UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 2054

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check the appropriate box:

| ☒ | Preliminary Information Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| ☐ | Definitive Information Statement |

| GROVE, INC. |

| (Name of Registrant As Specified In Its Charter) |

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14c5(g) and 0-11. | |

|

|

|

|

|

| (1) | Title of each class of securities to which transaction applies: |

|

| (2) | Aggregate number of securities to which transaction applies: |

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing is calculated and state how it was determined): |

|

| (4) | Proposed maximum aggregate value of transaction: |

|

| (5) | Total fee paid: |

|

|

|

|

| ☐ | Fee paid previously with preliminary materials: | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or Schedule and the date of its filing. | |

|

|

|

|

|

| (1) | Amount previously paid: |

|

| (2) | Form, Schedule or Registration Statement No. |

|

| (3) | Filing Party: |

|

| (4) | Date Filed: |

GROVE, INC.

17129 US Hwy 19 N.

Clearwater, FL 33760

NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT

TO ALL STOCKHOLDERS OF GROVE, INC.

July 14, 2022

Dear Stockholders of Grove, Inc.:

This Notice and the accompanying Information Statement are first being mailed on or about [●], 2022 to the holders of record of the outstanding common stock and preferred stock of Grove, Inc., a Nevada corporation (the “Company”) as of July 11, 2022 (the “Record Date”). We are furnishing this Information Statement in connection with actions taken by stockholders who have the authority to vote a majority of the outstanding shares of our common stock, par value $0.001 per share (“Common Stock”) and our Series A Convertible Preferred Stock, par value $0.0001 per share (“Series A Preferred Stock”).

By written consent dated July 11, 2022, stockholders holding 51.39% of the voting equity of the Company approved and ratified the following corporate actions (collectively, the “Actions”):

| 1. | Changing the name of the Company from “Grove, Inc.” to “Upexi, Inc.” or similar available name (the “Name Change”) and applying for a new stock symbol (the “Symbol Change”). | |

| 2. | An Amendment to the Articles of Incorporation, as amended (the “Articles of Incorporation”) with the Secretary of State of the State of Nevada (the “Secretary of State”) to effect the Name Change (the “Amendment”). |

The Actions were approved by the Company’s board of directors on July 5, 2022.

Pursuant to Rule 14c-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the proposals will not be effective until at least 20 calendar days after the mailing of the Information Statement to our stockholders. Therefore, the Information Statement is being sent to you for informational purposes only.

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

Pursuant to rules adopted by the Securities and Exchange Commission, copies of these reports may be obtained from the SEC’s EDGAR archives at https://www.sec.gov. This is not a notice of a meeting of stockholders and no stockholders’ meeting will be held to consider the action described herein. The accompanying Information Statement is being furnished to you solely for the purpose of informing stockholders of the action described herein pursuant to Section 14(c) of the Exchange Act and the regulations promulgated thereunder, including Regulation 14C.

ACCORDINGLY, WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY. NO PROXY CARD HAS BEEN ENCLOSED WITH THE INFORMATION STATEMENT.

The accompanying Information Statement will serve as written notice to stockholders of the Company pursuant to Section 78.370 of the Nevada Revised Statutes.

| Dated: July 14, 2022 | By Order of the Board of Directors |

| |

|

|

|

|

|

|

| By: | /s/ Allan Marshall |

|

|

|

| Allan Marshall |

|

|

|

| Chief Executive Officer and Chairman |

|

| 2 |

GROVE, INC.

17129 US Hwy 19 N.

Clearwater, FL 33760

__________________________

INFORMATION STATEMENT

__________________________

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

__________________________

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. THIS INFORMATION STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING YOU OF THE MATTERS DESCRIBED HEREIN.

