UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Amendment No. 1)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

| UPEXI, INC. |

| (Name of Registrant as Specified in Its Charter) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |

|

|

| |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

|

|

|

|

|

| (1) | Title of each class of securities to which transaction applies: |

|

| (2) | Aggregate number of securities to which transaction applies: |

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

| (4) | Proposed maximum aggregate value of transaction: |

|

| (5) | Total fee paid: |

|

|

| |

| ☐ | Fee paid previously with preliminary materials. | |

|

|

| |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

|

|

|

|

|

| (1) | Amount Previously Paid: |

|

| (2) | Form, Schedule or Registration Statement No.: |

|

| (3) | Filing Party: |

|

| (4) | Date Filed: |

Explanatory Note: This Amendment No. 1 to Schedule 14A (the “Amendment”) is being filed to amend the definitive proxy statement (the “Original Proxy”) of Upexi, Inc. (the “Company”) for its Annual Meeting of Shareholders which was filed with the Securities and Exchange Commission on May 12, 2025. The sole purpose of the amendment is to include Annex A, Annex B, and Annex C as exhibits.

| 2 |

| Table of Contents |

Upexi, Inc.

3030 N. Rocky Point Drive, Suite 420, Tampa, FL 33607

To Our Shareholders:

We are pleased to announce that the Annual Meeting of shareholders (the “Annual Meeting”) of Upexi, Inc. (“we,” “our,” “us,” “Company,” or “Upexi”) will be held at 9:00 a.m. EDT on Monday, June 16, 2025. You are invited to participate in the Annual Meeting.

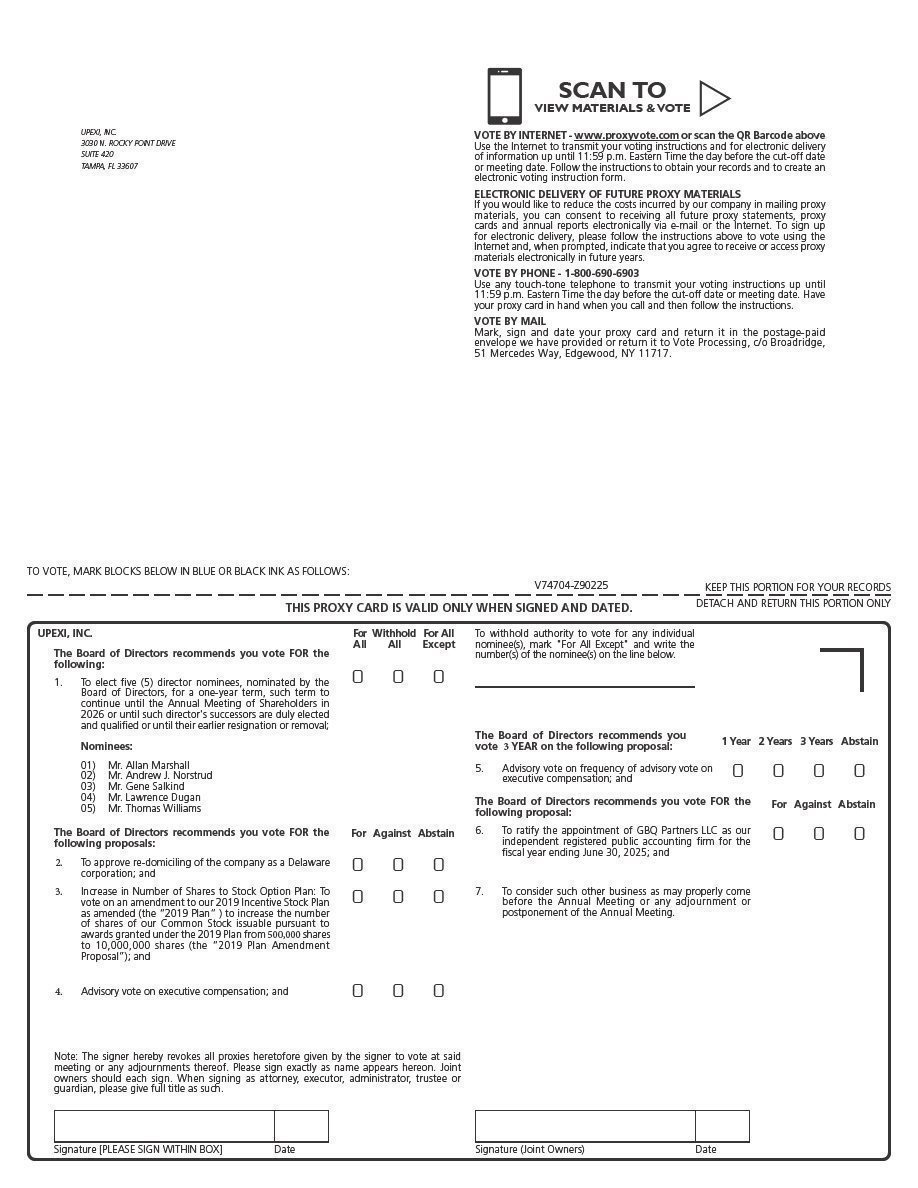

The purpose of the meeting is to consider and vote on the following matters:

|

| 1. | Election of Directors: To elect 5 directors for a one-year term; and |

|

|

|

|

|

| 2. | To approve re-domiciling of the company as a Delaware corporation; and |

|

|

|

|

|

| 3.

| Increase in Number of Shares to Stock Option Plan: To vote on an amendment to our 2019 Incentive Stock Plan as amended (the “2019 Plan” ) to increase the number of shares of our Common Stock issuable pursuant to awards granted under the 2019 Plan from 500,000 shares to 10,000,000 shares (the “2019 Plan Amendment Proposal”); and |

|

|

|

|

|

| 4. | Advisory vote on executive compensation; and |

|

|

|

|

|

| 5. | Advisory vote on frequency of advisory vote on executive compensation; and |

|

|

|

|

|

| 6. | Ratification of Appointment of Independent Accountants: To vote on a proposal to ratify the appointment of GBQ Partners LLC as our independent accountants for the financial year ending June 30, 2025; and |

|

|

|

|

|

| 7. | Any other business that may properly be brought before the meeting or any adjournment of the meeting. |

The record date for the determination of shareholders entitled to vote at the Annual Meeting is April 11, 2025 (the “Record Date”). You are entitled to participate remotely in the Annual Meeting if you were a holder of record of our Common Stock or Preferred Stock as of the close of business on the Record Date. Please note, if you plan to attend the Annual Meeting in person, you will need to register in advance and receive an admission card to be admitted. Please follow the instructions on page 5 of the Proxy Statement. Please refer to the Q&A section below if you are a street name holder and would like to attend the Annual Meeting. Record holders of shares may cast one vote for each share of our Common Stock and ten votes for each share of our Preferred Stock.

Your vote is important. Whether or not you plan to attend the meeting, we ask that you appoint the Proxies named in the enclosed proxy card to vote your shares for you by signing, dating and returning the enclosed proxy card, or following the instructions in the proxy statement and on your proxy card to appoint the Proxies by telephone or Internet. This will help us ensure that your shares are represented and that a quorum is present at the meeting. If you sign a proxy card or appoint the Proxies by telephone or Internet, you may later revoke your appointment or change your vote by following the instructions in the accompanying proxy statement or attend the Annual Meeting and vote the shares you hold of record on the meeting website. Attending the Annual Meeting alone will not revoke a proxy card. If your shares are held in “street name” by a broker or other nominee, the record holder of your shares must vote them for you, so you should follow your broker’s or nominee’s directions and give it instructions as to how you want it to vote your shares. We would appreciate receiving your proxy by Sunday, June 15, 2025.

