7. Survival; Indemnification.

7.1 Survival of Representations and Warranties.

All representations, warranties, covenants and obligations contained in this Agreement and any certificates or other documents delivered pursuant to this Agreement shall survive the Closing Date and the consummation of the transactions contemplated herein, provided however that claims for breach of the representations and warranties in Sections 3, 4 and 5 of this Agreement are subject to the time limitations of Section 7.2 below.

7.2 Time Limitations for Certain Representations and Warranties.

(a) Claims by the Buyer for breach of the following representations and warranties must be made within the following time periods:

(i) For those representations and warranties in Sections 3.6, 3.7, 3.9 through 3.14 inclusive, and 3.16 through 3.29 inclusive (collectively the “Non-Fundamental Representations and Warranties”) inclusive, prior to midnight of the first (1st) anniversary of the Closing Date;

(ii) For all other representations and warranties in Section 3 (collectively the “Fundamental Representations and Warranties), prior to expiration of the applicable statute of limitations; and

(iii) For representative and warranties of the Selling Parties in Section 5, prior to expiration of the applicable statute of limitations

(b) Claims by the Selling Parties for breach of Buying Parties’ representations and warranties in Sections 4 and 5 must be made prior to expiration of the applicable statute of limitations.

(c) Notwithstanding the above, the survival period for misrepresentations or breaches of representations and warranties arising out of Special Misconduct by any Party is extended to be the expiration date of the applicable statutes of limitation (including any extension thereto). The covenants and agreements of the Parties shall survive the Closing in accordance with their terms.

7.3 Indemnification Rights and Obligations.

(a) Subject to the provisions of Sections 7.3 to 7.8, the Selling Parties hereby agree to jointly and severally indemnify the Buying Parties fully and hold harmless each of the Buying Parties and their respective direct shareholders, members or partners, managers, directors, officers and employees (collectively, the “Indemnified Buyers” and singularly each an “Indemnified Buyer”) harmless for, and will pay to the Indemnified Buyers the amount of, any loss, liability, claim, damage, diminution in value or expense, including, without limitation, the costs of reasonable attorneys' or accountants' fees related thereto, whether or not involving a Third-Party Claim (collectively “Damages”), arising from or in connection with:

| Page 22 |

(i) any breach or inaccuracy of any representation or warranty made by any of the Selling Parties in this Agreement (subject to the time limitations set forth in Section 7.2 above) or any certificate or any Closing Document delivered pursuant hereto;

(ii) the failure of any of the Selling Parties to comply with any covenants, agreements or obligations made by Seller and/or any other Selling Parties in this Agreement;

(iii) Any Retained Liabilities; or

(iv) Any Liability arising out of or attributable to the operation of the Business, or the ownership of the Acquired Assets or sale of Products by Seller, prior to Closing, except for those Assumed Liabilities of Seller expressly assumed by Buyer under this Agreement.

(b) Subject the provisions of Sections 7.3 to 7.8, the Buying Parties hereby agree to indemnify fully and hold harmless each of the Selling Parties and their respective direct shareholders, members or partners, managers, directors, officers and employees (together with the Selling Parties, called the “Indemnified Sellers”) harmless for, and will pay to the Indemnified Sellers the amount of any Damages arising from or in connection with:

(i) any breach or inaccuracy of any representation or warranty made by either of the Buying Parties in this Agreement (subject to the time limitations set forth in Section 7.2) above or any certificate or Closing Document delivered pursuant hereto; or

(ii) the failure of either of the Buying Parties to comply with any covenants, agreements or obligations made by such Buying Party in this Agreement;

(iii) Any Liability arising out or attributable to the operation of the Business, or the ownership of the Acquired Assets by the Buyer, after the Closing or sale of Products by Buyer after Closing other than (1) Retained Liabilities; and (2) that described in Section 7.3(a)(iv) above.

7.4 Limitation on Indemnification Liability.

(a) Selling Parties shall not have any obligation to indemnify Indemnified Buyer for a breach of any of the Non-Fundamental Representations and Warranties of Selling Parties until the Indemnified Buyers have collectively suffered Damages arising out of or in connection with all such breaches (of those Non-Fundamental Representations and Warranties), in the aggregate, in excess of Twenty Thousand Dollars ($20,000) ("Indemnification Basket") after which point Selling Parties will be obligated to indemnify the respective Indemnified Buyers from and against all such Damages as provided herein in their totality including the Indemnification Basket amount (i.e., as incurred, from and including the "first dollar" of such Damages).

(b) There will be an aggregate ceiling ("Indemnification Ceiling") on the obligation of the Selling Parties to indemnify the Indemnified Buyers from and against Damages arising out of or in connection with breaches of any of the Non-Fundamental Representations and Warranties; such Indemnification Ceiling being an amount equal to the Purchase Price.

| Page 23 |

(c) Notwithstanding the above, this Section 7.4 shall not apply to any breach or inaccuracy of a Non-Fundamental Representation and Warranty of Selling Parties that is based on Special Misconduct.

7.5 Materiality Scrape.

For purposes of this Section 7, any breach of or inaccuracy in any representation or warranty shall be determined without regard to any materiality, Material Adverse Change, any material respect or other similar qualification contained in or otherwise applicable to such representation or warranty.