Information Concerning the Actions by Written Consent

This Information Statement is being furnished to the stockholders of Grove, Inc., a Nevada corporation (the “Company”, “we”, “us” or “our”), pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations promulgated thereunder, for the purpose of informing our stockholders that, on July 5, 2022, our board of directors approved by written consent, and on July 11, 2022, the stockholders holding a majority of the voting power of the Company also approved by written consent, the following corporate actions (collectively, the “Actions”):

|

| 1. | Changing the name of the Company from “Grove, Inc.” to “Upexi, Inc.” or similar available name (the “Name Change”) and applying for a new stock symbol (the “Symbol Change”). |

|

|

|

|

|

| 2. | An Amendment to the Articles of Incorporation, as amended (the “Articles of Incorporation”) with the Secretary of State of the State of Nevada (the “Secretary of State”) to effect the Name Change (the “Amendment”). |

Under the laws of the State of Nevada and our bylaws, stockholder action may be taken by written consent without a meeting of the stockholders. The written consent of our board of directors and the written consent of the stockholders holding a majority of the voting power of the Company are sufficient to approve the Actions. Therefore, no proxies or consents were or are being solicited in connection with the Actions.

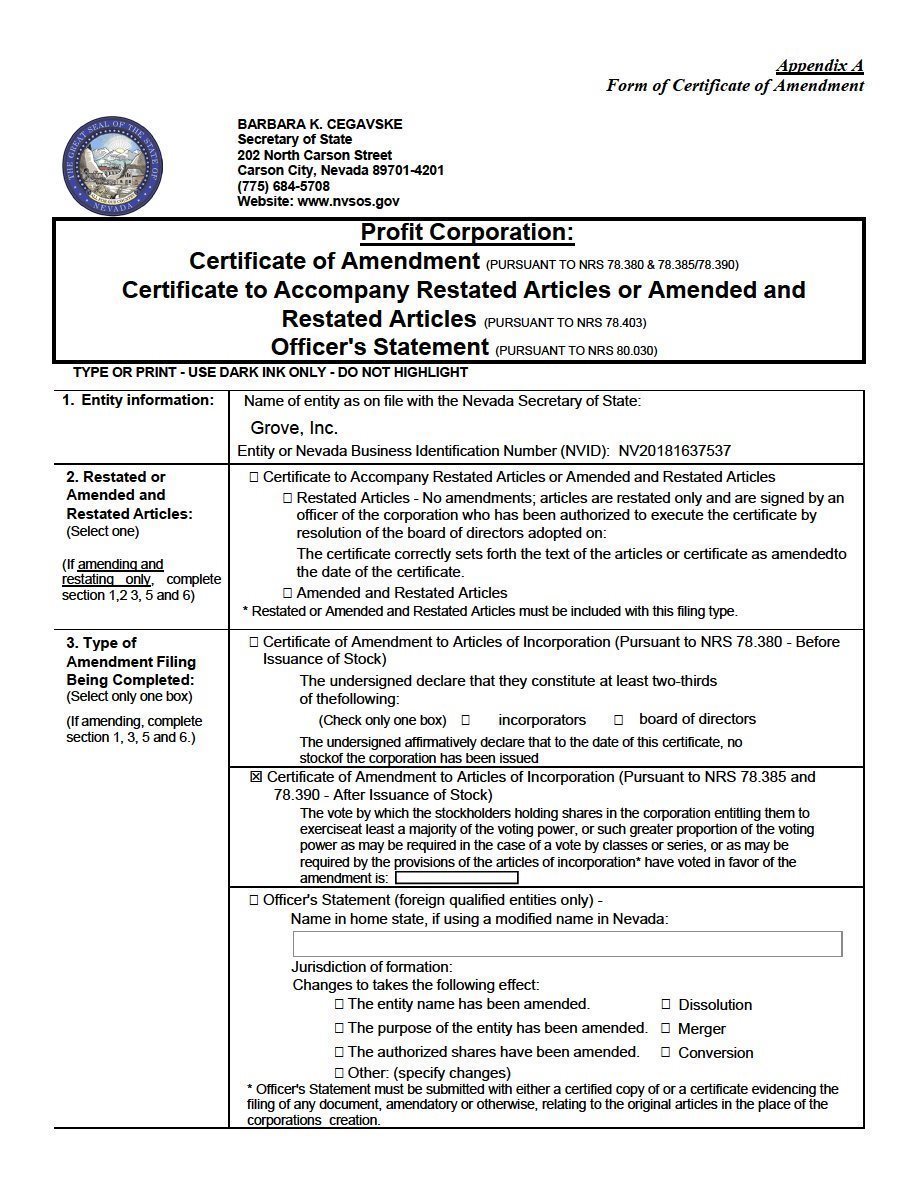

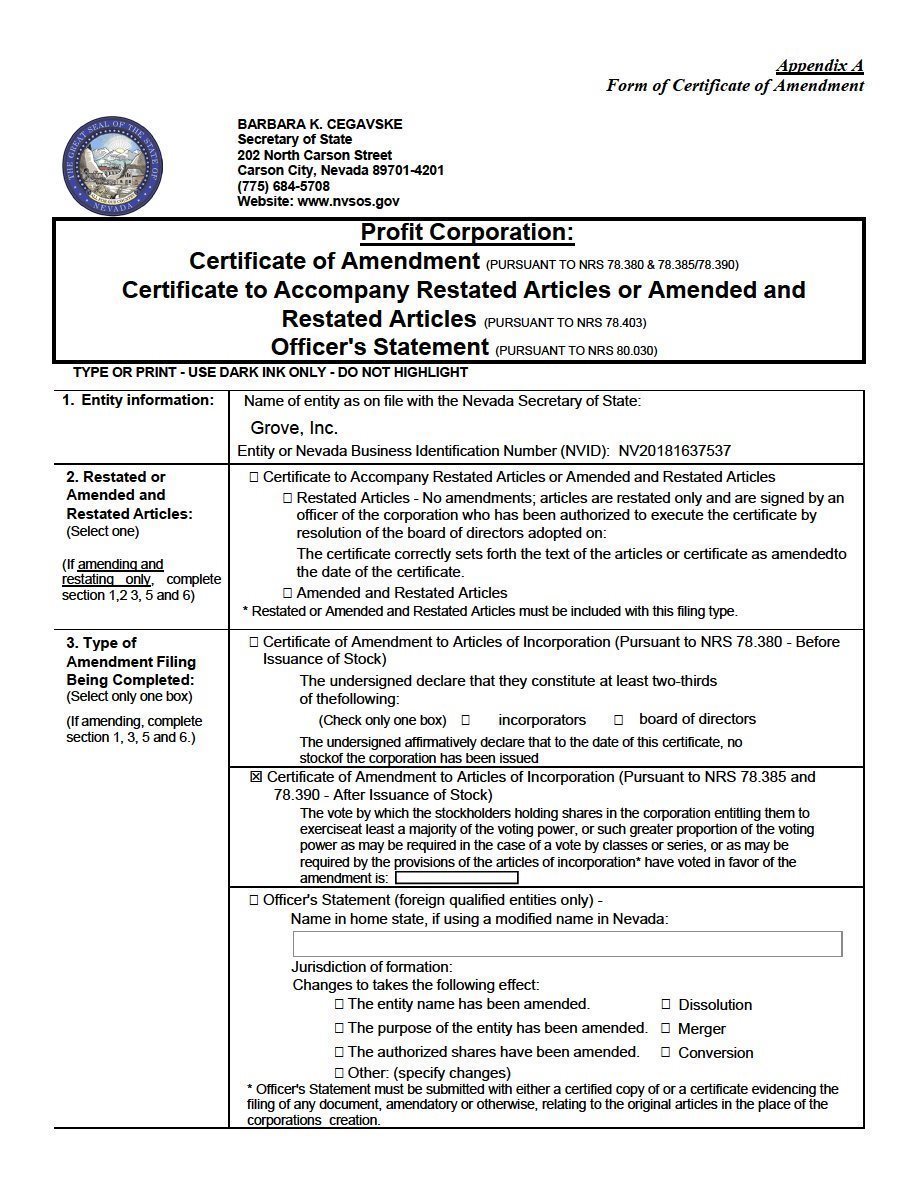

We intend to file a Certificate of Amendment to our Articles of Incorporation to effectuate the Amendment. The proposed Certificate of Amendment, attached hereto as Appendix A, will become effective when it has been accepted for filing by the Secretary of State. We expect the filing will be made within a few days after the later of the date that is 20 days from the date this Information Statement is disseminated to our stockholders and the date The Nasdaq Capital Market completes its review and processing of our Symbol Change. We intend to issue a press release announcing the effective date of the name change and our new trading symbol.