BY ORDER OF THE BOARD,

/s/ Allan Marshall

Allan Marshall

CEO and Chairman of the Board

April 29, 2025

| 3 |

| Table of Contents |

Important Notice Regarding the Availability of Proxy Materials for the Annual

Meeting of Shareholders to be held on June 16, 2025:

We are pleased to take advantage of the rules of the U.S. Securities and Exchange Commission that allow companies to furnish their proxy materials over the Internet. As a result, on or about April 29, 2025, we mailed a Notice Regarding Availability of Proxy Materials to our stockholders rather than a full paper set of the proxy materials. The Notice Regarding Availability of Proxy Materials contains instructions on how to access our proxy materials over the Internet, as well as instructions on how stockholders may obtain a paper copy of our proxy materials. To make it easier for you to vote, both Internet and telephone voting are available. The instructions on the Notice Regarding Availability of Proxy Materials or, if you received a paper copy of the proxy materials, the proxy card, each describe how to use these convenient services. This Proxy Statement and our Annual Report on Form 10-K and 10-K/A for the Year Ended June 30, 2024 (the “Annual Report”) and the Quarterly Reports on Form 10-Q for the Quarters ended September 30, 2024 and December 31, 2024 are available at www.ProxyVote.com.

| 4 |

| Table of Contents |

UPEXI, INC.

3030 N. Rocky Point Drive, Suite 420, Tampa, FL 33607

This proxy statement is dated May 12, 2025 and is being furnished to our shareholders as of the close of business on April 11, 2025 (the “Record Date”), by our Board of Directors in connection with our solicitation of proxy appointments in the form of the enclosed proxy card for use at the 2025 Annual Meeting of our shareholders and at any adjournments of the meeting.

The Annual Meeting will take place on Monday, June 16, 2025, at 9 a.m., Eastern Daylight Time (EDT), at 3030 N. Rocky Point Drive, Suite 420, Tampa, FL 33607.

This Proxy Statement has been prepared by the management of the Company.

We use the “Notice and Access” method of providing proxy materials to you via the internet instead of mailing printed copies. We believe that this process provides you with a convenient and quick way to access the proxy materials, including our proxy statement, Annual Report and our quarterly reports, and to authorize a proxy to vote your shares, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials.

Most shareholders will not receive paper copies of the proxy materials unless they request them. Instead, the Important Notice Regarding Availability of Proxy Materials, which we refer to as the Notice and Access card, that was mailed to our shareholders on or about April 29, 2025, provides instructions regarding how you may access and review all of the proxy materials on the internet. The Notice and Access card also includes instructions on how to submit your proxy via the internet or telephone. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials printed on the Notice and Access card. You may also request paper copies of the proxy materials and provide voting instructions by completing and returning the enclosed voting instruction form in the addressed, postage paid envelope provided.

If your shares are held by a brokerage house or other custodian, nominee or fiduciary in “street name,” as the record holder of your shares, it is required to vote your shares according to your instructions. Your broker, bank, trust or other nominee is required to send you directions on how to vote those shares. If your shares are held in “street name” and you would like to vote your shares in person while attending the Annual Meeting, you must contact your broker, custodian, nominee or fiduciary to obtain a legal proxy form from the record holder of your shares and present it to the inspector of election with your ballot.

QUESTIONS AND ANSWERS ABOUT OUR ANNUAL MEETING

What is the purpose of the Annual Meeting?

Our 2025 Annual Meeting will be held for the following purposes:

|

| 1. | To elect five (5) director nominees, nominated by the Board of Directors, for a one-year term, such term to continue until the Annual Meeting of Shareholders in 2025 or until such director's successors are duly elected and qualified or until their earlier resignation or removal (Proposal 1); and |

|

|

|

|

|

| 2. | To Redomicile the Company as a Delaware Corporation (Proposal 2); and |

|

|

|

|

|

| 3. | Increase in Number of Shares to Stock Option Plan: To vote on an amendment to our 2019 Incentive Stock Plan as amended (the “2019 Plan” ) to increase the number of shares of our Common Stock issuable pursuant to awards granted under the 2019 Plan from 500,000 shares to 10,000,000 shares (Proposal 3); and |

|

|

|

|

|

| 4. | Advisory vote on executive compensation (Proposal 4); and |

|

|

|

|

|

| 5. | Advisory vote on frequency of advisory vote on executive compensation (Proposal 5); and |

|

|

|

|

|

| 6. | To ratify the appointment of GBQ Partners LLC as our independent registered public accounting firm for the fiscal year ending June 30, 2025 (Proposal 6); and |

|

|

|

|

|

| 7. | To consider such other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

| 5 |

| Table of Contents |

Who can vote at the Annual Meeting?

You can vote at the Annual Meeting if, as of the close of business on April 11, 2025, the record date, you were a holder of record of the Company’s Common Stock or Preferred Stock. As of the record date, there were issued and outstanding 1,425,924 shares of Common Stock, each of which is entitled to one vote on each matter to come before the Annual Meeting, and 150,000 shares of Preferred Stock, each of which is entitled to ten votes on each matter to come before the Annual Meeting.

How many shares must be present to conduct business at the Annual Meeting?

A quorum is necessary to hold a valid meeting of shareholders. For each of the proposals to be presented at the Annual Meeting, the holders of shares of a majority of the issued and outstanding shares entitled to vote at such meeting must be present. As such, holders of our outstanding Common Stock and Preferred Stock as of April 11, 2025, the record date, representing 1,462,963 shares must be present at the Annual Meeting, in person or by proxy. If you vote, including by Internet, or mailing the proxy card, your shares voted will be counted towards the quorum for the Annual Meeting. Abstentions and broker non-votes are counted as present for the purpose of determining a quorum.

How do I vote?

Registered Shareholders. If you are a registered shareholder (i.e., you hold your shares in your own name through our transfer agent, VStock Transfer, LLC, referred to herein as “VStock”), you may vote by proxy via the Internet, or by mail by following the instructions provided on the proxy card. Shareholders of record who attend the Annual Meeting may vote in person by obtaining a ballot from the inspector of elections.

Beneficial Owners. If you are a beneficial owner of shares (i.e., your shares are held in the name of a brokerage firm, bank or a trustee), you may vote by proxy by following the instructions provided in the voting instruction form or other materials provided to you by the brokerage firm, bank, or other nominee that holds your shares. To vote in person at the Annual Meeting, you must obtain a legal proxy from the brokerage firm, bank or other nominee that holds your shares.

Will my shares be voted if I do not provide voting instructions?

If you are a shareholder of record and you properly sign, date and return a proxy card, but do not indicate how you wish to vote with respect to a particular nominee or proposal, then your shares will be voted FOR the election of the five nominees for director named in “Proposal 1,” and FOR the ratification of redomiciling the Company as a Delaware corporation “Proposal 2,” and FOR the ratification of the Increase in Number of Shares to Stock Option Plan “Proposal 3,” and FOR the ratification of the compensation of the Company’s Named Executive Officers “Proposal 4,” and FOR the ratification of a three-year frequency for the say-on-pay vote “Proposal 5,” and FOR the ratification of the Appointment of GBQ Partners LLC as our Independent Registered Public Accounting Firm for the fiscal year ending June 30, 2025 “Proposal 6”.

