UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

|

| |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

| |

| ☒ | Definitive Proxy Statement |

|

| |

| ☐ | Definitive Additional Materials |

|

| |

| ☐ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

| GROVE INC. |

| (Name of Registrant as Specified in Its Charter) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |

|

| ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

|

| ||

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

|

| ||

| ☐ | Fee paid previously with preliminary materials. | |

|

| ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

|

| ||

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Grove, Inc.

1710 Whitney Mesa Drive Henderson, Nevada 89014

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS |

The Annual Meeting of shareholders of Grove, Inc. will be held at 10:00 a.m. EDT on Tuesday May 24, 2022.

The purposes of the meeting are:

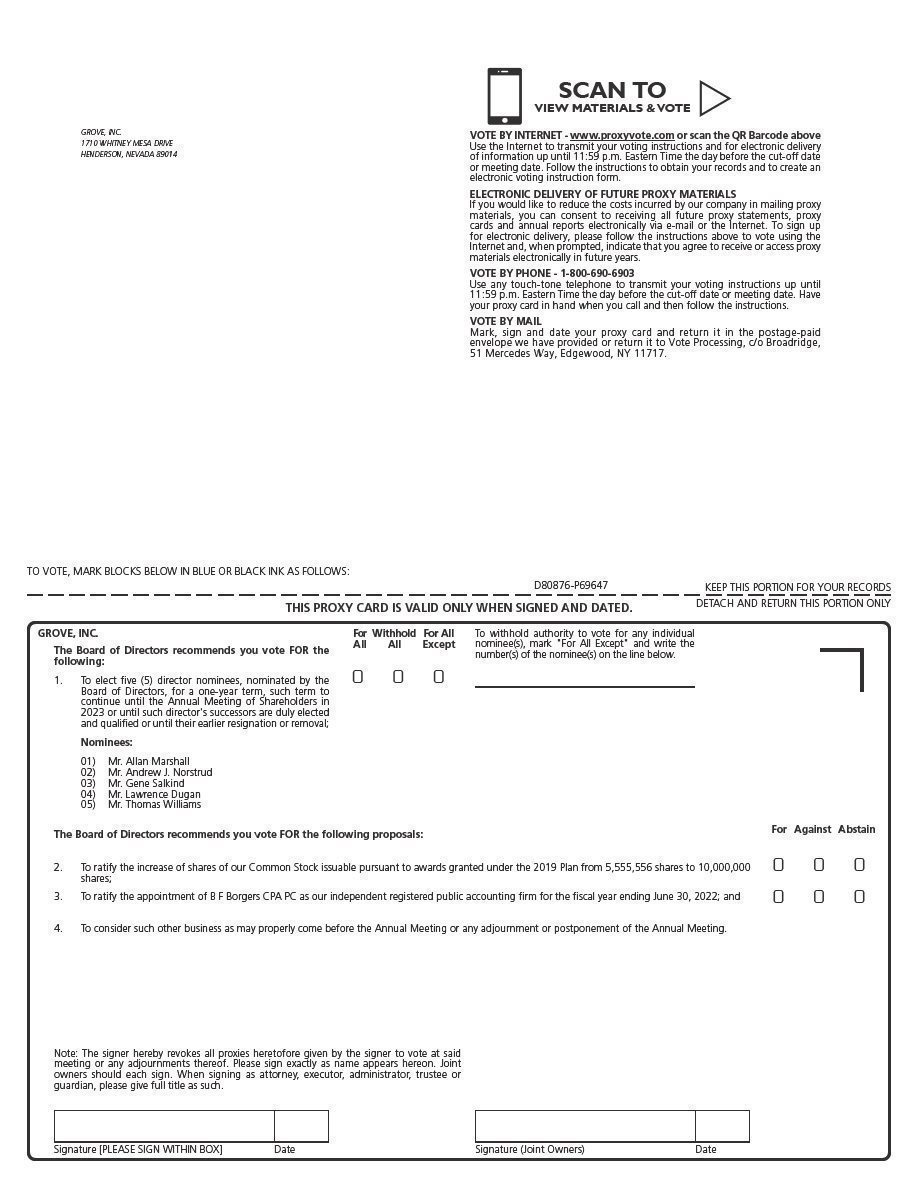

|

| 1. | Election of Directors: To elect 5 directors for a one-year term. |

|

|

|

|

|

| 2. | Increase in Number of Shares to Stock Option Plan: To vote on an amendment to our 2019 Incentive Stock Plan as amended (the “2019 Plan” ) to increase the number of shares of our Common Stock issuable pursuant to awards granted under the 2019 Plan from 5,555,556 shares to 10,000,000 shares (the “2019 Plan Amendment Proposal”); and |

|

|

|

|

|

| 3. | Ratification of Appointment of Independent Accountants: To vote on a proposal to ratify the appointment of B F Borgers CPA PC as our independent accountants for 2022. |

In addition to the matters listed above, at the Annual Meeting our shareholders will vote on such other matters as may properly come before the meeting. The Board of Directors currently knows of no matters that may be voted upon at the Annual Meeting other than the matters set forth above.

The record date for the determination of shareholders entitled to vote at the Annual Meeting is March 21, 2022 (the “Record Date”). You are entitled to participate remotely in the Annual Meeting if you were a holder of record of our Common Stock or Preferred Stock as of the close of business on the Record Date. Please refer to the Q&A section below if you are a street name holder and would like to attend the Annual Meeting. Record holders of shares may cast one vote for each share of our Common Stock and ten votes for each share of our Preferred Stock.

Please note, if you plan to attend the Annual Meeting in person, you will need to register in advance and receive an admission card to be admitted. Please follow the instructions on page __ of the Proxy Statement.

You are invited to participate in the Annual Meeting. However, if you are the record holder of your shares of our Common Stock or Preferred Stock, we ask that you appoint the Proxies named in the enclosed proxy statement to vote your shares for you by signing, dating and returning the enclosed proxy card, or following the instructions in the proxy statement and on your proxy card to appoint the Proxies by telephone or Internet. Even if you plan to participate in the Annual Meeting, voting by proxy will help us ensure that your shares are represented and that a quorum is present at the meeting. If you sign a proxy card or appoint the Proxies by telephone or Internet, you may later revoke your appointment or change your vote by following the instructions in the accompanying proxy statement or attend the Annual Meeting and vote the shares you hold of record on the meeting website. Attending the Annual Meeting alone will not revoke a proxy card. If your shares are held in “street name” by a broker or other nominee, the record holder of your shares must vote them for you, so you should follow your broker’s or nominee’s directions and give it instructions as to how you want it to vote your shares.

| 2 |

We are pleased to take advantage of the rules of the U.S. Securities and Exchange Commission that allow companies to furnish their proxy materials over the Internet. As a result, on April 11, 2022, we mailed a Notice Regarding Availability of Proxy Materials to our stockholders rather than a full paper set of the proxy materials. The Notice Regarding Availability of Proxy Materials contains instructions on how to access our proxy materials over the Internet, as well as instructions on how stockholders may obtain a paper copy of our proxy materials. To make it easier for you to vote, both Internet and telephone voting are available. The instructions on the Notice Regarding Availability of Proxy Materials or, if you received a paper copy of the proxy materials, the proxy card, each describe how to use these convenient services.

BY ORDER OF THE BOARD,

/s/ Allan Marshall

Allan Marshall

CEO and Chairman of the Board

Important Notice Regarding the Availability of Proxy Materials for the Annual

Meeting of Shareholders to be held on May 24, 2022: This Proxy Statement and our Annual Report on Form 10-K for the Year Ended June 30, 2021 (the “Annual Report”) and the Quarterly Report on Form 10-Q for the Six Months ended December 30, 2021 (the “December 2021 Quarterly Report”) are available at www.ProxyVote.com.

| 3 |

GROVE, INC.