7.6 No Double Recovery; Effect of Insurance; Third Party Claims.

(a) In the event an Indemnified Buyer recovers Damages in respect of an indemnification claim, no other Indemnified Buyer, as applicable, may recover the same Damages in respect of an indemnification claim under this Agreement. Additionally, no Indemnified Person is entitled to a double recovery of the same Damages.

(b) In the event an Indemnified Seller recovers Damages in respect of an indemnification claim, no other Indemnified Seller, as applicable, may recover the same Damages in respect of an indemnification claim under this Agreement. Additionally, no Indemnified Seller is entitled to a double recovery of the same Damages.

(c) Any Damages subject to indemnification pursuant to this Agreement will (1) be net of insurance proceeds received by the Indemnified Person that actually reduce the amount of the Damages (“Insurance Proceeds”) and, (2) be net of any proceeds actually received by the Indemnified Person from any third party for indemnification for such Damages that reduce the amount of the Damages (“Third Party Proceeds”). Accordingly, the amount which any Indemnifying Person is required to pay pursuant to this Agreement to any Indemnified Person pursuant to this Agreement will be reduced by any Insurance Proceeds or Third Party Proceeds theretofore actually recovered by or on behalf of the Indemnified Person in respect of the related Damages. If an Indemnified Person receives a payment required by this Agreement from an Indemnifying Person in respect of any Damages (an “Indemnity Payment”) and subsequently receives Insurance Proceeds or Third Party Proceeds for those same Damages, then the Indemnified Person will pay to the Indemnifying Person an amount equal to the excess of the Indemnity Payment received over the amount of the Indemnity Payment that would have been due if the Insurance Proceeds or Third Party Proceeds had been received, realized or recovered before the Indemnity Payment was made.

(d) An insurer who would otherwise be obligated to pay any claim shall not be relieved of the responsibility with respect thereto or, solely by virtue of the indemnification and contributions provisions hereof, have any subrogation rights with respect thereto. The Indemnified Person shall use commercially reasonable efforts to seek to collect or recover any third-party Insurance Proceeds and any Third Party Proceeds to which the Indemnified Person is entitled in connection with any Damages for which the Indemnified Person seeks contribution or indemnification pursuant to this Agreement; provided, that the Indemnified Person’s inability to collect or recover any such Insurance Proceeds or Third Party Proceeds shall not limit the Indemnifying Person’s obligations hereunder.

| Page 24 |

7.7 Setoff.

Upon notice to Seller from either Buying Party specifying in reasonable detail the basis therefor, Buying Parties may withhold and set off any amount to which they may be entitled under this Section 7 (or any other agreement entered into pursuant to this Agreement, or otherwise) against the Seller or any of the Selling Parties against amounts otherwise payable under the Convertible Note, regardless of whether any Selling Party disputes such setoff claim, or whether such setoff claim is for a contingent or an unliquidated amount. The exercise of such right of setoff by a Buying Party in good faith, whether or not ultimately determined to be justified, will not constitute an event of default under the Promissory Note or Convertible Note. Neither the exercise of nor the failure to exercise such right of setoff will constitute an election of remedies or limit any of the Buying Parties in any manner in the enforcement of any other remedies that may be available to them. The Parties acknowledge that Buyer is not the maker of the Convertible Note, but is a Subsidiary of Grove, which is the maker of the Promissory Note or the Convertible Note, and Grove is entitled to make a setoff with respect to claims for indemnification that Buyer or Grove assert against any Selling Party.

7.8 Exclusive Remedy.

With the exception of a Party’s ability to recover for any claim for Special Misconduct related to this Agreement or any Closing Document or the transactions contemplated hereby or thereby, the indemnification provisions set forth in this Section 7 of this Agreement shall be the sole and exclusive remedy of any Party with respect to any and all monetary claims for any breach or nonperformance by any other Party of any representation, warranty, covenant or agreement contained herein; provided, however, nothing shall limit any Party’s right to seek and obtain any equitable relief to which it may be entitled.

8. Miscellaneous.

8.1 Notices.

All notices, demands and other communications hereunder shall be in writing and (a) delivered in person, (b) mailed by first class certified mail, postage prepaid, return receipt requested, (c) sent by electronic (email) transmission or (d) sent by overnight courier (e.g., FedEx) or other overnight courier of national reputation, in each case, addressed as follows:

To Selling Parties at:

David H. Rahm, M.D. and Yvette La-Garde

VitaMedica Corporation

946 10th Street

Manhattan Beach, CA 90266

Email: david@vitamedica.com

With a copy to:

Steven E. Burton, Esq.

Speciale & Burton, APC

21243 Ventura Blvd., Ste. 210

Woodland Hills, CA 91364

Fax: (818) 884-0806

Email: sburton@speciale-burton.com

| Page 25 |

To the Buyer at:

Grove, Inc.

Attn: Andrew Norstrud

1710 Whitney Mesa Drive

Henderson, NV 89014

With a copy to:

Averitt & Alford, PA

Attn: Barry C. Averitt

472 Osceola Avenue

Jacksonville Beach, FL 32250

Fax No.: 904-758-0546

Each Party may change its address for notices by giving notice thereof in accordance with this Section 8.1. Each such notice or communication will be effective: (i) if given in person, upon delivery or refusal of delivery; (ii) if given by certified mail upon on the date of delivery or refusal of delivery as evidenced by the return receipt; or (iii) if given by overnight courier on the date delivery or refusal of delivery as evidenced by the records of such overnight courier.

8.2 Jurisdiction, Venue and Service of Process.