Consistent with applicable law, we intend to count abstentions and broker non-votes for the purpose of determining the presence or absence of a quorum for the transaction of business. A broker “non-vote” refers to shares held by a broker or nominee that does not have the authority, either express or discretionary, to vote on a particular matter. Applicable rules no longer permit brokers to vote on certain “non-routine” matters if the broker has not received instructions from the beneficial owner. Proposal 1 (Election of Directors), 2 (Redomiciling the Company as a Delaware corporation and 3 (Increase of the shares available for the Incentive Stock Play) are considered to be “non-routine” matters. Accordingly, it is important that beneficial owners instruct their brokers how they wish to vote their shares with respect to these Proposals. Proposal 4 (Advisory vote on executive compensation) , 5 (Advisory vote on frequency of advisory vote on executive compensation), and 6 (Ratification of Appointment of Auditor) are considered to be a “routine” matter. Your broker, therefore, may vote your shares in its discretion if you do not provide instructions on how to vote on this “routine” matter.

| 6 |

| Table of Contents |

Can I change my vote after I have voted?

Yes, you may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may change your vote by voting again on a later date on the Internet (only your latest Internet proxy submitted prior to the Annual Meeting will be counted), signing and returning a new proxy card with a later date, or attending and voting at the Annual Meeting. However, your attendance at the Annual Meeting will not automatically revoke any prior proxy unless you vote again at the Annual Meeting or specifically request in writing that your prior proxy be revoked.

What is the deadline to vote?

If you hold shares as the shareholder of record, your vote by proxy must be received before 11:59 p.m. ET on June 15, 2025. If you are the beneficial owner of shares, please follow the voting instructions provided by your broker, trustee or other nominee.

What vote is required to elect directors or take other action at the Annual Meeting?

|

| · | Proposal 1: Election of Five (5) Directors. The election of the five director nominees named in this Proxy Statement requires the affirmative vote of shares of Common Stock and Preferred Stock, voting as a single class, representing a plurality of the votes cast on the proposal at the Annual Meeting. This means that the five nominees will be elected if they receive more affirmative votes than any other person. You may not cumulate your votes for the election of directors. Brokers may not use discretionary authority to vote shares on the election of directors if they have not received specific instructions from their clients. For your vote to be counted in the election of directors, you will need to communicate your voting decisions to your bank, broker or other nominee before the date of the Annual Meeting in accordance with their specific instructions. |

|

|

|

|

|

| · | Proposal 2: Re-domiciling of the company as a Delaware corporation. The approval of this requires the affirmative vote of shares of Common Stock and Preferred Stock, voting as a single class, representing a majority of votes cast on the proposal at the Annual Meeting. |

|

|

|

|

|

| · | Proposal 3: Ratification of the Increase of shares of Common Stock issuable pursuant to awards granted under the 2019 Plan. Ratification of increase of shares of our Common Stock issuable pursuant to awards granted under the 2019 Plan from 500,000 shares to 10,000,000 shares, requires the affirmative vote of shares of Common Stock and Preferred Stock, voting as a single class, representing a majority of votes cast on the proposal at the Annual Meeting. |

|

|

|

|

|

| · | Proposal 4: Advisory vote on executive compensation. |

|

|

|

|

|

| · | Proposal 5: Advisory vote on frequency of advisory vote on executive compensation |

|

| · | Proposal 6: Ratification of the Appointment of GBQ Partners LLC as Our Independent Registered Public Accounting Firm for 2025. Ratification of the appointment of GBQ Partners LLC as our independent registered public accounting firm for the year ending June 30, 2025, requires the affirmative vote of shares of Common Stock and Preferred Stock, voting as a single class, representing a majority of votes cast on the proposal at the Annual Meeting. |

In general, other business properly brought before the Annual Meeting requires the affirmative vote of shares of Common Stock and Preferred Stock, voting as a single class, representing a majority of votes cast on such matter at the Annual Meeting.

| 7 |

| Table of Contents |

How does the Board recommend that I vote?

Our Board recommends that you vote your shares ”FOR” each director nominee named in this Proxy Statement, ”FOR” ratification of redomiciling the Company to a Delaware corporation, ”FOR” ratification of increase of shares of our Common Stock issuable pursuant to awards granted under the 2019 Plan from 500,000 shares to 10,000,000 shares, ”FOR” ratification of executive compensation, FOR” ratification of a three-year frequency for the say-on-pay vote, and ”FOR” ratification of GBQ Partners LLC as our independent registered public accounting firm for the fiscal year ending June 30, 2025.

How will the persons named as proxies vote?

If you complete and submit a proxy, the persons named as proxies will follow your instructions. If you submit a proxy but do not provide instructions, or if your instructions are unclear, the persons named as proxies will vote as recommended by our Board of Directors or, if no recommendation is given, in their own discretion.

Where can I find the results of the voting?

We intend to announce preliminary voting results at the Annual Meeting and will publish final results through a Current Report on Form 8-K to be filed with the Securities and Exchange Commission (“SEC”) within four business days after the Annual Meeting. The Current Report on Form 8-K will be available on the SEC website, www.sec.gov.

Do I need a ticket to attend the Annual Meeting?

Yes, you will need an admission card to enter the Annual Meeting. You may request tickets by providing the name under which you hold shares of record or, if your shares are held in the name of a bank, broker or other holder of record, the evidence of your beneficial ownership of the shares, the number of tickets you are requesting and your contact information. You can submit your request in the following ways:

|

| · | by sending an e-mail to andrew@upexi.com; or |

|

| · | by calling us at (702) 332-5591. |

Shareholders also must present a form of personal photo identification in order to be admitted to the Annual Meeting.

Who will pay for the cost of soliciting proxies?

We will pay for the cost of soliciting proxies. Our directors, officers and other employees, without additional compensation, may solicit proxies personally, in writing, by telephone, by email or otherwise. As is customary, we will reimburse brokerage firms, fiduciaries, voting trustees, and other nominees for forwarding our proxy materials to each beneficial owner of Common Stock and Preferred Stock held of record by them.

| 8 |

| Table of Contents |

PROPOSAL 1: ELECTION OF DIRECTORS

Upon the recommendation of the Nominating and Governance Committee of the Board of Directors, our Board of Directors has nominated for re-election at the Annual Meeting each of Mr. Allan Marshall, Mr. Andrew Norstrud, Mr. Gene Salkind, Mr. Lawrence Dugan and Mr. Thomas Williams for a new term expiring at the 2026 Annual Meeting of shareholders or until their successors are duly elected and qualified. Each nominee is currently serving as a member of our Board of Directors.

In the event any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies voting for their election will be voted for any nominee who shall be designated by the Board of Directors to fill the vacancy. As of the date of this Proxy Statement, we are not aware of any nominee that is unable or will decline to serve as a director if elected.

Required Vote

The affirmative vote of shares of our Common Stock and Preferred Stock, voting as a single class, representing a plurality of the votes cast is required to elect each of Mr. Allan Marshall, Mr. Andrew Norstrud, Mr. Gene Salkind, Mr. Lawrence Dugan and Mr. Thomas Williams as directors of the Company.

Recommendation

Our Board of Directors unanimously recommends a vote “FOR” the election of each of Mr. Allan Marshall, Mr. Andrew Norstrud, Mr. Gene Salkind, Mr. Lawrence Dugan and Mr. Thomas Williams to our Board of Directors. Properly authorized proxies solicited by Board of Directors will be voted “FOR” the nominees unless instructions to withhold or to the contrary are given.