1710 Whitney Mesa Drive

Henderson, Nevada 89014

PROXY STATEMENT

This proxy statement is dated April 11, 2022 and is being furnished to our shareholders as of the close of business on March 21, 2022, the record date, by our Board of Directors in connection with our solicitation of proxy appointments in the form of the enclosed proxy card for use at the 2022 Annual Meeting of our shareholders and at any adjournments of the meeting.

The Annual Meeting will take place on May 24, 2022, at 10 a.m., Eastern Daylight Time (EDT), at 505 Water Street, Tampa, FL 33602, Tampa Marriot Water Street.

This Proxy Statement has been prepared by the management of the Company.

We use the “Notice and Access” method of providing proxy materials to you via the internet instead of mailing printed copies. We believe that this process provides you with a convenient and quick way to access the proxy materials, including our proxy statement, Annual Report and the December 2021 Quarterly Report, and to authorize a proxy to vote your shares, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials.

Most shareholders will not receive paper copies of the proxy materials unless they request them. Instead, the Important Notice Regarding Availability of Proxy Materials, which we refer to as the Notice and Access card, that was mailed to our shareholders on April 11, 2022, provides instructions regarding how you may access and review all of the proxy materials on the internet. The Notice and Access card also includes instructions on how to submit your proxy via the internet or telephone. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials printed on the Notice and Access card.

If your shares are held by a brokerage house or other custodian, nominee or fiduciary in “street name,” you will receive a Notice and Access card with instructions for providing to such intermediary voting instructions for your shares. You may also request paper copies of the proxy materials and provide voting instructions by completing and returning the enclosed voting instruction form in the addressed, postage paid envelope provided. Alternatively, if you receive paper copies, many intermediaries provide instructions for their beneficial holders to provide voting instructions via the internet or by telephone. If your shares are held in “street name” and you would like to vote your shares in person while attending the Annual Meeting, you must contact your broker, custodian, nominee or fiduciary to obtain a legal proxy form from the record holder of your shares and present it to the inspector of election with your ballot.

QUESTIONS AND ANSWERS ABOUT OUR ANNUAL MEETING

What is the purpose of the Annual Meeting?

Our 2021 Annual Meeting will be held for the following purposes:

| 1. | To elect five (5) director nominees, nominated by the Board of Directors, for a one-year term, such term to continue until the Annual Meeting of Shareholders in 2023 or until such director's successors are duly elected and qualified or until their earlier resignation or removal (Proposal 1); | |

|

|

|

|

| 2. | To ratify the increase of shares of our Common Stock issuable pursuant to awards granted under the 2019 Plan from 5,555,556 shares to 10,000,000 shares (Proposal 2); | |

|

|

|

|

|

| 3. | To ratify the appointment of B F Borgers CPA PC as our independent registered public accounting firm for the fiscal year ending June 30, 2022 (Proposal 3); and |

|

|

|

|

|

| 4. | To consider such other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

| 4 |

In addition, senior management of the Company will be available to respond to your questions.

Who can vote at the Annual Meeting?

You can vote at the Annual Meeting if, as of the close of business on March 21, 2022, the record date, you were a holder of record of the Company’s Common Stock or Preferred Stock. As of the record date, there were issued and outstanding 16,576,088 shares of Common Stock, each of which is entitled to one vote on each matter to come before the Annual Meeting, and 500,000 shares of Preferred Stock, each of which is entitled to ten votes on each matter to come before the Annual Meeting.

How many shares must be present to conduct business at the Annual Meeting?

A quorum is necessary to hold a valid meeting of shareholders. For each of the proposals to be presented at the Annual Meeting, the holders of shares of our outstanding Common Stock and Preferred Stock as of March 21, 2022, the record date, representing 8,538045 shares must be present at the Annual Meeting, in person or by proxy. If you vote, including by Internet, or proxy card your shares voted will be counted towards the quorum for the Annual Meeting. Abstentions and broker non-votes are counted as present for the purpose of determining a quorum.

How do I vote?

Registered Shareholders. If you are a registered shareholder (i.e., you hold your shares in your own name through our transfer agent, VStock Transfer, LLC, referred to herein as “VStock”), you may vote by proxy via the Internet, or by mail by following the instructions provided on the proxy card. Shareholders of record who attend the Annual Meeting may vote in person by obtaining a ballot from the inspector of elections.

Beneficial Owners. If you are a beneficial owner of shares (i.e., your shares are held in the name of a brokerage firm, bank or a trustee), you may vote by proxy by following the instructions provided in the voting instruction form or other materials provided to you by the brokerage firm, bank, or other nominee that holds your shares. To vote in person at the Annual Meeting, you must obtain a legal proxy from the brokerage firm, bank or other nominee that holds your shares.

Will my shares be voted if I do not provide voting instructions?

If you are a shareholder of record and you properly sign, date and return a proxy card, but do not indicate how you wish to vote with respect to a particular nominee or proposal, then your shares will be voted FOR the election of the five nominees for director named in “Proposal 1,” and FOR the increase of shares of Common Stock issuable pursuant to awards granted under the 2019 Plan from 5,555,556 shares to 10,000,000 shares in “Proposal 2” and FOR the ratification of the Appointment of B F Borgers CPA PC as our Independent Registered Public Accounting Firm for the fiscal year ending June 30 31, 2022 “in Proposal 3”.

| 5 |

Consistent with applicable law, we intend to count abstentions and broker non-votes only for the purpose of determining the presence or absence of a quorum for the transaction of business. A broker “non-vote” refers to shares held by a broker or nominee that does not have the authority, either express or discretionary, to vote on a particular matter. Applicable rules no longer permit brokers to vote on certain “non-routine” matters if the broker has not received instructions from the beneficial owner. Proposal 1 and Proposal 2 are considered to be “non-routine” matters. Accordingly, it is important that beneficial owners instruct their brokers how they wish to vote their shares with respect to Proposal 1 and Proposal 2. Proposal 3 is considered to be a “routine” matter. Your broker, therefore, may vote your shares in its discretion if you do not provide instructions on how to vote on this “routine” matter.

Can I change my vote after I have voted?

Yes, you may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may change your vote by voting again on a later date on the Internet (only your latest Internet proxy submitted prior to the Annual Meeting will be counted), signing and returning a new proxy card with a later date, or attending and voting at the Annual Meeting. However, your attendance at the Annual Meeting will not automatically revoke any prior proxy unless you vote again at the Annual Meeting or specifically request in writing that your prior proxy be revoked.

What is the deadline to vote?

If you hold shares as the shareholder of record, your vote by proxy must be received before 11:59 p.m. ET on May 23, 2022. If you are the beneficial owner of shares, please follow the voting instructions provided by your broker, trustee or other nominee.

What vote is required to elect directors or take other action at the Annual Meeting?

| · | Proposal 1: Election of Five (5) Directors. The election of the five director nominees named in this Proxy Statement requires the affirmative vote of shares of Common Stock and Preferred Stock, voting as a single class, representing a plurality of the votes cast on the proposal at the Annual Meeting. This means that the five nominees will be elected if they receive more affirmative votes than any other person. You may not cumulate your votes for the election of directors. Brokers may not use discretionary authority to vote shares on the election of directors if they have not received specific instructions from their clients. For your vote to be counted in the election of directors, you will need to communicate your voting decisions to your bank, broker or other nominee before the date of the Annual Meeting in accordance with their specific instructions. |

| · | Proposal 2: Ratification of the Increase of shares of Common Stock issuable pursuant to awards granted under the 2019 Plan. Ratification of increase of shares of our Common Stock issuable pursuant to awards granted under the 2019 Plan from 5,555,556 shares to 10,000,000 shares, requires the affirmative vote of shares of Common Stock and Preferred Stock, voting as a single class, representing a majority of votes cast on the proposal at the Annual Meeting. |

| · | Proposal 3: Ratification of the Appointment of B F Borgers CPA PC as Our Independent Registered Public Accounting Firm for 2022. Ratification of the appointment of B F Borgers CPA PC as our independent registered public accounting firm for the year ending June 30, 2022, requires the affirmative vote of shares of Common Stock and Preferred Stock, voting as a single class, representing a majority of votes cast on the proposal at the Annual Meeting. |

In general, other business properly brought before the Annual Meeting requires the affirmative vote of shares of Common Stock and Preferred Stock, voting as a single class, representing a majority of votes cast on such matter at the Annual Meeting.

| 6 |

How does the Board recommend that I vote?