Record Date

Our board of directors has fixed the close of business on July 11, 2022 (the “Record Date”), as the record date for determining our stockholders who are entitled to receive this Information Statement. Only our stockholders of record as of the Record Date are entitled to notice of the information disclosed in this Information Statement. As of the Record Date, there were 16,819,842 shares of common stock, par value $0.001 (“Common Stock”), and 500,000 shares of Series A Convertible Preferred Stock, par value $0.001 (the “Series A Preferred Stock”) issued and outstanding. Stockholders as of the Record Date who did not consent to any of the Actions are not entitled to dissenters’ rights or appraisal rights in connection with any of the Actions under the laws of the State of Nevada or under our bylaws.

Expenses

The cost of preparing and furnishing this Information Statement will be borne by us. We may request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of our Common Stock and Series A Preferred Stock held on the Record Date.

| 3 |

Stockholders Sharing an Address

We will deliver, or cause to be delivered, only one copy of this Information Statement to multiple stockholders sharing an address, unless we have received contrary instructions from one or more of the stockholders. We undertake to promptly deliver, or cause to be promptly delivered, upon written or oral request, a separate copy of this Information Statement to a stockholder at a shared address to which a single copy of this Information Statement is delivered. A stockholder can notify us that the stockholder wishes to receive a separate copy of this Information Statement by contacting us at the address set forth above. Conversely, if multiple stockholders sharing an address receive multiple Information Statements and wish to receive only one, such stockholders can notify us at the address set forth above.