Directors/Nominees

Our Board of Directors currently consists of five members, as set forth in the table below. Our Board of Directors consists of an experienced group of business leaders, with experience in corporate governance, corporate finance, capital markets and technology.

| Name |

| Position Held with the Company |

| Age |

| Date First Elected or Appointed |

| Allan Marshall |

| Chief Executive Officer, Director (Chairman) |

| 58 |

| May 2019 |

| Andrew J. Norstrud |

| Chief Financial Officer, Director |

| 51 |

| April 2020 |

| Gene Salkind |

| Director |

| 71 |

| January 2021 |

| Thomas C. Williams |

| Director |

| 65 |

| January 2021 |

| Lawrence H. Dugan |

| Director |

| 58 |

| January 2021 |

Business Experience

Set forth below is information about the nominees for election as directors. The factual information about each nominee and director has been provided by that person. The particular experience, qualifications, attributes or skills that led our Board of Directors to conclude that each should serve on our Board, in light of our business and structure, were determined by our Board or its Nominating and Governance Committee and are outlined below in each nominee’s bio.

| 9 |

| Table of Contents |

Allan Marshall, 58, Chief Executive Officer, Director. Mr. Marshall joined the Company as CEO in May of 2019 and was previously retired prior to joining the Company working as a serial entrepreneur with a focus on development stage companies in hyper growth industries, with the past several years focusing on the technology and cannabis industries. Mr. Marshall is often the driving force behind the organization for its initial growth and funding strategies. Mr. Marshall began his career in the transportation and logistics industry. Mr. Marshall founded Segmentz, Inc. in November of 2000 and served as the Chief Executive Officer, successfully acquiring five distinct logistic companies, raised more than $25,000,000 of capital, creating the infrastructure and business foundation that is now XPO Logistics, Inc. (NYSE: XPO) with revenues in excess of $17 billion. Prior to Segmentz, Mr. Marshall founded U.S. Transportation Services, Inc. (“UST”) in 1995, whose main focus was third party logistics. UST was sold to Professional Transportation Group, Inc. in January 2000 and Professional Transportation Group ceased business in November 2000. Prior to 1995, Mr. Marshall served as Vice President of U.S. Traffic Ltd, a Canadian company, where he founded their United States logistics division and had previously founded a successful driver leasing company in Toronto, Ontario, Canada.

Andrew J. Norstrud, 51, Chief Financial Officer, Director. Mr. Norstrud joined Upexi, Inc. in July of 2019 as a consultant and became the Chief Financial Officer in April of 2020 and a Director as of January 2020. Prior to joining Upexi, Inc., Mr. Norstrud worked as a consultant through his own consulting firm. Mr. Norstrud served as the Chief Financial Officer for Gee Group Inc. from March 2013 until June 2018. Mr. Norstrud also served Gee Group as CEO from March 7, 2014 until April 1, 2015. Mr. Norstrud served as a director of GEE Group Inc. from March 7, 2014 until August 16, 2017. Prior to GEE Group Inc., Mr. Norstrud was a consultant with Norco Accounting and Consulting from October 2011 until March 2013. From October 2005 to October 2011, Mr. Norstrud served as the Chief Financial Officer for Jagged Peak. Prior to his role at Jagged Peak, Mr. Norstrud was the Chief Financial Officer of Segmentz, Inc. (XPO Logistics), and played an instrumental role in the company achieving its strategic goals by pursuing and attaining growth initiatives, building a financial team, completing and integrating strategic acquisitions and implementing the structure required of public companies. Previously, Mr. Norstrud worked for Grant Thornton LLP and PricewaterhouseCoopers LLP and has extensive experience with young, rapid growth public companies. Mr. Norstrud earned a BA in Business and Accounting from Western State College and a Master of Accounting with a systems emphasis from the University of Florida. Mr. Norstrud is a Florida licensed Certified Public Accountant.

Gene Salkind, 71, Director. Gene Salkind, M.D. has been a practicing neurosurgeon for more than 35 years outside of Philadelphia, PA. He graduated from the University of Pennsylvania in 1974 with a B.A., Cum Laude, and received his medical degree from the Lewis Katz School of Medicine in 1979. He returned to the University of Pennsylvania for his neurosurgical residency and in 1985 was selected as the Chief Resident in Neurosurgery at the Hospital of the University of Pennsylvania. Since that time, he has been in a university affiliated practice of general neurological surgery. He has served as the Chief of Neurosurgery at Holy Redeemer Hospital, Albert Einstein Medical Center, and Jeanes Hospital in Philadelphia. He has authored numerous peer reviewed journal articles and has given lectures throughout the country on various neurosurgical topics. He has held professorships at the University of Pennsylvania, the Allegheny Health Education and Research Foundation, and currently at the Lewis Katz School of Medicine.

Dr. Salkind is a prominent investor in the pharmaceutical arena. Past investments include Intuitive Surgical, Pharmacyclics, which grew from less than $1 per share to subsequently being acquired by Abbvie for $250 per share, and Centocor, one of the nation’s largest biotechnology companies, which was acquired by Johnson & Johnson for $4.9 billion in stock. Dr. Salkind currently sits on the boards of Cure Pharmaceuticals, a leader in the biotechnology field through its continual pursuit of redefining traditional drug delivery, and Mobiquity Technologies, Inc., a digital engagement provider. Mobiquity owns and operates a national location based mobile advertising network. The company’s suite of technologies allows clients to execute personalized and relevant experiences, driving brand awareness and incremental revenue. He was previously a board member of Derm Tech International, a global leader in non-invasive dermatological molecular diagnostics.

Dr. Salkind in 2019 joined the Strategic Advisory Board of Bio Symetrics, a company that has built data services tools for automated pre-processing, integrated analytics, and predictive modeling to make machine learning accessible to scientists and providers. Their technology serves health and hospital systems, biopharma, drug discovery and precision medicine. Dr. Salkind, a member of our audit committee, currently owns greater than ten percent (10%) of the outstanding voting securities of the Company.

| 10 |

| Table of Contents |

Thomas Williams, 65, has over 40 years of experience in the insurance industry. He has served in multiple roles in both originations and the administration side of operations. Mr. Williams has a specialization in providing securitization mechanisms of illiquid insurance assets. Thomas was with Smith Barney for his training in the capital markets and insurance industries.

Mr. Williams is currently an officer and director in several Ireland based holding companies with a focus in the insurance industry. He is an active member of the Risk Committee of Wyndham, a large Bermuda based captive. He has extensive experience in the Offshore and European Union insurance markets in both developing the structures and implementing corporate governance. His current role includes providing risk management services to a Section 110 Investment platform in both Luxembourg and Ireland for CSM Securities. Mr. Williams was the intermediary in the sale of Associate Industries of Florida, one of the largest insurance companies in workers’ compensation. He facilitated the sale to Am Trust, a New York publicly traded company in 2009.

Mr. Williams has served on the board of directors of two public companies:

|

| · | GEE Group, an American Stock Exchange Company from 2008 to 2018. At this company, he chaired the nominating committee and was a member of the Corporate Governance Committee and Audit Committee. |

|

|

|

|

|

| · | Two Rivers Water and Farming from 2019 to 2020. |

Mr. Williams completed a training program at Northwestern’s Kellogg Business School for Corporate Governance in Public Companies in 2013.

Lawrence H Dugan, 58, Director. Mr. Dugan is a partner with the accounting firm Dorra & Dugan and has been since 1996. Mr. Dugan graduated from the University of Central Florida in 1989. Mr. Dugan is a Florida licensed Certified Public Accountant.

BOARD OF DIRECTORS AND

Our Board of Directors has adopted Corporate Governance Guidelines that, together with our Bylaws, establish various processes related to the structure and leadership of our Board and the governance of our organization.