Our Board recommends that you vote your shares ”FOR” each director nominee named in this Proxy Statement and ”FOR” ratification of the increase of shares of Common Stock issuable under the 2019 plan and “FOR” ratification of B F Borgers CPA PC as our independent registered public accounting firm for the fiscal year ending June 30, 2022.

How will the persons named as proxies vote?

If you complete and submit a proxy, the persons named as proxies will follow your instructions. If you submit a proxy but do not provide instructions, or if your instructions are unclear, the persons named as proxies will vote as recommended by our Board of Directors or, if no recommendation is given, in their own discretion.

Where can I find the results of the voting?

We intend to announce preliminary voting results at the Annual Meeting and will publish final results through a Current Report on Form 8-K to be filed with the Securities and Exchange Commission (“SEC”) within four business days after the Annual Meeting. The Current Report on Form 8-K will be available on the SEC website, www.sec.gov.

Do I need a ticket to attend the Annual Meeting?

Yes, you will need an admission card to enter the Annual Meeting. You may request tickets by providing the name under which you hold shares of record or, if your shares are held in the name of a bank, broker or other holder of record, the evidence of your beneficial ownership of the shares, the number of tickets you are requesting and your contact information. You can submit your request in the following ways:

| · | by sending an e-mail to andrew.norstrud@cbd.io; or |

| · | by calling us at (702) 332-5591. |

Shareholders also must present a form of personal photo identification in order to be admitted to the Annual Meeting.

Who will pay for the cost of soliciting proxies?

We will pay for the cost of soliciting proxies. Our directors, officers and other employees, without additional compensation, may solicit proxies personally, in writing, by telephone, by email or otherwise. As is customary, we will reimburse brokerage firms, fiduciaries, voting trustees, and other nominees for forwarding our proxy materials to each beneficial owner of Common Stock held of record by them.

| 7 |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

PROPOSAL 1: ELECTION OF DIRECTORS

Upon the recommendation of the Nominating Committee of the Board of Directors, our Board of Directors has nominated for re-election at the Annual Meeting each of Mr. Allan Marshall, Mr. Andrew Norstrud, Mr. Gene Salkind, Mr. Lawrence Dugan and Mr. Thomas Williams for a new term expiring at the 2023 Annual Meeting of shareholders or until their successors are duly elected and qualified. Each nominee is currently serving as a member of our Board of Directors.

In the event any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies voting for their election will be voted for any nominee who shall be designated by the Board of Directors to fill the vacancy. As of the date of this Proxy Statement, we are not aware of any nominee that is unable or will decline to serve as a director if elected.

Required Vote

The affirmative vote of shares of our Common Stock and Preferred Stock, voting as a single class, representing a plurality of the votes cast is required to elect each of Mr. Allan Marshall, Mr. Andrew Norstrud, Mr. Gene Salkind, Mr. Lawrence Dugan and Mr. Thomas Williams as directors of the Company.

Recommendation

Our Board of Directors unanimously recommends a vote “FOR” the election of each of Mr. Allan Marshall, Mr. Andrew Norstrud, Mr. Gene Salkind, Mr. Lawrence Dugan and Mr. Thomas Williams to our Board of Directors. Properly authorized proxies solicited by Board of Directors will be voted “FOR” the nominees unless instructions to withhold or to the contrary are given.

Directors/Nominees

Our Board of Directors currently consists of five members, as set forth in the table below. Our Board of Directors consists of an experienced group of business leaders, with experience in corporate governance, corporate finance, capital markets and technology.

| Name |

| Position Held with the Company |

| Age |

| Date First Elected or Appointed |

| Allan Marshall |

| Chief Executive Officer, Director (Chairman) |

| 54 |

| May 2019 |

| Andrew J. Norstrud |

| Chief Financial Officer, Director |

| 48 |

| April 2020 |

| Robert Hackett |

| President |

| 35 |

| August 2018 |

| Gene Salkind |

| Director |

| 67 |

| January 2021 |

| Thomas C. Williams |

| Director |

| 61 |

| January 2021 |

| Lawrence H. Dugan |

| Director |

| 54 |

| January 2021 |

Business Experience

Set forth below is information about the nominees for election as directors. The factual information about each nominee and director has been provided by that person. The particular experience, qualifications, attributes or skills that led our Board of Directors to conclude that each should serve on our Board, in light of our business and structure, were determined by our Board or its Governance and Nominating Committee and are outlined below in each nominees bio.

| 8 |

Allan Marshall, 54, Chief Executive Officer, Director. Mr. Marshall was retired prior to joining the Company working as a serial entrepreneur with a focus on development stage companies in hyper growth industries, with the past several years focusing on the technology and cannabis industries. Mr. Marshall is often the driving force behind the organization for its initial growth and funding strategies. Mr. Marshall began his career in the transportation and logistics industry. Mr. Marshall founded Segmentz, Inc. in November of 2000 and served as the Chief Executive Officer, successfully acquiring five distinct logistic companies, raised more than $25,000,000 of capital, creating the infrastructure and business foundation that is now XPO Logistics, Inc. (NYSE: XPO) with revenues in excess of $17 billion. Prior to Segmentz, Mr. Marshall founded U.S. Transportation Services, Inc. (“UST”) in 1995, whose main focus was third party logistics. UST was sold to Professional Transportation Group, Inc. in January 2000 and Professional Transportation Group ceased business in November 2000. Prior to 1995, Mr. Marshall served as Vice President of U.S. Traffic Ltd, a Canadian company, where he founded their United States logistics division and had previously founded a successful driver leasing company in Toronto, Ontario, Canada. Mr. Marshall’s broad industry experience as well as his extensive experience forming, growing and managing public companies qualifies him to serve on our board

Andrew J. Norstrud, 48, Chief Financial Officer, Director. Mr. Norstrud joined Grove, Inc. in July of 2019 as a consultant and became the Chief Financial Officer in April of 2020 and a Director as of January, 2020. Mr. Norstrud is also the Chief Financial Officer and Director of nDivsion Inc. since January of 2019 and working with nDivsion Inc. since March of 2018. Prior to joining Grove, Inc., Mr. Norstrud served as the Chief Financial Officer for Gee Group Inc. from April 1, 2015 until June 15, 2018. Mr. Norstrud joined the Company in March 2013 as CFO and served as CEO and CFO from March 7, 2014 until April 1, 2015. Mr. Norstrud served as a director of GEE Group Inc. from March 7, 2014 until August 16, 2017. Prior to GEE Group Inc., Mr. Norstrud was a consultant with Norco Accounting and Consulting from October 2011 until March 2013. From October 2005 to October 2011, Mr. Norstrud served as the Chief Financial Officer for Jagged Peak. Prior to his role at Jagged Peak, Mr. Norstrud was the Chief Financial Officer of Segmentz, Inc. (XPO Logistics), and played an instrumental role in the company achieving its strategic goals by pursuing and attaining growth initiatives, building a financial team, completing and integrating strategic acquisitions and implementing the structure required of public companies. Previously, Mr. Norstrud worked for Grant Thornton LLP and PricewaterhouseCoopers LLP and has extensive experience with young, rapid growth public companies. Mr. Norstrud earned a BA in Business and Accounting from Western State College and a Master of Accounting with a systems emphasis from the University of Florida. Mr. Norstrud is a Florida licensed Certified Public Accountant. Mr. Norstrud’s extensive experience with public companies as the Chief Financial Officer and serving on several public companies Board of Directors qualifies him to serve on our board.