Information Regarding the Amendment

Reasons for Name Change

The board of directors believes the change of our name from “Grove, Inc.” to “Upexi, Inc.” will be in our best interests as the new name better reflects our long-term strategy and identity. The name change aligns the Company’s corporate name with the Company’s new primary focus on the growth and expansion of our brand aggregation business and acquiring of e-commerce businesses.

Approval of Name Change

The Board, on July 5, 2022, and the holders of 6,213,987 shares of Common Stock and 500,000 shares of Series A Preferred Stock, representing 36.94% and 100% of the issued and outstanding shares of our Common Stock and Series A Preferred Stock, respectively, and 51.39% of the voting equity of the Company, on July 11, 2022, executed and delivered to the Company the written consents approving the Amendment. Accordingly, in compliance with the laws of the State of Nevada and our bylaws a majority of the outstanding voting shares has approved the Amendment, and no other vote or proxy is required of the stockholders.

Effect on Stockholders

The change of name will not effect in any way the validity or transferability of stock certificates outstanding at the time of the name change, our capital structure or the trading of our common stock on The Nasdaq Capital Market. Following implementation of the amendment, stockholders may continue to hold their existing certificates or receive new certificates reflecting the name change by delivering their existing certificates to the Company’s transfer agent. Stockholders should not destroy any stock certificates and should not deliver any stock certificates to the transfer agent until after the effectiveness of the name change.

No Appraisal Rights

Our stockholders do not have any “appraisal” or “dissenters” rights in connection with the approval or implementation of the Amendment.