Director Independence

Determination of Independent Directors. Applicable Nasdaq rules require that a majority of our Board of Directors be independent. Our Corporate Governance Guidelines also require that a majority of the members of our Board be independent and that each year our Board review transactions, relationships and other arrangements involving our directors and determine which of the directors the Board considers to be independent. In making those determinations, the Board applies the independence criteria contained in the listing requirements of The NASDAQ Stock Market (“Nasdaq”). The Board has directed our Nominating and Governance Committee to assess each director’s independence and report its findings to the Board in connection with the Board’s annual determination re: same. In addition, between those annual determinations, the Committee is directed to monitor the status of each director on an ongoing basis and inform the Board of changes in factors or circumstances that may affect a director’s ability to exercise independent judgment in carrying out his or her duties as a director. The following table lists our current directors and persons who served as directors during fiscal year 2024-2025 who our Board believes were during their terms of office, and will be if re-elected, “independent” directors under Nasdaq’s criteria.

|

| · | Gene Salkind |

|

|

|

|

|

| · | Lawrence Dugan |

|

|

|

|

|

| · | Thomas Williams |

| 11 |

| Table of Contents |

In addition to the specific Nasdaq criteria, in assessing each director’s or nominee’s independence, the Nominating and Governance Committee and the Board consider whether they believe transactions that are disclosable in our proxy statements as “related person transactions,” as well as any other transactions, relationships, arrangements or other factors known to the Committee or the Board, could impair that director’s ability to exercise independent judgment in carrying out his or her duties as a director. In its determination that our current directors named above are or will be independent, the Committee and the Board considered those transactions and relationships described or referenced below under the heading “TRANSACTIONS WITH RELATED PERSONS”.

Board Leadership Structure

Our Board performs its oversight role through various committees whose members are appointed by the Board after consideration of the recommendations of our independent Nominating and Governance Committee. Our Board has also constituted separate Compensation Committee and Audit Committee, whose duties are described below. Those committees may be established as separate committees of our Board or as joint committees of the Boards. Our Board annually elects a Chairman whose duties are described in our Bylaws and, currently, our Chief Executive Officer, Allan Marshall, also serves as Chairman of our Board. Mr. Marshall has served as our Chairman since inception of the Company. Although our Bylaws contemplate that our Chairman will be considered an officer, under our Corporate Governance Guidelines the Board will exercise its judgment and discretion in the selection of its Chairman and may select any of its members as Chairman. The Board has no formal policy as to whether our Chief Executive Officer will or may serve as Chairman or whether any other director, including an independent director, may be elected to serve as Chairman.

In practice, our Board has found that having a combined Chairman and Chief Executive Officer role allows for more productive board meetings. As Chairman, Mr. Marshall is responsible for leading board meetings and meetings of shareholders, generally setting the agendas for board meetings (subject to the requests of other directors) and providing information to the other directors in advance of meetings and between meetings. Mr. Marshall’s direct involvement in our operations makes him best positioned to lead strategic planning sessions and determine the time allocated to each agenda item in discussions of our short- and long-term objectives. As a result, our Board currently believes that maintaining a structure that combines the roles of Chairman and Chief Executive Officer is the appropriate leadership structure for our company. Any independent director may request additional executive sessions at any meeting.

| 12 |

| Table of Contents |

As described below under the heading “COMMITTEES OF OUR BOARDS,” all matters pertaining to executive compensation, the selection of nominees for election as directors, the appointment of members of Board committees, the approval of transactions with related persons, and various other governance matters, are subject to the review and approval or recommendation of Board committees made up entirely of independent directors. Our Corporate Governance Guidelines also provide that:

|

| · | all independent directors have full access to any member of management and to our independent accountants for the purpose of understanding issues relating to our business; |

|

|

|

|

|

| · | upon request, our management will arrange for our outside advisors to be made available for discussions with the Board, any Board committee, our independent directors as a group, or individual directors; and |

|

|

|

|

|

| · | the Board, each Board committee, and our independent directors as a group, in each case by a majority vote, have the authority to retain independent advisors from time to time, at our expense, who are separate from and unrelated to our regular advisors. |

Our Board believes the provisions described above enhance the effectiveness of our independent directors and provide for a leadership structure that is appropriate for our company, without regard to whether our Chairman is an independent director.

Board Role in Risk Oversight

While management is responsible for risk management in daily operations, the board of directors is responsible for overall risk oversight of the Company. The Board, or the appropriate committee, assesses existing and significant emerging risks on an ongoing basis as they arise. While the Board applies similar oversight standards to all material risks facing the company, focusing more frequently on the areas that represent more immediate risks, individual risks generally differ in duration and severity, and timeframes required for effective mitigation may vary greatly or change over time as risk environments evolve. Thus, the Board may adjust its oversight strategy on a case-by-case basis, as appropriate. The Board believes that this is a continuous process that requires regular attention from the full Board. This ongoing effort focuses the Board on the Company’s operational and financial performance over the short, intermediate and long term.

Attendance by Directors at Meetings

Board of Directors Meetings. Our Board of Directors met five (5) times during fiscal year 2024. Our Corporate Governance Guidelines provide that directors are expected to regularly attend meetings of the Boards and of the committees on which they serve (subject to circumstances that make their absence unavoidable), to review materials provided to them in advance of meetings, and to participate actively in discussions at meetings and in the work of the committees on which they serve. During the year ended June 30, 2024, all of our directors attended all of the meetings held, except one where only four of the five directors was able to attend.

Annual Meetings. Attendance by our directors at Annual Meetings of our shareholders gives directors an opportunity to meet, talk with and hear the concerns of shareholders who attend those meetings, and it gives those shareholders access to our directors that they may not have at any other time. In order to facilitate directors’ attendance, we schedule our Annual Meetings on the same dates as regular meetings of the Board of Directors. Our Board recognizes that our outside directors have their own business interests and are not our employees, and that it is not always possible for them to attend Annual Meetings. However, our Board believes that attendance by directors at our Annual Meetings is beneficial to us and to our shareholders, and our Corporate Governance Guidelines provide that our directors are strongly encouraged to attend each Annual Meeting. All of our board members attended the last year’s annual meeting.

| 13 |

| Table of Contents |

Communications with Our Board

Our Board of Directors encourages our shareholders to communicate their concerns and other matters related to our business, and the Board has established a process by which you may send written communications to the Board or to one or more individual directors. You may address and mail your communication to:

Board of Directors

Upexi, Inc. Attention: Corporate Secretary

3030 N. Rocky Drive, Suite 420

Tampa, FL 33607

You also may send communications by email to info@upexi.com. You should indicate whether your communication is directed to the entire Board of Directors, to a particular committee of the Board or its Chairman, or to one or more individual directors. All communications will be reviewed by our Corporate Secretary and, with the exception of communications our Corporate Secretary considers to be unrelated to our business, forwarded to the intended recipients.

Code of Ethics

Our Board of Directors has adopted a code of ethics that apply to all our officers, directors and employees including our financial officers. A copy of the code is posted on our website and may be found at https://ir.upexi.com/corporate-governance/governance-documents. Information contained in, or accessible through, our website does not constitute part of this proxy statement. The Code of Ethics (the “Code”) is intended to promote:

|

| · | honest and ethical conduct; |

|

|

|

|

|

| · | the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

|

|

|

|

|

| · | full, fair, accurate, timely and understandable disclosure in reports and documents that we file with or submit to the SEC and in other public communications we make; |

|

|

|

|

|

| · | compliance with applicable governmental laws, rules and regulations; |

|

|

|

|

|

| · | prompt internal reporting of violations of the Code and accounting issues to the Boards’ Audit Committee and, in the case of violations by directors, also to the Compensation, Nominating and Governance Committees; and |

|

|

|

|

|

| · | accountability for adherence to the Code. |

We have established means by which officers, employees, customers, suppliers, shareholders or others may submit confidential and anonymous reports regarding ethical or other concerns about our company or any of our respective employees. Reports may be submitted by following the procedure set forth in our Whistleblower Policy posted on our website at https://ir.upexi.com/corporate-governance/governance-documents.

| 14 |

| Table of Contents |

Insider Trading Policy

Our Board has adopted an Insider Trading Policy that applies to all of our directors, executive officers, and employees. This policy also is affirmed by our domestic third party vendors, and our international vendors either affirm this policy or a similar, local, more applicable policy, regulation, or law. The policy attempts to establish standards that will avoid even the appearance of improper conduct on the part of insiders by requiring, among other things, that insiders maintain the confidentiality of information about the Company and to not engage in transactions in the Company’s securities while aware of material nonpublic information.