Gene Salkind, 67, Director. Gene Salkind, M.D. has been a practicing neurosurgeon for greater than 35 years outside of Philadelphia, PA. He graduated from the University of Pennsylvania in 1974 with a B.A., Cum Laude, and received his medical degree from the Lewis Katz School of Medicine in 1979. He returned to the University of Pennsylvania for his neurosurgical residency and in 1985 was selected as the Chief Resident in Neurosurgery at the Hospital of the University of Pennsylvania. Since that time, he has been in a University affiliated practice of general neurological surgery. He is currently the Chief of Neurosurgery at Holy Redeemer Hospital and has also been the Chief of Neurosurgery at Albert Einstein Medical Center and Jeanes Hospital in Philadelphia. He has authored numerous peer reviewed journal articles and has given lectures throughout the country on various neurosurgical topics. He has held professorships at the University of Pennsylvania, the Allegheny Health Education and Research Foundation, and currently at the Lewis Katz School of Medicine.

| 9 |

Dr. Salkind is a prominent investor in the pharmaceutical arena. Past investments include Intuitive Surgical, Pharmacyclics, which grew from less than $1 per share to subsequently being acquired by Abbvie for $250 per share, and Centocor, one of the nation’s largest biotechnology companies, which was acquired by Johnson & Johnson for $4.9 billion in stock. Dr. Salkind currently sits on the boards of Cure Pharmaceuticals (OTCMKTS: CURR), a leader in the biotechnology field through its continual pursuit of redefining traditional drug delivery, and Mobiquity Technologies, Inc. (NASDAQ: MOBQ), a digital engagement provider. The company owns and operates a national location based mobile advertising network. The company’s suite of technologies allows clients to execute personalized and relevant experiences, driving brand awareness and incremental revenue. He was previously a board member of Derm Tech International (NASDAQ: DMTK), a global leader in non-invasive dermatological molecular diagnostics.

Dr. Salkind in 2019 joined the Strategic Advisory Board of Bio Symetrics, a company that has built data services tools for automated pre-processing, integrated analytics, and predictive modeling to make machine learning accessible to scientists and providers. Their technology serves health and hospital systems, biopharma, drug discovery and precision medicine. Dr. Salkind is and has been an employee and shareholder of Leonard A. Bruno MD/ Gene Salkind MD for the past five years. Dr. Salkind, a member of our audit committee, currently owns greater than ten percent (10%) of the outstanding voting securities of the Company.

Mr. Salkind’s extensive background in medicine, assisting in the growth of public companies and also serving as a board member on several public companies Board of Directors qualifies him to serve on our board.

Thomas Williams, 61, has over 35 years of experience in the insurance industry. He has served in multiple roles in both originations and the administration side of operations. Mr. Williams has a specialization in providing securitization mechanisms of illiquid insurance assets. Thomas was with Smith Barney for his training on the capital markets and insurance industries.

Mr. Williams is currently an Officer and Director in several Ireland based holding companies with a focus in the insurance industry. He is an acting member of the Risk Committee of Wyndham, a large Bermuda based captive. Additionally, he has formed three insurance operations: JTRM, GIH and Arculius. Their lines of business range from Directors and Officers Liability Coverage, Life Extension Risk and Workers Compensation. He has extensive experience in the Offshore and European Union insurance markets in both developing the structure and implementing corporate governance.

Mr. Williams was the intermediary in the sale of Associate Industries of Florida, one of the largest insurance companies in Workers Compensation. He facilitated the sale to Am Trust, a New York publicly traded company in 2009.

Mr. Williams has served on the Board of two public companies:

|

| · | GEE Group, an American Stock Exchange Company from 2008 to 2018. At this company, he chaired the nominating committee and was a member of the Corporate Governance Committee and Audit Committee. |

|

|

|

|

|

| · | Two Rivers Water and Farming from 2019 to 2020. |

| 10 |

Mr. Williams completed a training program at Northwestern’s Kellogg Business School for Corporate Governance in Public Companies in 2013. Mr. Williams’s background in insurance and serving as a board member on several public companies Board of Directors qualifies him to serve on our board.

Lawrence H Dugan, 54, Director. Mr. Dugan is a partner with the accounting firm Dorra & Dugan and has been since 1996. Mr. Dugan graduated from the University of Central Florida in 1989. Mr. Dugan is a Florida licensed Certified Public Accountant. Mr. Dugan’s financial and tax background qualifies him to serve on our board and serve as the audit committee chairman and financial expert on our board.

Executive Officers

Robert Hackett, 35, President. Mr. Hackett has been actively building consumer lifestyle businesses for 15 years. In 2004, he opened a hookah lounge in Whittier, California. Prior to joining as an executive of the Company, Mr. Hackett was an equity holder, managing member and/or officer of Steam Distribution, LLC, One Hit Wonder, Inc., Havz, LLC, d/b/a Steam Wholesale, and One Hit Wonder Holdings, LLC, collectively known as “HAVZ Consolidated”, which filed voluntary petitions for relief under Chapter 11 (Chapter 11 Proceedings) of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the District of Nevada and was subsequently acquired by the Company in 2019. By 2010 he had opened three lounges and had started a distribution business for related products to other lounges and retailers throughout California. In 2011, his firm entered into an exclusive contract to distribute a tobacco-free hookah alternative invented in Germany, called Shiazo. He retained full rights to North America. Over the next few years, as the retail footprint of customers purchasing the Shiazo product increased, Mr. Hackett’s Company added products to its distribution portfolio which could be sold into the expanding customer base. In 2014, Mr. Hackett’s Company started formulating and manufacturing its own vape liquid line, “One Hit Wonder”, which over the next two years, became a globally recognized vape eliquid brand. Over the next few years, Mr. Hackett led the development of several additional brands and more than 100 SKU’s, including the launch of cannabidiol (hemp derived CBD) products. Mr. Hackett recognized the need for a more efficient sourcing and distribution model, and the potential of building one online. He hired a team of programmers and developers and built a dropship platform that would enable vendors and buyers to seamlessly transact. CBD.io was created as a singular destination for vendors operating in the burgeoning CBD market to source, private-label, wholesale and retail. The platform design is a response to solving the issues of inefficiency and cost that he had experienced in the vape and CBD supply chain over the past several years.

CORPORATE GOVERNANCE

Our Board of Directors has adopted Corporate Governance Guidelines that, together with our Bylaws, establish various processes related to the structure and leadership of our Board and the governance of our organization.

| 11 |

Director Independence

Determination of Independent Directors. Our Corporate Governance Guidelines require that a majority of the members of our Board be “independent” and that each year our Board reviews transactions, relationships and other arrangements involving our directors and determines which of the directors the Board considers to be independent. In making those determinations, the Board applies the independence criteria contained in the listing requirements of The NASDAQ Stock Market (“Nasdaq”). The Board has directed our Compensation, Nominations and Governance and Audit Committees to assess each outside director’s independence and report its findings to the Board in connection with the Board’s annual determination re: same. In addition, between those annual determinations, the Committee is directed to monitor the status of each director on an ongoing basis and inform the Board of changes in factors or circumstances that may affect a director’s ability to exercise independent judgment in carrying out his or her duties as a director. The following table lists our current directors and persons who served as directors during 2021 whom our Board believes were during their terms of office, and will be if re-elected, “independent” directors under Nasdaq’s criteria.

|

| · | Gene Salkind |

|

|

|

|

|

| · | Lawrence Dugan |

|

|

|

|

|

| · | Thomas Williams |

In addition to the specific Nasdaq criteria, in assessing each director’s or nominee’s independence, the Compensation, Nominations and Governance and Audit Committee and the Board consider whether they believe transactions that are disclosable in our proxy statements as “related person transactions,” as well as any other transactions, relationships, arrangements or other factors known to the Committee or the Board, could impair that director’s ability to exercise independent judgment in carrying out his or her duties as a director. In its determination that our current directors named above are or will be independent, the Committee and the Board considered those transactions and relationships described or referenced below under the heading “TRANSACTIONS WITH RELATED PERSONS”.