Security Ownership of Certain Beneficial Owners

The following table sets forth, as of July 11, 2022, certain information with respect to the beneficial ownership of our common and preferred shares by each stockholder, or group of affiliated persons, known by us to be the beneficial owner of more than 5% of our common and preferred shares, as well as by each of our current directors and executive officers, and our directors and executive officers as a group. Each person has sole voting and investment power with respect to the shares of Common Stock and Series A Preferred Stock, except as otherwise indicated. Beneficial ownership consists of a direct interest in the shares of Common Stock and Series A Preferred Stock, except as otherwise indicated. Unless otherwise indicated, the address of each of the following persons is c/o Grove Inc., 17129 US Hwy 19 N., Clearwater, FL 33760.

| 4 |

| Name and Address | Number of Shares | Percent of Class(1) |

| More than 5% Beneficial Owners: |

|

|

| Jeffrey Bishop | 1,198,730 (2) | 7.13% |

| Officers and Directors |

|

|

| Allan Marshall | 4,368,056 (3) | 25.97% |

| Gene Salkind | 2,409,886 (4) | 14.33% |

| Robert Hackett | 1,444,444 (5) | 8.59% |

| Andrew Norstrud | 880,557 (6) | 5.24% |

| Lawrence Dugan | 84,723 (7) | 0.50% |

| Thomas Williams | 56,945 (8) | 0.34% |

| All executive officers and directors as a group (six persons) | 9,244,611 | 54.96% |

|

| (1) | Under Rule 13d-3, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (i) voting power, which includes the power to vote, or to direct the voting of shares; and (ii) investment power, which includes the power to dispose or direct the disposition of shares. Certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares outstanding is deemed to include the number of shares beneficially owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of outstanding shares of any person as shown in this table does not necessarily reflect the person’s actual ownership or voting power with respect to the number of shares of Common Stock actually outstanding on July 11, 2022. As of July 11, 2022, there were 16,819,842 shares of our Company’s Common Stock issued and outstanding. |

|

|

|

|

|

| (2) | Mr. Bishop’s address is 18 Sackett Rd., Lee NH 03861. |

|

|

|

|

|

| (3) | Represents (i) 2,527,778 shares of Common Stock, (ii) 277,778 shares issuable upon the conversion of Series A Preferred Stock and (iii) 1,562,500 shares issuable upon the exercise of stock options that are exercisable within 60 days. Does not include 520,833 shares issuable upon vesting and exercise of remaining stock options. |

|

|

|

|

|

| (4) | Represents (i) 2,352,941 shares of Common Stock and (ii) 56,945 shares issuable upon the exercise of stock options that are exercisable within 60 days. Does not include 20,833 shares issuable upon vesting and exercise of remaining stock options. |

|

|

|

|

|

| (5) | Represents 1,444,444 shares of Common Stock. |

|

|

|

|

|

| (6) | Represents (i) 305,556 shares of Common Stock and (ii) 575,001 shares issuable upon the exercise of stock options that are exercisable within 60 days. Does not include 180,555 shares issuable upon vesting and exercise of remaining stock options. |

|

|

|

|

|

| (7) | Represents (i) 27,778 shares of Common Stock and (ii) 56,945 shares issuable upon the exercise of stock options that are exercisable within 60 days. Does not include 20,833 shares issuable upon vesting and exercise of remaining stock options. |

|

|

|

|

|

| (8) | Represents 56,945 shares issuable upon the exercise of stock options that are exercisable within 60 days. Does not include 20,833 shares issuable upon vesting and exercise of remaining stock options. |

Additional Information about the Company

We file annual, quarterly and current reports, Proxy Statements and other documents with the SEC under the Exchange Act. The Company’s SEC filings made electronically through the SEC’s EDGAR system are available to the public at the SEC’s website at http://www.sec.gov. You may also request a copy of the Company’s filings with the SEC, at no cost, by sending a request to: Grove, Inc., 17129 US Hwy 19 N., Clearwater, FL 33760.

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

| Dated: July 14, 2022 | By Order of the Board of Directors |

| |

|

|

|

|

|

|

| By: | /s/ Allan Marshall |

|

|

|

| Allan Marshall |

|

|

|

| Chief Executive Officer and Chairman |

|

| 5 |

| 6 |

| 7 |