Clawback Policy

We adopted the Upexi, Inc. Clawback Policy effective as of October 2, 2023. In the event that we are required to prepare a financial restatement, the Committee will recoup all erroneously awarded incentive-based compensation calculated on a pre-tax basis received after October 2, 2023, by a person (i) after beginning service as an executive officer, (ii) who served as an executive officer at any time during the performance period for that incentive-based compensation, and (iii) during the three completed fiscal years immediately preceding the date that the Company is required to prepare a restatement, and any transition period (that results from a change in the Company’s fiscal year) of less than nine months within or immediately following those three completed fiscal years. “Clawback” or recoupment policy in our executive compensation program contributes to creating and maintaining a culture that emphasizes integrity and accountability and reinforces the performance-based principles underlying our executive compensation program.

Human Capital Management

Our associates are among our most important assets, and a top priority of our management is ensuring that we attract, retain and develop associates who are aligned with our goals. Our initiative during 2025 will remain focused on scaling talent to address future needs, while we continue to promote inclusion, equity and diversity initiatives, and enhance performance management and coaching, with a goal of developing a workplace for the future. In promoting inclusion, equity and diversity, we aim to foster inclusion of, and provide opportunities for advancement to, all our associates, and we start by embracing diversity. We consider diversity to be broader than gender or race and to include demographics such as religion, national origin, age, disability, military service, sexual orientation, and gender identity, as well as diversity of thought, perspective, experience and interests. By continuing to commit to inclusion and diversity, we are focused on enhancing associate and customer experiences and relationships and driving innovation of our products and services.

Hedging Policy

To date our Company has not adopted a hedging policy applicable to its officers or directors.

Our Board of Directors has three standing committees that assist the Board in oversight and governance matters. They are the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee. Each committee operates under a written charter approved by our Board that sets out the committee’s composition, authority, duties and responsibilities. Each member of the three committees is an “independent director” as that term is defined by Nasdaq’s listing standards. A copy of the current charter of each committee is posted on our website and may be found at https://ir.upexi.com/corporate-governance/governance-documents.

Members of the Audit Committee and the Compensation, Nominating and Governance Committee must satisfy requirements of Nasdaq’s listing standards and other laws and regulations applicable to service on those committees, as well as any membership requirements specified in the committees’ written charters.

| 15 |

| Table of Contents |

The Audit Committee is required to meet at least quarterly and the Compensation Committee, and Nominating and Governance Committee are required to meet at least once a year, and each may meet more frequently as it and/or its Chairman considers necessary. Each committee also will meet when requested by the Chairman of the Board. In addition to their duties and responsibilities set forth in their respective charters, each committee is authorized to undertake such other duties and responsibilities within the scope of its primary functions as the committee or the Boards may from time to time deem necessary or appropriate. In discharging its duties, each committee may:

|

| · | at its discretion and without the prior approval of management or the Boards, retain or obtain the advice of outside consultants or advisors (including legal counsel and other advisors), at our expense, in accordance with procedures established from time to time by the committee, and oversee and approve all terms of the engagement of any such consultants or advisors, including their fees or other compensation; |

|

|

|

|

|

| · | conduct investigations and request and consider information (from management or otherwise) as the committee considers necessary, relevant, or helpful in its deliberations and the formulation of its decisions or recommendations; |

|

|

|

|

|

| · | seek any information from our employees (who are directed to cooperate with each committee’s requests), or from external parties, and consult to the extent it deems appropriate with the Chairman of the Board, the Chief Executive Officer, other directors, and other officers and employees; and |

|

|

|

|

|

| · | delegate any of its responsibilities to subcommittees or to individual members to the extent not inconsistent with other sections of its charter (including applicable independence requirements), or applicable laws or regulations. |

| Directors Name |

| Audit Committee |

| Compensation Committee |

| Nominating and Governance Committee |

|

| Gene Salkind |

| X |

| X |

| X |

|

| Thomas Williams |

| X |

| X |

| X |

|

| Lawrence H. Dugan |

| X |

| X |

| X |

|

Audit Committee

On January 27, 2021, our Board established an audit committee that operates under a written charter as approved by our Board. The members of our audit committee are Dr. Gene Salkind, Mr. Thomas Williams, and Mr. Lawrence Dugan. Mr. Dugan serves as chairman of the audit committee and our Board has determined that he is an “audit committee financial expert” as defined by applicable SEC rules. The Board has determined that Dr. Salkind, Mr. Williams and Mr. Dugan are independent directors as that term is defined in Rule 5605(a)(2) of the Nasdaq Listing Rules, and has determined that Dr. Salkind, Mr. Williams and Mr. Dugan as audit committee members also meet the independence requirements of the Securities and Exchange Commission. The audit committee met five (5) times in fiscal year 2024.

Our audit committee is responsible for:

|

| · | the integrity of the Company's financial statements, |

|

|

|

|

|

| · | the effectiveness of the Company's internal control over financial reporting, |

|

|

|

|

|

| · | the Company's compliance with legal and regulatory requirements, |

|

|

|

|

|

| · | the independent registered public accounting firm's qualifications and independence, |

|

|

|

|

|

| · | the performance of the Company's independent registered public accountants, |

|

|

|

|

|

| · | reviewing and approving related persons transactions; and |

|

|

|

|

|

| · | preparation of the audit committee report as required to be included in the Company’s annual proxy statement. |

| 16 |

| Table of Contents |

The Audit Committee also is responsible for establishing procedures for the receipt, retention and treatment of complaints from employees, customers, suppliers, shareholders or others related to accounting and financial processes and reporting, internal controls, and auditing matters, including procedures for the confidential, anonymous submission by employees of concerns regarding those matters, and for evaluating any fraud, whether or not material, that involves management or other employees who have a significant role in our internal controls.

Information regarding the process for and factors considered in the Audit Committee’s selection of our independent accountants is contained under the heading “PROPOSAL 6: RATIFICATION OF APPOINTMENT OF INDEPENDENT ACCOUNTANTS.”

Audit Committee Financial Expert.

Lawrence H. Dugan is a partner with the accounting firm Dorra & Dugan and has been since 1996. Mr. Dugan graduated from the University of Central Florida in 1989. Mr. Dugan is a Florida licensed Certified Public Accountant. Our Board of Directors has designated Mr. Dugan as the Committee’s “Audit Committee Financial Expert,” as that term is defined by the rules of the SEC.

Audit Committee Report

This report is furnished by the Audit Committee, the members of which, on the date of the filing of our 2024 Annual Report on Form 10-K, are named below.