Board Leadership Structure

Our Board performs its oversight role through various committees whose members are appointed by the Board after consideration of the recommendations of our independent Compensation, Nominations and Governance and Audit Committee. Those committees may be established as separate committees of our Board or as joint committees of the Boards. Each Board annually elects a Chairman whose duties are described in our Bylaws and, currently, our Chief Executive Officer, Allan Marshall, also serves as Chairman of our Board. Mr. Marshall has served as our Chairman since inception of the Company. Although our Bylaws contemplate that our Chairman will be considered an officer, under our Corporate Governance Guidelines the Board will exercise its judgment and discretion in the selection of its Chairman and may select any of its members as Chairman. The Board has no formal policy as to whether our Chief Executive Officer will or may serve as Chairman or whether any other director, including an independent director, may be elected to serve as Chairman.

In practice our Board has found that having a combined Chairman and Chief Executive Officer role allows for more productive board meetings. As Chairman, Mr. Marshall is responsible for leading board meetings and meetings of shareholders, generally setting the agendas for board meetings (subject to the requests of other directors) and providing information to the other directors in advance of meetings and between meetings. Mr. Marshall’s direct involvement in our operations makes him best positioned to lead strategic planning sessions and determine the time allocated to each agenda item in discussions of our short- and long-term objectives. As a result, our Board currently believes that maintaining a structure that combines the roles of Chairman and Chief Executive Officer is the appropriate leadership structure for our company.

| 12 |

As described below under the heading “COMMITTEES OF OUR BOARDS,” all matters pertaining to executive compensation, the selection of nominees for election as directors, the appointment of members of Board committees, the approval of transactions with related persons, and various other governance matters, are subject to the review and approval or recommendation of Board committees made up entirely of independent directors. Our Corporate Governance Guidelines also provide that:

|

| · | all independent directors have full access to any member of management and to our independent accountants for the purpose of understanding issues relating to our business; |

|

|

|

|

|

| · | upon request, our management will arrange for our outside advisors to be made available for discussions with the Board, any Board committee, our independent directors as a group, or individual directors; and |

|

|

|

|

|

| · | the Board, each Board committee, and our independent directors as a group, in each case by a majority vote, have the authority to retain independent advisors from time to time, at our expense, who are separate from and unrelated to our regular advisors. |

Our Board believes the provisions described above enhance the effectiveness of our independent directors and provide for a leadership structure that is appropriate for our company, without regard to whether our Chairman is an independent director.

Board Role in Risk Oversight

While management is responsible for risk management in daily operations, the board of directors is responsible for overall risk oversight of the Company. A central focus for our Board is oversight of our corporate strategy and management’s execution of such strategy. The Board believes that this is a continuous process that requires regular attention from the full Board. This ongoing effort focuses the Board on the Company’s operational and financial performance over the short, intermediate and long term.

Attendance by Directors at Meetings

Board of Directors Meetings. Our Board of Directors met four times during 2021. Our Corporate Governance Guidelines provide that directors are expected to regularly attend meetings of the Boards and of the committees on which they serve (subject to circumstances that make their absence unavoidable), to review materials provided to them in advance of meetings, and to participate actively in discussions at meetings and in the work of the committees on which they serve. During the year ended June 30, 2021, all of our directors attended 100% of the meetings held.

Annual Meetings. Attendance by our directors at Annual Meetings of our shareholders gives directors an opportunity to meet, talk with and hear the concerns of shareholders who attend those meetings, and it gives those shareholders access to our directors that they may not have at any other time. In order to facilitate directors’ attendance, we schedule our Annual Meetings on the same dates as regular meetings of the Board of Directors. Our Board recognizes that our outside directors have their own business interests and are not our employees, and that it is not always possible for them to attend Annual Meetings. However, our Board believes that attendance by directors at our Annual Meetings is beneficial to us and to our shareholders, and our Corporate Governance Guidelines provide that our directors are strongly encouraged to attend each Annual Meeting.

| 13 |

Communications with Our Board

Our Board of Directors encourages our shareholders to communicate their concerns and other matters related to our business, and the Board has established a process by which you may send written communications to the Board or to one or more individual directors. You may address and mail your communication to:

Board of Directors

Grove Inc. Attention: Corporate Secretary

1710 Whitney Mesa Drive

Henderson, Nevada 89014-2055

You also may send communications by email to info@cbd.io. You should indicate whether your communication is directed to the entire Board of Directors, to a particular committee of the Board or its Chairman, or to one or more individual directors. All communications will be reviewed by our Corporate Secretary and, with the exception of communications our Corporate Secretary considers to be unrelated to our business, forwarded to the intended recipients.

Code of Ethics

Our Board of Directors has adopted a code of ethics that apply to all or officers, directors and employees including our financial officers, respectively. Copies of the Code is posted on our website and may be found at https://groveinc.io/corporate-governance/. The Code of Ethics is intended to promote:

|

| · | honest and ethical conduct; |

|

|

|

|

|

| · | the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

|

|

|

|

|

| · | full, fair, accurate, timely and understandable disclosure in reports and documents that we file with or submit to the SEC and in other public communications we make; |

|

|

|

|

|

| · | compliance with applicable governmental laws, rules and regulations; |

|

|

|

|

|

| · | prompt internal reporting of violations of the Codes and accounting issues to the Boards’ Audit Committee and, in the case of violations of the Directors Code of Ethics, also to the Compensation, Nominations and Governance Committee; and |

|

|

|

|

|

| · | accountability for adherence to the Codes. |

We have established means by which officers, employees, customers, suppliers, shareholders or others may submit confidential and anonymous reports regarding ethical or other concerns about our company or any of our respective employees. Reports may be submitted online through our website at https://groveinc.io/whistleblower-form/. We intend to satisfy the disclosure requirement under Item 5.05 of Current Report on Form 8-K regarding an amendment to or waiver from a provision of our Financial Officers Code of Ethics by posting that information on our Internet website at https://groveinc.io/corporate-governance/.

| 14 |

Human Capital Management

Our associates are among our most important assets, and a top priority of our management is ensuring that we attract, retain and develop associates who are aligned with our goals. An initiative during 2021 will be to scale talent to address future needs, while we continue to promote inclusion, equity and diversity initiatives, and enhance performance management and coaching, with a goal of developing a workplace for the future. In promoting inclusion, equity and diversity, we aim to foster inclusion of, and provide opportunities for advancement to, all our associates, and we start by embracing diversity. We consider diversity to be broader than gender or race and to include demographics such as religion, national origin, age, disability, military service, sexual orientation, and gender identity, as well as diversity of thought, perspective, experience and interests. By continuing to commit to inclusion and diversity, we are focused on enhancing associate and customer experiences and relationships and driving innovation of our products and services.

Hedging Policy

To date our Company has not adopted a hedging policy applicable to its officers or directors.

COMMITTEES OF OUR BOARD

Our Board of Directors has three standing committees that assist the Board in oversight and governance matters. They are the Audit Committee, the Compensation Committee, and the Nominations and Governance Committee. Each committee operates under a written charter approved by our Board that sets out the committee’s composition, authority, duties and responsibilities. We believe that each member of the three committees is an “independent director” as that term is defined by Nasdaq’s listing standards. A copy of the current charter of each committee is posted on our website and may be found at www.//groveinc.io/corporate-governance/.