Our management is responsible for our financial reporting process, including our system of internal controls and disclosure controls and procedures, and for the preparation of our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. Our independent accountants are responsible for auditing those financial statements. The Audit Committee oversees and reviews those processes. In connection with the preparation and audit of our consolidated financial statements for 2024, the Committee has:

|

| · | reviewed and discussed our audited consolidated financial statements for 2024 with our management; |

|

|

|

|

|

| · | discussed with our independent accountants the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC; |

|

|

|

|

|

| · | received the written disclosures and letter from our independent accountants required by applicable requirements of the Public Company Accounting Oversight Board regarding the accountants’ communications with the Committee concerning independence; and |

|

|

|

|

|

| · | discussed the independence of our independent accountants with the accountants. |

Based on the above reviews and discussions, the Committee recommended to our Board of Directors that the audited consolidated financial statements be included in our 2024 Annual Report on Form 10-K as filed with the SEC.

Lawrence H. Dugan

Gene Salkind

Thomas Williams

| 17 |

| Table of Contents |

Compensation Committee

On January 27, 2021, our Board established a compensation committee that operates under a written charter as approved by our Board. The members of our compensation committee are Dr. Gene Salkind, Mr. Thomas Williams, and Mr. Lawrence Dugan. Dr. Salkind serves as chairman of the compensation committee.

Our compensation committee is responsible for the oversight of, and the annual and ongoing review of, the Chief Executive Officer, the compensation of the senior management team, and the bonus programs in place for employees, which includes:

|

| · | reviewing the performance of the Chief Executive Officer and other senior officers, and determining the bonus entitlement for such officer or officers on an annual basis, |

|

|

|

|

|

| · | determining and approving proposed annual compensation and incentive opportunity level of executive officers for each fiscal year, and recommending such compensation to the Board, |

|

|

|

|

|

| · | determination of proposed grants of stock options to directors, employees, consultants and advisors with the Chief Executive Officer, |

|

|

|

|

|

| · | reviewing and recommending to the Board the compensation of the Board and committee members, |

|

|

|

|

|

| · | administering and approving any general benefit plans in place for employees, |

|

|

|

|

|

| · | engaging and setting the compensation for independent counsel and other advisors and consultants, |

|

|

|

|

|

| · | preparing any reports on director and officer compensation to be included in the Company’s proxy statements, |

|

|

|

|

|

| · | assessing the Company’s competitive positions for each component of officer compensation and making recommendations to the Board regarding such positions, and |

|

|

|

|

|

| · | reviewing and assessing the adequacy of its charter and submitting any recommended changes to our Board for its consideration and approval. |

In considering compensation to be paid to our directors and our executive officers named in the Summary Compensation Table below, the Committee considers information provided by our Chairman and Chief Executive Officer, including, in the case of officers other than himself, information about those officers’ individual performance and his recommendations as to their compensation.

The compensation committee may retain the services of consultants or other advisors at our expense, and under its charter the compensation committee is directly responsible for the appointment, compensation, terms of engagement and oversight of the work of its consultants and advisors. The compensation committee met two (2) times in fiscal year 2024 and three (3) times during fiscal year ended June 30, 2023.

Nominating and Governance Committee

On January 27, 2021, our Board established a nominating and governance committee that operates under a written charter as approved by our Board. The members of our nominating and governance committee are Dr. Gene Salkind, Mr. Thomas Williams, and Mr. Lawrence Dugan. Mr. Williams serves as chairman of the nominating and governance committee.

| 18 |

| Table of Contents |

Our nominating and corporate governance committee is responsible for assisting the Board in:

|

| · | proposing a slate of qualified nominees for election to the Board by the shareholders or in the event of a Board vacancy, |

|

|

|

|

|

| · | evaluating the suitability of potential nominees for membership on the Board, |

|

|

|

|

|

| · | determining the composition of the Board and its committees, |

|

|

|

|

|

| · | monitoring a process to assess Board, committee and management effectiveness, |

|

|

|

|

|

| · | aiding and monitoring management succession planning, and |

|

|

|

|

|

| · | developing, recommending to the Board, implementing and monitoring policies and processes related to the Company’s corporate governance guidelines. |

The nominating and governance committee met twice in fiscal year 2024 and fiscal year 2023.

Director Selection Process

As provided in its charter, the nominating and governance committee is responsible for recommending to our Board of Directors all nominees for election to the Board of Directors, including nominees for re-election to the Board of Directors, in each case after consultation with the Chairman of the Board of Directors. The nominating and governance committee considers, among other things, the level of experience, financial literacy and business acumen of the candidate. In addition, qualified candidates for director are those who, in the judgment of the nominating and governance committee, have significant decision-making responsibility, with business, legal or academic experience, and other disciplines relevant to the Company's businesses, the nominee's ownership interest in the Company, and willingness and ability to devote adequate time to Board of Directors duties, all in the context of the needs of the Board of Directors at that point in time and with the objective of ensuring diversity in the background, experience, and viewpoints of Board of Directors members.

The nominating and governance committee may identify potential nominees for election to our Board of Directors from a variety of sources, including recommendations from current directors and officers, recommendations from our stockholders or any other source the committee deems appropriate.

Our stockholders can nominate candidates for election as director by following the procedures set forth in our Bylaws, which are summarized below. We did not receive any director nominees from our stockholders for the Annual Meeting.

Our Bylaws provide that any stockholder entitled to vote in the election of directors generally may make nominations for the election of directors to be held at an Annual Meeting, provided that such stockholder has given actual written notice of his intent to make such nomination or nominations to the Secretary of the Company not less than sixty (60) days nor more than ninety (90) days prior to the appropriate anniversary date of the previous meeting of shareholders of the Company called for the election of directors. In accordance with the Company's Bylaws, submissions must include: (1) the name and address of the shareholder who intends to make the nomination and of the person or persons to be nominated; (2) a representation that such shareholder is a holder of record of stock of the Company entitled to vote at such meeting and intends to appear in person or by proxy at such meeting to nominate the person or persons specified in the notice; (3) the consent of each nominee to serve as director of the Company, if so elected; and (4) the class and number of shares of stock of the Company which are beneficially owned by such shareholder on the date of such shareholder's notice and, to the extent known, by any other shareholders known by such shareholder to be supporting such nominees on the date of such shareholder notice.

This is only a summary of the advance notice procedure. Any stockholder who wishes to nominate a potential director candidate must follow the specific requirements set forth in our Bylaws, a copy of which may be obtained by sending a request to: Upexi, Inc., 3030 N. Rocky Point Drive, Suite 420, Tampa, FL 33607 and is available on www.sec.gov.

| 19 |

| Table of Contents |

Family Relationships

There are no family relationships between any of our directors, executive officers and proposed directors or executive officers.

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors or executive officers has, during the past ten years:

|

| 1. | been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offences); |

|

|

|

|

|

| 2. | had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time, other than the filings of voluntary petitions for relief under Chapter 11 (Chapter 11 Proceedings) of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the District of Nevada by Steam Distribution, LLC, One Hit Wonder, Inc., Havz, LLC, d/b/a Steam Wholesale, and One Hit Wonder Holdings, LLC, of which Mr. Robert Hackett was an equity holder, managing member and/or officer; |

|

|

|

|

|

| 3. | been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity; |

|

|

|

|

|

| 4.

| been found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

|

|

|

|

|

| 5.

| been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

|

|

|

|

|

| 6.

| been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26)), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29)), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

| 20 |

| Table of Contents |

Shareholder Proposals for Next Year’s Annual Meeting

Shareholders interested in submitting a proposal for inclusion in our proxy materials for the 2026 Annual Meeting may do so by following the procedures set forth in Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). To be eligible for inclusion in such proxy materials pursuant to such rule, shareholder proposals must be received by our Secretary no later than December 31, 2025.