Members of the Audit Committee and the Compensation, Nominations and Governance Committee must satisfy requirements of Nasdaq’s listing standards and other laws and regulations applicable to service on those committees, as well as any membership requirements specified in the committees’ written charters.

The Audit Committee is required to meet at least quarterly and the Compensation Committee, and Nominations and Governance Committee are required to meet at least once a year, and each may meet more frequently as it and/or its Chairman considers necessary. Each committee also will meet when requested by the Chairman of the Board. In addition to their duties and responsibilities set forth in their respective charters, each committee is authorized to undertake such other duties and responsibilities within the scope of its primary functions as the committee or the Boards may from time to time deem necessary or appropriate. In discharging its duties, each committee may:

| 15 |

|

| · | at its discretion and without the prior approval of management or the Boards, retain or obtain the advice of outside consultants or advisors (including legal counsel and other advisors), at our expense, in accordance with procedures established from time to time by the committee, and oversee and approve all terms of the engagement of any such consultants or advisors, including their fees or other compensation; |

|

|

|

|

|

| · | conduct investigations and request and consider information (from management or otherwise) as the committee considers necessary, relevant, or helpful in its deliberations and the formulation of its decisions or recommendations; |

|

|

|

|

|

| · | seek any information from our employees (who are directed to cooperate with each committee’s requests), or from external parties, and consult to the extent it deems appropriate with the Chairman of the Boards, the Chief Executive Officer, other directors, and other officers and employees; and |

|

|

|

|

|

| · | delegate any of its responsibilities to subcommittees or to individual members to the extent not inconsistent with other sections of its charter (including applicable independence requirements), or applicable laws or regulations. |

| Directors Name | Audit Committee | Compensation Committee | Nominations and Governance Committee |

| Gene Salkind | X | X | X |

| Thomas Williams | X | X | X |

| X Lawrence H. Dugan | X | X | X |

Audit Committee

On January 27, 2021, our Board established an audit committee that operates under a written charter as approved by our Board. The members of our audit committee are Dr. Gene Salkind, Mr. Thomas Williams, and Mr. Lawrence Dugan. Mr. Dugan serves as chairman of the audit committee and our Board has determined that he is an “audit committee financial expert” as defined by applicable SEC rules. The Board has determined that Dr. Salkind, Mr. Williams and Mr. Dugan are independent directors as that term is defined in Rule 5605(a)(2) of the Nasdaq Listing Rules, and has determined that Dr. Salkind, Mr. Williams and Mr. Dugan as audit committee members also meet the independence requirements of the Securities and Exchange Commission. The audit committee met three times in fiscal year 2021.

Our audit committee is responsible for:

|

| · | the integrity of the Company's financial statements, |

|

|

|

|

|

| · | the effectiveness of the Company's internal control over financial reporting, |

|

|

|

|

|

| · | the Company's compliance with legal and regulatory requirements, |

|

|

|

|

|

| · | the independent registered public accounting firm's qualifications and independence, |

|

|

|

|

|

| · | and the performance of the Company's independent registered public accountants and |

|

|

|

|

|

| · | preparation of the audit committee report as required to be included in the Company’s annual proxy statement. |

The Audit Committee also is responsible for establishing procedures for the receipt, retention and treatment of complaints from employees, customers, suppliers, shareholders or others related to accounting and financial processes and reporting, internal controls, and auditing matters, including procedures for the confidential, anonymous submission by employees of concerns regarding those matters, and for evaluating any fraud, whether or not material, that involves management or other employees who have a significant role in our internal controls.

| 16 |

Information regarding the process for and factors considered in the Audit Committee’s selection of our independent accountants is contained under the heading “PROPOSAL 3: RATIFICATION OF APPOINTMENT OF INDEPENDENT ACCOUNTANTS.”

Audit Committee Financial Expert.

Lawrence H. Dugan is a partner with the accounting firm Dorra & Dugan and has been since 1996. Mr. Dugan graduated from the University of Central Florida in 1989. Mr. Dugan is a Florida licensed Certified Public Accountant. Our Board of Directors has designated Mr. Dugan as the Committee’s “Audit Committee Financial Expert,” as that term is defined by the rules of the SEC.

Audit Committee Report

This report is furnished by the Audit Committee, the members of which, on the date of the filing of our 2021 Annual Report on Form 10-K, are named below.

Our management is responsible for our financial reporting process, including our system of internal controls and disclosure controls and procedures, and for the preparation of our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. Our independent accountants are responsible for auditing those financial statements. The Audit Committee oversees and reviews those processes. In connection with the preparation and audit of our consolidated financial statements for 2021, the Committee has:

|

| · | reviewed and discussed our audited consolidated financial statements for 2021 with our management; |

|

|

|

|

|

| · | discussed with our independent accountants the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC; |

|

|

|

|

|

| · | received the written disclosures and letter from our independent accountants required by applicable requirements of the Public Company Accounting Oversight Board regarding the accountants’ communications with the Committee concerning independence; and |

|

|

|

|

|

| · | discussed the independence of our independent accountants with the accountants. |

Based on the above reviews and discussions, the Committee recommended to our Board of Directors that the audited consolidated financial statements be included in our 2021 Annual Report on Form 10-K as filed with the SEC.

Lawrence H. Dugan

Gene Salkind

Thomas Williams

Compensation Committee

On January 27, 2021, our Board established a compensation committee that operates under a written charter as approved by our Board. The members of our compensation committee are Dr. Gene Salkind, Mr. Thomas Williams, and Mr. Lawrence Dugan. Dr. Salkind serves as chairman of the compensation committee.

| 17 |

Our compensation committee is responsible for the oversight of, and the annual and ongoing review of, the Chief Executive Officer, the compensation of the senior management team, and the bonus programs in place for employees, which includes:

|

| · | reviewing the performance of the Chief Executive Officer and other senior officers, and determining the bonus entitlement for such officer or officers on an annual basis, |

|

|

|

|

|

| · | determining and approving proposed annual compensation and incentive opportunity level of executive officers for each fiscal year, and recommending such compensation to the Board, |

|

|

|

|

|

| · | administration of determination of proposed grants of stock options to directors, employees, consultants and advisors with the Chief Executive Officer, |

|

|

|

|

|

| · | reviewing and recommending to the Board the compensation of the Board and committee members, |

|

|

|

|

|

| · | administering and approving any general benefit plans in place for employees, |

|

|

|

|

|

| · | engaging and setting the compensation for independent counsel and other advisors and consultants, |

|

|

|

|

|

| · | preparing any reports on director and officer compensation to be included in the Company’s proxy statements, |

|

|

|

|

|

| · | assessing the Company’s competitive positions for each component of officer compensation and making recommendations to the Board regarding such positions, and |

|

|

|

|

|

| · | reviewing and assessing the adequacy of its charter and submitting any recommended changes to our Board for its consideration and approval. |

In considering compensation to be paid to our directors and our executive officers named in the Summary Compensation Table below, the Committee considers information provided by our Chairman and Chief Executive Officer, including, in the case of officers other than himself, information about those officers’ individual performance and his recommendations as to their compensation.

The compensation committee may retain the services of consultants or other advisors at our expense, and under its charter the compensation committee is directly responsible for the appointment, compensation, terms of engagement and oversight of the work of its consultants and advisors. The compensation committee met twice in fiscal year 2021.