In addition to satisfying the foregoing requirements under our by-laws, to comply with the SEC’s universal proxy rules, shareholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than April 1, 2026.

The following table shows the compensation for each of the years ended June 30, 2024 and June 30, 2023 awarded to or earned by each individual who served as our principal executive officer or acting in a similar capacity during the last completed fiscal year and our two other most highly compensated executive officers who were serving as executive officers as of June 30, 2024. The persons listed in the following table are referred to herein as the “named executive officers” or “NEOs.”

|

| · | Allan Marshall – Chairman and Chief Executive Officer |

|

|

|

|

|

| · | Andrew Norstrud – Chief Financial Officer |

| Name and Principal Position |

| Year |

| Salary ($) |

|

| Bonus ($) |

|

| Stock Awards ($) |

|

| Option Awards ($)(3) |

|

| Non-Equity Incentive Plan Compensation ($) |

|

| Nonqualified Deferred Compensation Earnings ($) |

|

| All Other Compensation ($) |

|

| Total ($) |

| ||||||||

| Allan Marshall, CEO, and Director (2) |

| 2024 |

|

| 840,000 |

|

|

| 250,769 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 1,090,769 |

|

|

|

| 2023 |

|

| 840,000 |

|

|

| 341,068 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 90,000 |

|

|

| 1,271,068 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Andrew Norstrud, Chief Financial Officer (3) |

| 2024 |

|

| 250,000 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 250,000 |

|

|

|

| 2023 |

|

| 250,000 |

|

|

| 150,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 30,000 |

|

|

| 430,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Anthony Bazan, COO (1) |

| 2023 |

|

| 294,800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 294,800 |

|

_____________

|

| (1) | Anthony Bazan resigned all positions with the Company on June 15, 2023. |

|

| (2) | At June 30, 2024, Allan Marshall had an accrued and unpaid bonus of $399,231 not included in this compensation table. |

|

| (3) | At June 30, 2024, Andrew Norstrud had an accrued and unpaid bonus of $375,000 not included in this compensation table. |

There are no arrangements or plans in which we provide pension, retirement or similar benefits for directors or executive officers. Our directors and executive officers may receive share options at the discretion of our board of directors in the future. We do not have any material bonus or profit-sharing plans pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that share options may be granted at the discretion of our board of directors. The value of the option awards is based on the intrinsic value at date of grant.

|

| (3) | Represents equity-based compensation expense calculated in accordance with the provisions of Accounting Standards Codification Section 718 – Compensation – Stock Compensation, using the Black-Scholes option pricing model as set forth in Notes to our consolidated financial statements in Item 13. |

| 21 |

| Table of Contents |

Employment Agreements

Allan Marshall

On March 15, 2021, the Company entered a new employment agreement that superseded all previous agreements with Allan Marshall, Chairman and Chief Executive Officer (the “Marshall Employment Agreement”). The Marshall Employment Agreement provides for a three-year term ending on March 15, 2025, unless employment is earlier terminated in accordance with the provisions thereof and after the initial term has a standard 1-year automatic extension clause if there is no notice by the Company of termination. Mr. Marshall received a starting base salary at the rate of $460,000 per year which can and was adjusted by the Compensation Committee to $840,000 per year. In the previous contract Mr. Marshall was granted an option to purchase 55,556 shares of Common Stock at a price of $30.60 per share with 27,778 shares vesting immediately and 27,778 shares vesting ratably over a two-year period. The options are exercisable for 10 years and provide for cashless exercise. Mr. Marshall is entitled to receive an annual bonus based on criteria to be agreed to by Mr. Marshall and the Compensation Committee. The Marshall Employment Agreement contains standard termination, change of control, non-compete and confidentiality provisions.

On April 24, 2025, the Company entered into a new employment agreement with Allan Marshall as Chief Executive Officer. The Marshall Agreement maintains Mr. Marshall’s base salary at $840,000 per year and can be increased at the discretion of the Board of Directors. Mr. Marshall was granted a warrant to purchase up to 500,000 shares of common stock at a per share price of $2.28 per share with a term of five years and was awarded a restricted stock grant of 75,000 shares that cliff vests after six months of continued employment. In addition, Mr. Marshall has performance bonuses that Mr. Marshall can earn with the achievement of certain milestones. The term of the agreement is three years and will automatically renew for a one year period if it is not terminated earlier.

Andrew Norstrud

On February 1, 2021, the Company entered an employment agreement with Andrew Norstrud, Chief Financial Officer (the “Norstrud Employment Agreement”). The Norstrud Employment Agreement provides for a three-year term ending on February 1, 2024, unless employment is earlier terminated in accordance with the provisions thereof and after the initial term has a standard 1-year automatic extension clause if there is no notice by the Company of termination. Mr. Norstrud received a starting base salary at the rate of $250,000 per year which can be adjusted by the Compensation Committee. Mr. Norstrud was granted an option to purchase 19,444 shares of Common Stock at a price of $30.60 per share vesting ratably over a two-year period. The options are exercisable for 10 years and provide for cashless exercise. Mr. Norstrud is entitled to receive an annual bonus based on criteria to be agreed to by Mr. Norstrud and the Chief Executive Officer and the Compensation Committee. The Norstrud Employment Agreement contains standard termination, change of control, non-compete and confidentiality provisions.

On April 24, 2025, the Company entered into a new employment agreement with Andrew Norstrud as Chief Financial Officer. The Norstrud Agreement increases Mr. Norstrud’s base salary to $350,000 per year and can be increased at the discretion of the Board of Directors. Mr. Norstrud was awarded a restricted stock grant of 100,000 shares that vests 10% per month for 10 months of continued employment. Mr. Norstrud will be paid a quarterly bonus of between 30% and 100% of his salary as determined by the Chief Executive Officer. In addition, Mr. Norstrud may receive additional incentive compensation at the discretion of the Chief Executive Officer and the Board of Directors. The term of the agreement is three years and will automatically renew for a one year period, if it is not terminated earlier.

| 22 |

| Table of Contents |

Outstanding Equity Awards at Fiscal Year- End Table

The following table summarizes equity awards granted to Named Executive Officers and directors that were outstanding as of June 30, 2024:

|

|

| Option Awards |

| Stock Awards |

| |||||||||||||||||||||||||||||

| Name |

| Number of Securities Underlying Unexercised Options: # Exercisable |

|

| Number of Securities Underlying Unexercised Options: # Unexercisable |

|

| Equity Incentive Plan Awards: Number of Securities Underlying Unearned and Unexercisable Options: |

|

| Option Exercise Price $ |

|

| Option Expiration Date |

| # of Shares or Units of Stock That Have Not Vested # |

|

| Market Value of Shares or Units of Stock That Have Not Vested $ |

|

| Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested # |

|

| Equity Incentive Plan Awards: Market of Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested $ |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

| Allan Marshall, CEO, and Director |

|

| 62,500 |

|

|

| - |

|

|

| - |

|

| $ | 83.60 |

|

| 7/21/2031 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

|

|

| 41,667 |

|

|

| - |

|

|

| - |

|

| $ | 30.60 |

|

| 6/1/2029 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Andrew Norstrud, |

|

| 10,000 |

|

|

| - |

|

|

| - |

|

| $ | 83.60 |

|

| 7/21/2031 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| Chief Financial Officer and Director |

|

| 8.334 |

|

|

| - |

|

|

| - |

|

| $ | 30.60 |

|

| 2/1/2031 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

|

|

| 19,445 |

|

|

| - |

|

|

| - |

|

| $ | 30.60 |

|

| 6/1/2029 |

|

| - |

|