Compensation Committee Report

This report has been furnished by the compensation committee, the members of which are named above, in the committee’s capacity as the Boards’ compensation committee. The compensation committee has:

|

| · | reviewed and discussed with management the Compensation Discussion and Analysis that is included in this proxy statement; and |

|

|

|

|

|

| · | based on that review and discussion, recommended to the full Board of Directors that the Compensation Discussion and Analysis be included in our proxy statement and Annual Report on Form 10-K. |

| 18 |

Lawrence H. Dugan

Gene Salkind

Thomas Williams

Nomination and Governance Committee

On January 27, 2021, our Board established a nomination and governance committee that operates under a written charter as approved by our Board. The members of our nomination and governance committee are Dr. Gene Salkind, Mr. Thomas Williams, and Mr. Lawrence Dugan. Mr. Williams serves as chairman of the nomination and governance committee.

Our nomination and corporate governance committee is responsible for assisting the Board in:

|

| · | proposing a slate of qualified nominees for election to the Board by the shareholders or in the event of a Board vacancy, |

|

|

|

|

|

| · | evaluating the suitability of potential nominees for membership on the Board, |

|

|

|

|

|

| · | determining the composition of the Board and its committees, |

|

|

|

|

|

| · | monitoring a process to assess Board, committee and management effectiveness, |

|

|

|

|

|

| · | aiding and monitoring management succession planning, and |

|

|

|

|

|

| · | developing, recommending to the Board, implementing and monitoring policies and processes related to the Company’s corporate governance guidelines. |

The nomination and governance committee met once in fiscal year 2021.

Director Selection Process

As provided in its charter, the nomination and governance committee is responsible for recommending to our Board of Directors all nominees for election to the Board of Directors, including nominees for re-election to the Board of Directors, in each case after consultation with the Chairman of the Board of Directors. The nomination and governance committee considers, among other things, the level of experience, financial literacy and business acumen of the candidate. In addition, qualified candidates for director are those who, in the judgment of the nomination and governance committee, have significant decision-making responsibility, with business, legal or academic experience, and other disciplines relevant to the Company's businesses, the nominee's ownership interest in the Company, and willingness and ability to devote adequate time to Board of Directors duties, all in the context of the needs of the Board of Directors at that point in time and with the objective of ensuring diversity in the background, experience, and viewpoints of Board of Directors members.

The nomination and governance committee may identify potential nominees for election to our Board of Directors from a variety of sources, including recommendations from current directors and officers, recommendations from our stockholders or any other source the committee deems appropriate.

| 19 |

Our stockholders can nominate candidates for election as director by following the procedures set forth in our Bylaws, which are summarized below. We did not receive any director nominees from our stockholders for the Annual Meeting.

Our Bylaws provide that any stockholder entitled to vote in the election of directors generally may make nominations for the election of directors to be held at an Annual Meeting, provided that such stockholder has given actual written notice of his intent to make such nomination or nominations to the Secretary of the Company not less than sixty (60) days nor more than ninety (90) days prior to the appropriate anniversary date of the previous meeting of shareholders of the Company called for the election of directors. In accordance with the Company's Bylaws, submissions must include: (1) the name and address of the shareholder who intends to make the nomination and of the person or persons to be nominated; (2) a representation that such shareholder is a holder of record of stock of the Company entitled to vote at such meeting and intends to appear in person or by proxy at such meeting to nominate the person or persons specified in the notice; (3) the consent of each nominee to serve as director of the Company, if so elected; and (4) the class and number of shares of stock of the Company which are beneficially owned by such shareholder on the date of such shareholder's notice and, to the extent known, by any other shareholders known by such shareholder to be supporting such nominees on the date of such shareholder notice.

Any stockholder who wishes to nominate a potential director candidate must follow the specific requirements set forth in our Bylaws, a copy of which may be obtained by sending a request to: Grove, Inc., 1710 Whitney Mesa Drive, Henderson, Nevada 89014, and is available on www.sec.gov.

Family Relationships

There are no family relationships among our executive officers, directors and significant employees.

Shareholder Proposals for Next Year’s Annual Meeting

Shareholders interested in submitting a proposal for inclusion in our proxy materials for the 2023 Annual Meeting may do so by following the procedures set forth in Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). To be eligible for inclusion in such proxy materials pursuant to such rule, shareholder proposals must be received by our Secretary no later than January 31, 2023.

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

In this section, we describe the material components of our executive compensation program for our “named executive officers” whose compensation is set forth in the Summary Compensation Table and other compensation tables under this heading. This discussion also provides an overview of our compensation philosophy and objectives, and how and why our Boards’ joint Compensation, Nominations and Governance Committee implements compensation processes and arrives at specific compensation decisions and recommendations involving the named executive officers. Our 2021 named executive officers are listed below, in the order in which they appear in the Summary Compensation Table, and we refer to them in this discussion as our “NEOs.”

|

| · | Allan Marshall – Chairman and Chief Executive Officer |

|

|

|

|

|

| · | Andrew Norstrud – Chief Financial Officer |

|

|

|

|

|

| · | Robert Hackett - President |

| 20 |

SUMMARY COMPENSATION TABLE

| Name and Principal Position |

| Year |

| Salary ($) |

|

| Bonus ($) |

|

| Stock Awards ($) |

|

| Option Awards ($)(4) |

|

| Non-Equity Incentive Plan Compensation ($) |

|

| Nonqualified Deferred Compensation Earnings ($) |

|

| All Other Compensation ($) |

|

| Total ($) |

| ||||||||

| Allan Marshall, CEO, and Director |

| 2021 |

|

| 284,615 |

|

|

| 741,910 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 1,026,525 | (1) |

|

|

| 2020 |

|

| 300,000 |

|

|

| - |

|

|

| - |

|

|

| 1,325,600 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 1,625,600 | (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

| Andrew Norstrud, Chief Financial Officer |

| 2021 |

|

| 210,000 | 50,000 | - | 344,900 | - |

|

|

| - |

|

|

| - | 644,900 |

| |||||||||||||||

|

|

| 2020 |

|

| 184,230 |

|

|

| - |

|

|

| - |

|

|

| 198,840 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 383,070 | (3) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Robert Hackett, President |

| 2021 |

|

| 125,000 |

|

|

| 50,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 175,000 |

|

|

|

| 2020 |

|

| 130,913 |

|

|

| - |

|

|

| - |

|

|

|

|

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 130,913 |

|

There are no arrangements or plans in which we provide pension, retirement or similar benefits for directors or executive officers. Our directors and executive officers may receive share options at the discretion of our board of directors in the future. We do not have any material bonus or profit-sharing plans pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that share options may be granted at the discretion of our board of directors. The value of the option awards is based on the intrinsic value at date of grant.

| (1) | At June 30, 2021 Allan Marshall had an accrual of $486,200 for 2021 bonus that was subsequently paid in August of 2021. |

|

|

|

| (2) | At June 30, 2020 Allan Marshall had an accrual of $72,692 of earned compensation that had not been paid. |

|

|

|

| (3) | For the fiscal year 2020, Andrew Norstrud received compensation through a consulting contract $175,000 and on June 30, 2020, there was an accrual of $7,500 owed to Andrew Norstrud for compensation. |

|

|

|

| (4) | Represents equity-based compensation expense calculated in accordance with the provisions of Accounting Standards Codification Section 718 – Compensation – Stock Compensation, using the Black-Scholes option pricing model as set forth in Notes to our consolidated financial statements. |

Discretionary Bonuses. From time to time the Compensation Committee may consider and recommend, and the Boards of Directors may approve, payment of a discretionary cash bonus to one or more executive officers based on particular performance or achievement considerations or other factors related to the retention of motivated and talented executive officers. No discretionary bonuses were recommended, approved, or paid to any of our NEOs for 2020 or 2021.

| 21 |

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END TABLE

The following table summarizes equity awards granted to Named Executive Officers and directors that were outstanding as of June 30, 2021:

|

|

| Option Awards |

| Stock Awards | |||||||||||||||||||||

| Name |

| Number of Securities Underlying Unexercised Options: # Exercisable |

|

| Number of Securities Underlying Unexercised Options: # Unexercisable |

|

| Equity Incentive Plan Awards: Number of Securities Underlying Unearned and Unexercisable Options: |

| Option Exercise Price $ |

|

| Option Expiration Date |

| # of Shares or Units of Stock That Have Not Vested # |

| Market Value of Shares or Units of Stock That Have Not Vested $ |

| Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested # |

| Equity Incentive Plan Awards: Market of Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested $ | ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Allan Marshall, CEO, and Director |

|

| 787,037 |

|

|

| - |

|

|

|

| $ | 1.53 |

|

| 6/1/2029 |

|

|

|

|

|

|

|

| |

| Andrew Norstrud, Chief Financial Officer and Director |

|

| 210,648 |

|

|

| 178,241 |

|

|

|

| $ | 1.53 |

|

| 1/1/2031 |

|

|

|

|

|

|

|

| |

|

|

|

| 166,667 |

|

|

| - |

|

|

|

| $ | 1.53 |

|

| 6/1/2029 |

|

|

|

|

|

|

|

| |

| Robert Hackett, President |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Pension, Retirement or Similar Benefit Plans

There are no arrangements or plans in which we provide pension, retirement or similar benefits for directors or executive officers. We have no material bonus or profit-sharing plans pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that stock options may be granted at the discretion of the board of directors or a committee thereof.

Indebtedness of Directors, Senior Officers, Executive Officers and Other Management

None of our directors or executive officers or any associate or affiliate of our company during the last two fiscal years, is or has been indebted to our company by way of guarantee, support agreement, letter of credit or other similar agreement or understanding currently outstanding.

| 22 |

Director Compensation

| Name |

| Fees Earned or Paid in Cash ($) |

|

| Stock Awards ($) |

|

| Option Awards ($) |

|

| Non-Equity Incentive Plan Compensation ($) |

|

| Nonqualified Deferred Compensation Earnings ($) |

|

| All Other Compensation ($) |

|

| Total ($) |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

| Lawrence H. Dugan |

| $ |

|

| - |

|

| $ | 24,637 |

|

|

| - |

|

|

| - |

|

|

| - |

|

| $ | 24,637 |

| ||

| Gene Salkind |

| $ |

|

| - |

|

| $ | 24,637 |

|

|

| - |

|

|

| - |

|

|

| - |

|

| $ | 24,637 |

| ||

| Thomas Williams |

| $ |

|

| - |

|

| $ | 24,637 |

|

|

| - |

|

|

| - |

|

|

| - |

|

| $ | 24,637 |

| ||

We do not have any agreements for compensating our directors for their services in their capacity as directors, although such directors have received and are expected in the future to receive stock options to purchase shares of our Common Stock as awarded by our Board of Directors.

Related Person Transactions During 2021

For the years ended June 30, 2020, the Company leased the Las Vegas warehouse from a shareholder for $22,071 per month. This lease ended December 31, 2019, and there were no further liabilities related to this lease. The owner of the warehouse is also related to one of the members of management.

During the year ended June 30, 2021, the Company received a promissory note from one of the members of management. The loan was for an aggregate sum of $750,000, for a period of two years and had an interest rate of 2% per annum. The Company repaid the loan during the three months ended March 31, 2021.

During the year ended June 30, 2021, the Company repaid a note from one of the members of management. The loan was $12,000 and was due upon demand.

During the year ended June 30, 2021, a member of management purchased 500,000 shares of Preferred Stock for $50,000 cash. The Company recognized $50,000 for the beneficial conversion feature as a deemed Preferred Stock dividend in the Consolidated Statements of Operations. The Preferred Stock is convertible into the Company’s Common Stock at a ratio of one share of the Company’s Common Stock for every 1.8 shares of Preferred Stock at the holder’s option, has preferential liquidation rights and the Preferred Stock shall vote together with the Common Stock as a single class on all matters to which shareholders of the Company are entitled to vote at the rate of ten votes per share of Preferred Stock.

Effective October 1, 2021, the Company entered into an Equity Interest Purchase Agreement (the “I/O Agreement“) with Gyprock Holdings LLC, a Delaware limited liability company, MFA Holdings Corp., a Florida corporation and Sherwood Ventures, LLC, a Texas limited liability company (each an “I/O Seller” and collectively called “I/O Sellers”). The I/O Sellers own all the membership interests in Interactive Offers, LLC, a Delaware limited liability company (“Interactive”). The Company’s CEO and Chairman, Allan Marshall, is the controlling stockholder and the president of MFA Holdings Corp. MFA Holdings Corp. owns twenty percent of the outstanding membership interests in Interactive. The above related party transactions are not necessarily indicative of the amounts and terms that would have been incurred had comparable transactions been entered into with independent parties.

| 23 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 21, 2022, certain information with respect to the beneficial ownership of our common and preferred shares by each shareholder, or group of affiliated persons, known by us to be the beneficial owner of more than 5% of our common and preferred shares, as well as by each of our current directors and executive officers, and our directors and executive officers as a group. Each person has sole voting and investment power with respect to the shares of Common Stock and Preferred Stock, except as otherwise indicated. Beneficial ownership consists of a direct interest in the shares of Common Stock and Preferred Stock, except as otherwise indicated.

Unless otherwise indicated, the address of each of the following persons is c/o Grove Inc., 1710 Whitney Mesa Drive Henderson, NV 89014.

Executive Officers and Directors:1

| Name and Address of Beneficial Owner |

| Amount and Nature of Beneficial Ownership |

| Percentage of Class(1) | ||

| Allan Marshall |

| 4,420,139 (2) |

| 23.93% | ||

| Gene Salkind |

| 2,411,969 (3) |

| 14.50% | ||

| Robert Hackett |

| 1,444,444 (4) |

| 8.71% | ||

| Andrew Norstrud |

| 840,279 (5) |

| 4.91% | ||

| Lawrence Dugan |

| 86,806 (6) |

| 0.52% | ||

| Thomas Williams |

| 59,028 (7) |

| 0.36% | ||

| Directors and Executive Officers as a Group (six persons) |

| 8,846,461 |

| 52.91% | ||

| 24 |

| (1)

| Under Rule 13d-3, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (i) voting power, which includes the power to vote, or to direct the voting of shares; and (ii) investment power, which includes the power to dispose or direct the disposition of shares. Certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares outstanding is deemed to include the number of shares beneficially owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of outstanding shares of any person as shown in this table does not necessarily reflect the person’s actual ownership or voting power with respect to the number of shares of Common Stock actually outstanding on March 21, 2022. As of March 21, 2022, there were 16,576,088 shares of our Company’s Common Stock issued and outstanding. | |||

|

|

| |||

| (2)

| Represents (i) 2,527,778 shares of Common Stock, (ii) 277,778 shares issuable upon the conversion of Preferred Stock and (iii) 1,614,583 shares issuable upon the exercise of stock options that are exercisable within 60 days. Does not include 468,750 shares issuable upon vesting and exercise of remaining stock options. | |||

|

|

| |||

| (3)

| Represents (i) 2,352,941 shares of Common Stock and (ii) 59,028 shares issuable upon the exercise of stock options that are exercisable within 60 days. Does not include 18,750 shares issuable upon vesting and exercise of remaining stock options. | |||

|

|

| |||

| (4) | Represents (i) 1,444,444 shares of Common Stock. | |||

|

|

| |||

| (5)

| Represents (i) 305,556 shares of Common Stock and (ii) 534,723 shares issuable upon the exercise of stock options that are exercisable within 60 days. Does not include 220,833 shares issuable upon vesting and exercise of remaining stock options. | |||

|

|

| |||

| (6)

| Represents (i) 27,778 shares of Common Stock and (ii) 59,028 shares issuable upon the exercise of stock options that are exercisable within 60 days. Does not include 18,750 shares issuable upon vesting and exercise of remaining stock options. | |||

|

|

| |||